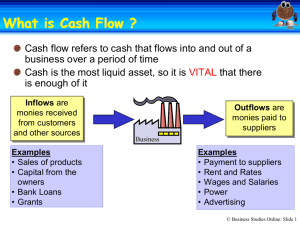

Cashflow Forecast Unit 5.2 What is meant by cash flow? • Cash flow is the flow of cash in and out of a business, over a period of time. • Cash inflows are the sum of money received by a business over a period of time while cash outflows is the exact opposite. Cash inflow • How can cash flow into a business? • By the sale of goods for cash • Through payments made by debtors • By borrowing money from external sources ( e.g. Loans) • Through the sale of assets if the business • From investors Cash Outflow • How can cash flow out of a business? • By purchasing goods or materials for cash • By the payment of wages/ salaries to the employees • By purchasing fixed assets • By repaying loans • By paying creditors of the business Cashflow Forecast Cash Flow Forecasts • A cash flow forecast is an estimate of future cash inflows and outflows of a business, usually on a month by month basis. This will then show the expected cash balance at the end of each month. Uses of cash flow forecast • There are many uses of cash flow forecasts, they are: • Starting up a business • Keeping the bank manager informed • Running an existing business • Managing cash flow Some common terms • Opening bank balance: is the amount of cash held by the business at the start of the month • Net cash flow: is the difference, each, month between the inflows and outflows • Closing cash balance: is the amount of cash held by business at the end of the month, this becomes the next month opening bank balance. What cash flow is not! • Cash and profit are two very different things. • Profit is the surplus after total costs have been subtracted from sales revenue and cash flow is not. How to solve cash flow problems • Arrange with your bank to borrow money over the time when you have negative cash flow • Reduce or delay some of your planned expenses • Increase your forecasted cash income in some way( e.g. a part time job.) • Delay paying for some of your expenses until cash is available