2 - Directions Online Career Service

advertisement

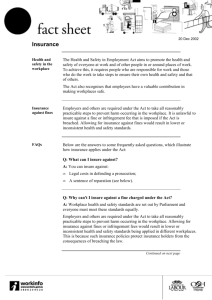

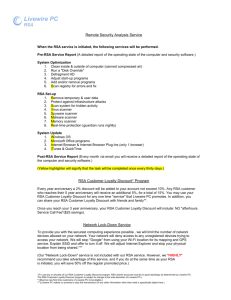

RSA – Apprentice Programme What is the Apprentice Programme? • The apprenticeship programme is a tailored 3 year programme, training us up to be commercial underwriters within our field. • An underwriter assesses all kinds of risks, and then decides whether they want to insure them and what the terms and premium are around this insurance. • In our Croydon office where the Apprenticeship takes place, the types of cover we offer are: - Property & Packages - Professional Indemnity - Motor - Liability - Property Owners • 2 A typical task we could have on a day to day basis, is looking at different cases provided to us by Brokers, and deciding whether or not we would like to insure them, and identifying what the main risks are around insuring them Our Customers from across the Group Our Customers – RSA does business with some of the strongest brands with over 20 million customers worldwide. 3 DID YOU KNOW…. 4 • We are the official insurers of the Bond film stuntmen • We insure world famous icons such as the Houses of Parliament, the Royal Albert Hall and Tower Bridge in London • We are the world’s leading Renewable Energy (RE) insurer • We insure every drop of milk in Denmark • We insure the paper that makes all the newspapers in Scandinavia • We’re real football fans! We insure Anfield, Emirates, Old Trafford, Stamford Bridge, St James’s, Blackburn and Watford football grounds How did we start at RSA? 5 • Luckily, we both had relatives within RSA who told us about the apprentice programme last year as this was the first year they had run it and we hadn’t heard about it. • This is NOT in anyway going to hold anyone back from applying who does not know someone who works in the company however, as the other 2 of our apprentice colleagues did not know anyone within RSA and were very successful! • We all attended an assessment day last June after our A levels where we were evaluated on our communication skills in a group task, our technical knowledge in a case study and finally a formal one on two interview. After finding out we were successful, we then started the job in September (meaning we could still have our summer holidays!!) • Neither of us particularly knew what we wanted to do after A-levels and weren’t set on going to uni without a focus of what we wanted out of it. We had never considered a career in insurance, but the apprentice programme sounded so well supported that it was an opportunity we couldn’t afford to miss. What skills do you need? 6 • A self-starting, assertive attitude towards personal development, a passion for continuous improvement and the learning agility to make it happen • Positive outlook, drive, energy and enthusiasm • Excellent customer focus including demonstrated ability to understand customers’ needs and build positive relationships • The ability to create positive and collaborative working relationships • Have bright ideas • Ability to be able to deliver Brilliant Service • Common sense! What have been our highlights? • Achieving our Licenses in our particular fields after 6 months meaning we can write new business • Having a lunch with Adrian Brown who is our UK CEO and also consecutive meetings with Jon Hancock who is the Managing Director of Commercial business • Having regular meetings with our assigned Mentors holding senior positions in the company, giving us advice throughout and allowing us to meet a whole new group of influential people • Spending some time among the other departments in RSA to learn about the company in a bigger picture • Attending broker meetings • Passing our CII Exams and progressing towards a Diploma in Insurance 7 Thank you! If you have any questions then please feel free to ask us at the end of the presentations 8