OUTLINE: REGISTERED DOMESTIC PARTNERS/DOMESTIC

advertisement

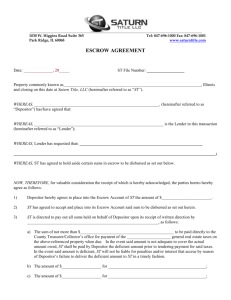

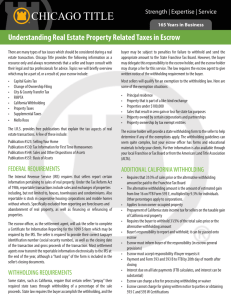

TITLE & ESCROW FOR DOMESTIC PARTNERS Multicultural Marketing Program Caridad Stuart Bay Area Multicultural Marketing Manager Fidelity National Title Group TODAY’S OBJECTIVES • Background • Title & Escrow Issues • Things to Remember ! • Q&A Background • According to the 1990 U.S. Census Bureau, unmarried couples comprised approximately 4.5 million families- one-third of these unmarried couples were of the same sex. • Census 2000 showed that same-sex couples live in 99 percent of all U.S. counties. • Domestic partnership benefits are available to employees at more than 570 companies, 141 colleges and universities, and more than 87 city, county and state governments. • Currently more than 10% of all employers offer domestic partner benefits. Among companies with more than 5,000 employees, almost 1/4th or 25% offer these benefits. • More than 62% of Americans support domestic partners receiving equal access to inheritance benefits. Source: Partners Task Force for Gay & Lesbian Couples Continued • Census 2000 shows that more than 40% of same-sex “unmarried partner” couples have lived together in the same home for more than five years. • Nearly one in four of the couples raise children. • More than one in 10 gay and lesbian couples include a senior over the age of 65. Nearly two-thirds of these couples have lived together for more than five years. Source: USA TODAY, “Don’t Ignore Gay’s Unions’ Social, Economic Impact.” Gary Gates 10/23/2003 • The greatest numbers of same-sex senior couples live in California, New York, and Florida. Demographics Metropolitan Areas with Highest Percentage of Same-Sex Households, 2000 Same-Sex Partner Households by Area Number Percent of all households in specified city San Francisco CA 8,902 2.7 Fort Lauderdale FL 1,418 2.1 Seattle WA 4,965 1.9 Oakland CA 2,650 1.8 Berkeley CA 788 1.8 Atlanta GA 2,833 1.7 Minneapolis MN 2,622 1.6 Washington DC 3,678 1.5 Long Beach CA 2,266 1.4 Portland OR 3,017 1.3 Who are Domestic Partners? » Both persons have a common residence » Neither person is married to someone else or is in a domestic partnership with someone else » Both persons cannot be related by blood » Both persons are at least 18 years » Both persons are members of the same sex OR » The partners of the opposite sex , one or both is over the age of 62 AND » One or both meets specified eligibility requirements under the Social Security Act » Both person are capable to consent to the domestic partnership. » Copy of form is attached. Form is to be filed with the Secretary of State. Declaration of Registered Domestic Partnership Domestic Partner Registry Facts • Enacted in 1999, the domestic partnership registry was the first of its kind in the US where the principal privilege was just hospital visitation rights. • As of January 1, 2005, California-registered domestic partners are subject to nearly all rights, protections, duties and obligations under state law that apply to married partners. • Assembly Bill 205, known as CA Domestic Partners Rights and Responsibilities Act, was signed into law on September 19, 2003 by Gov. Gray Davis. • Rights and duties under FEDERAL LAW do not apply to registered domestic partners. This includes Social Security rights, rights under immigration law, veterans’ benefits and treatment as a couple under federal tax law and the Proposition 13 exemption from reassessment of jointly held property, upon separation or termination of the marriage or after death does not apply to domestic partners. DPR Facts Continued As of 2007, California affords domestic partnerships most of the same responsibilities as marriages under state law (Cal. Fam. Code s 297.5) Among these: – – – – – – – – Making health care decisions for each other in certain circumstances Hospital and jail visitation rights Access to health insurance plans Spousal insurance policies Wills, intestate succession, conservatorships and trusts Property Tax provisions otherwise available only to married couples Obligation to file state tax returns as a married couple Community property rights and responsibilities previously only available to married spouses Title & Escrow Issues 1. In general, all title and escrow practices applicable to spouses are applicable to registered domestic partners. 2. Change in Ownership Exclusion- Registered Domestic Partners: Effective January 1, 2006, the following do not result in a change in ownership transfers of real property between domestic partners: • • • • • Transfers to a trustee for the beneficial use of a registered domestic partner, or the surviving registered domestic partner of a deceased transferor, or by a trustee of such a trust to the registered domestic partner of the trustor. Transfers that take effect upon the death of a registered domestic partner. Transfers to a registered domestic partner or former registered domestic partner in connection with a property settlement agreement or decree of dissolution of a registered domestic partnership or legal separation. The creation, transfer, or termination, solely between registered domestic partners, of any co-owner’s interest. The distribution of a legal entity’s property to a registered domestic partner or former registered domestic partner in exchange for the interest of the registered domestic partner in the legal entity in connection with a property settlement agreement or a decree of dissolution of a registered domestic partnership or legal separation Title & Escrow Issues Continued • Effective January 1, 2006, SB565 allows a Domestic Partner, who is registered with the Secretary of State, to be excluded from reassessment when a RDP is added or removed from property title, whether by Deed or by death, provided that the interest is conveyed to the RDP that remains on title. • Beginning with deeds recorded 1/3/06, the assessors office will identify transfers between RDPs by reviewing the PCOR (Preliminary Change in Ownership Report) that is typically filed with the Recorder’s Office at the same time the deed is recorded. The PCOR is not a public document; it is merely collected by the Recorder and forwarded to the Assessor together with an electronic copy of the deed. • The Assessor’s office procedure is to review the PCOR when processing deeds to determine whether or not the transfer requires reappraisal to current market value for assessment purposes. Therefore, it is imperative that all questions are answered and that the form is signed and dated. To the extent that the assessor can identify that the transfer was between RDPs, it will be excluded from reassessment. Vesting Registered Domestic Partnerships 1. 2. 3. 4. 5. 6. A and B, registered domestic partners A and B, domestic partners A and B, registered domestic partners as joint tenants A and B, registered domestic partners as tenants in common A, a registered domestic partner as his/her sole and separate property A and B, registered domestic partners, with California community property rights as applicable o registered domestic partnerships Vesting RDP Continued • #1and #2 are equivalent to vesting married persons as husband and wife. Domestic partners holding title in one of these ways are subject to the same rules and practices as are used for married persons holding title as community property. • #3, 4 & 5 are equivalent to vesting married persons as joint tenants, tenants in common and separate property, respectively. Domestic partners holding title in one of these ways are subject to the same rules and practices as are use for married persons holding title in the same manner. Community Property • On or after January 1, 2005, RDPs may take title to real property as community property and community property with right of survivorship. As with Married couples, real property, including property acquired between December 1999 and January 1, 2005, acquired by either or both partners during the RDP is presumed to be community property. • Because community property is not a transfer, no change in ownership occurs upon its application. • Because community property rights for RDPs are based on registration of the DP with the Secretary of State and not on a marriage relationship, a transfer of real property from one partner to himself and his RDP as “community property” is NOT excluded from change in ownership under the interspousal exclusion. Therefore, this type of transfer will result in a 50% change in ownership. Joint Tenancy • As with any other individuals, RDPs may hold title to property as joint tenants. • When insuring title into or out of a vested domestic partnership, joint tenancies are handled in the same manner as they would be handled for married couples. Sole and Separate Property • Deeds confirming an interest in real property as the separate interest of a domestic partner should include a community property disclaimer recital. • For eg: “The grantor is executing this instrument for the purpose of relinquishing all of grantor’s right, title and interest, including, but not limited to, any community property interest in an to the land described herein and placing title in the name of the grantee as his/her separate property.” Death of a Domestic Partner • The interest of a deceased domestic partner could be subject to Probate codes and the deceased partner’s interest may be therefore terminated of record by use of an Affidavit similar to the one used when a spouse dies and the property is held as community property (Affidavit of Death of Spouse) where title is held in a form other than joint tenancy, tenancy in common or separately. • If the domestic partners hold title “with California community property rights and survivorship rights,” a deceased partner’s interest may be terminated by an Affidavit (Affidavit Domestic Partnership Succeeding to Title to Community Property by Right of Survivorship). Affidavit of Death Title & Escrow COPY OF DEED W/ VERBAGE FOR PURPOSES OF RECORDING CORRECTLY AND PCOR HERE… COPY AND PASTE… RDP & Reporting Requirements • Effective January 1, 2007, a sale transaction wherein the sellers are registered domestic partners, they may complete the applicable California FTB Real Estate Withholding forms in accordance with the way they file their state tax return. • If RDPs file a joint return and are claiming they are exempt from withholding, together they should complete only one applicable 593C form. • If the sellers file separate tax returns, each seller should complete an appropriate and separate 593 form disclosing their ownership percentage. • Federal Reporting Requirements: California RDPs cannot file a joint tax return with the IRS. Sellers who are RDPs must complete a separate 1099S indicating their ownership percentage. Reporting Forms 593 CASE STUDY… • • • • • • Resale Transaction Property located in San Francisco Condominium Unit Sales Price set by Mayor’s Office 1 Buyer (Male) Typical Seller Case Study Continued • Title was requested by buyer’s agent. As normal, a copy of the contract and the buyer’s earnest money deposit was given to Escrow. Escrow was opened. Buyer’s name JOHN DOE, an unmarried man and seller was Mary Jane DOE. • Preliminary title report is received from title and Escrow Officer reviews the preliminary report for taxes, liens, judgments, easements, etc. • All looked to be standard- resale issues: • • • • • • Taxes due for 2007-2008 Tax Default for years 2004-2005, 2005-2006, 2006-2007 No supplemental taxes Easements & CC*Rs were normal Abstract Judgments (3) An exception showing a sales price limitation but no worries it can be resolved thru the Mayor’s office • An SI for the buyer JOHN DOE… pretty common name! Case Study Continued • • • An SI was emailed to the buyer’s agent to be completed by buyer and forwarded back to the Escrow Officer. In addition, a hard copy was mailed to the buyer’s residence. Days past and the Escrow Officer had not received the SI from the buyer or the agent. The Escrow Officer continued to contact the buyer’s agent and the buyer to emphasize the need for the SI. The issue with the sales price was resolved by the Mayor’s office. LOAN DOCS ARRIVE…. • The loan documents were drawn by the lender as John Doe, an unmarried man... Escrow drew the deed and escrow instructions as if title was to be held by buyer as an unmarried man. Case Study Continued… THE SIGNING • The buyer, an older man in his mid 60s, arrives to the title company with a young lady. The Escrow Officer assumed it was his daughter and began the signing of his loan documents. The Escrow Officer mentioned to Mr. John Doe that an SI was sent to him via email and mail, but that they had not received it and escrow could not close until this was executed to meet one of the exceptions on the preliminary report. Borrower executed all documents and off they went. • The loan package was put together to send to the lender and the recording package was put together along with the SI and sent to the title department. Case Study Continued… The Funding • Lender receives loan package and is immediately ready to fund the loan, however, Escrow was waiting to receive buyer’s funds to close and asked to hold off funding until notified. • Buyer brings in funds to close to escrow … Ready to Fund…. The Problem • Remember the SI that was executed last minute at the signing table… the Escrow receives a phone call from title. The title officer asked where was the deed from the non-borrowing registered domestic partner and by the way there is a lien against the buyer which will need to be addressed in escrow. Case Study The ONLY RESOLUTION • Escrow Officer immediately notified the lender that the buyer was in a RDP and that the deed would have to change. In addition, in order to meet funding cutoff for a file that was going to expire, the Escrow Officer rushed to get a hold of the buyer’s RDP and get her to execute a GD relinquishing her interest to the property. • Escrow Officer had to notify lender of the lien. The Escrow Officer had to rush a demand request to the lien holder of the judgment that appeared and request a verbal on funds due. The buyer had to rush and get a cashiers check for additional funds to close. YOU GET THE PICTURE! RIGHT? Statement of Information Form Things To REMEMBER! DO • ASK the question ahead of time • COMMUNICATE w/ your customer • Documentation: Make sure your customer can provide you with evidentiary documents i.e. copy of filed Registered Domestic Partnership certificate w/ the CA Secretary of State and forward to your Escrow Officer • FORWARD any and all forms provided by your Escrow Officer for your customer to complete, including Statement of Information, Borrower’s Authorization, etc. DON’T • ASSUME the relationship of your client (remember our case study) • WAIT until last minute to do all of the above! Thank You ! Caridad Stuart Bay Area Multicultural Marketing Manager Fidelity National Title Group 825 Broadway Oakland CA 94606 Direct: 510-338-1852 Cell : 925-818-3169