U3.3 Working Capital

advertisement

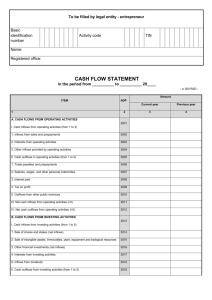

U3.3 Working Capital About Cash Current asset In hand or At bank Liquidity Cash Problems Lack of cash or working capital more often than lack of profit lead to: Insolvency Liquidation Working Capital Money available for daily business operation Also known as Net Current Assets Shows available funds to pay immediate expenses Working Capital = Current Assets – Current Liabilities Current Assets Cash Debtors Stocks Current Liabilities Overdrafts Creditors Tax Working Capital Cycle Production Costs Cash Sales Working Capital Cycle Hold enough cash to cover production costs i.e. stock, wages, debt collection Without being wasteful by holding too much i.e. cash could be more profitably invested elsewhere Current Ratio Desired ratio is 1:1 CA significantly higher indicates wastefulness CA significantly lower indicates liquidity problem Cash vs. Profit Simply put Profit = Revenues – Costs Revenues are not always cash! There are sources of cash outside of revenues. Profitable companies can be cash poor. Unprofitable companies can be cash rich. Cash Flow Forecasts Expected movement of cash in and out of a business: Cash Inflows receipts Cash Outflows payments, expenses, outgoings Net Cash Flow cash inflows – cash outflows Cash Flow Statements Depicts the actual flow of cash in and out of a business over a given period of time. Reasons for Cash Flow Forecasts Persuade banks and other lenders when seeking external finance. Aid in the anticipation and preparation for periods of time where cash flow shortages or surpluses may occur. Assists in business and strategic planning. Constructing Cash Flow Forecasts Jul Aug Sept Oct Nov Dec 5,000 3,000 300 (1,400) (2,600) 600 6,000 5,000 6,500 6,800 7,500 9,500 0 0 0 0 4,000 0 6,000 5,000 6,500 6,800 11,500 9,500 Stocks 2,500 2,200 2,700 2,700 3,000 3,300 Labor costs 3,500 3,500 3,500 3,500 3,500 3,500 Other costs 2,000 2,000 2,000 1,800 1,800 2,200 Total cash outflows 8,000 7,700 8,200 8,00 8,300 9,000 Net cash flow (2,000) (2,700) (1,700) (1,200) 3,200 500 Closing balance 3,000 300 (1,400) (2,600) 600 1,100 Opening Balance Inflows Cash sales revenue Other income Total cash inflows Outflows Cash Flow Forecast Practice Cash sales Stock purchases Rent Other costs Opening cash balance Net cash flow Closing balance Jan ($) Feb ($) 2,000 2,000 600 600 900 1,200 1,000 0 1,000 0 600 600 800 1,000 1,600 1,900 800 300 1,800 1,600 1,900 1,000 Mar ($) Apr ($) 4,000 Causes of Cash Flow Problems Overtrading: quick expansion Over borrowing: high geared Overstocking: poor inventory control Poor credit control: lenient credit policies Unforeseen changes: demand shifts Managing Working Capital Dealing with liquidity problems: Seek alternative sources of finance Improve cash inflows Reduce cash outflows Seeking Alternative Sources of Finance Overdrafts Sale and leaseback Selling off fixed assets Debt factoring Government assistance Growth strategies Improving Cash Inflows Tighter credit control Cash payments only Change pricing policy Improved product portfolio Improved marketing planning Reducing Cash Outflows Seek preferential credit terms Seek alternative suppliers Better stock control Reduce expenses Combining Strategies Pareto principle 80/20 rule 80% time and resources boosting cash inflow 20% on cost cutting Contingency fund Cash set aside for unexpected, emergency use Alternatives to Dealing with Cash Flow Problems Spread risks with wider customer base Require partial payments over time from customers of large or lengthy projects/services Establish systems to pay bills in regular installments Establish quality management systems Limitations of Cash Flow Forecasting Marketing Human resources Operations management Competitors Changing fashion and tastes Economic changes External shocks Working Capital and Business Strategy “More often than not, businesses fail because of cash flow problems rather than profitability problems.” Cash flow “forecasts and calculations are static, i.e. they only represent the cash flow situation of a firm at one point in time”. “Managers face a dilemma in balancing the conflict between the desire for sufficient working capital and the desire for profits.” “Working capital is regarded as being more important than profit in the short run.” 3.3.1 What is meant by working capital? a. Working capital (or net current assets) refers to the money available for the daily running of a business, i.e. it is used to pay for everyday costs such as wages, utility bills, and payment so suppliers. Working capital is mainly generated from the sale of goods and services. 3.3.2 explain the working capital cycle a. The working capital cycle refers to the interval between cash paid by a business for the costs of production and receiving the cash from customers. For example, if the customers pay by credit then payment is not received until a later date, although costs are incurred for the transaction. Due to its revamped menu, McDonald’s was able to entice more customers thereby helping to boost its sales by 6 per cent. However, cash is not the same as profit. The costs of product research and development for its new menu, for example, would contribute to higher operation costs and hence lower profits. It is likely that there is a significant time lag between investment expenditure (R&D and marketing costs for its revamped menu) and receiving sufficient sales revenue to recoup the costs. Hence, it is probably that overall profits declined despite sales revenue being slightly higher. Explain the use of cash cards b. Credit cards allow customers to ‘buy now and pay later’ through a third party, i.e. a financial lender. The finance company pays the retailer (and charges the retailer a small fee for the service) and charges the customer at a later date. Since credit improves flexibility (customers do not need to carry so much cash with them) and allows customers to buy now but to postpone payment, it can attract a large number of customers to businesses, including McDonald’s. Hence, sales revenues may increase since customers have a greater choice of payment systems. However, retailers and restaurants such as McDonald’s will not receive their payment instantaneously, i.e. there is a (relatively short) delay in payment from the credit card company. This therefore extends the working capital cycle of the business that offers credit to its customers. In addition, the amount received from the finance company will be slightly lower since a fee will be charged by the creditor. A firm faces a liquidity problem ;explain b. Definition of liquidity problem, i.e. the extent to which the firm can meet its short term debts. The firm seems to be suffering from worsening liquidity as seen by the closing balance figures. The net cash flow for the first four months of trading is also negative suggesting the firm has insufficient working capital. 3.3.5 Answer Key a. Profitable firms can experience cash flow problems for a number of reasons, such as: Overtrading Long working capital cycle Poor credit control Long credit periods