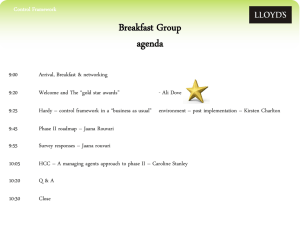

Control Framework Breakfast Group Presentation August

advertisement

Control Framework A warm Welcome to the august market Breakfast Group Control Framework Breakfast Group agenda 9:00 Arrival, Breakfast & networking All 9:20 Welcome Ali Dove 9:25 Update on Central Services Refresh Sam Nowell 9:50 Update on phase II progress - Top 3 issues raised - Brainstorm session Jaana Rouvari 10:20 Q&A All 10:30 Close Ali Dove Central Services Refresh Programme (CSRP) Driving Market Submission 3 CSRP - Where Are We Now? Carrier Benefits Sessions and Broker Workshops End July FSR Review Approach Revised Draft FSR FSR Review Workshops Mid August 1:1 Benefits Discussion Impact Assessments End Sep Programme Brief POC Broker engagement Market Submission Analysis Project Brief Market Submission 4 CSRP - Introduction The aim of CSRP is to provide a vision of central services to help resolve key market concerns Why was it initiated? • Market concerns over the age of the technology estate and as a consequence the supporting business processes • Lack of an agreed strategy regarding the markets requirements from Central Services What is CSRP? • CSRP aims to produce an agreed vision, owned by the market, which defines the future of central services (relating, but not limited to, technology and processes) for the London market. At it’s core it should enable: • • • • Increased levels of service to the Client The removal of unnecessary Londonisms The market to create value Reduced operational risk 5 CSRP - The Future Service Register The Future Service Register defines the analysis scope and today’s view for future central services • The scope of CSRP analysis phase is defined by the Future Service Register (FSR) • This describes today’s view of the future central services, agnostic of provider, though the lenses of the different stakeholders. Draft FSR Client View Broker View? Carrier View 6 CSRP – Programme Approach The FSR is being reviewed and refined through market workshops, subsequent projects will be benefits driven Draft FSR Review & Refine Market Workshops Validated FSR Prioritisation with benefits and value proposition Market Submission Prog 2 Prog 3 Prog … 7 Current – Market Submission Landscape ► Market specific processes adding complexity and cost ► Processing overhead absorbed by participant’s operations ► Disparate pseudo-duplicate records across multiple entities 8 CSRP - Driving Market Submission Development of the Future Services Register has provided very valuable insights… Customer Service Remove Londonisms Value Operational Risk Client Service • Shorter end to end cycle times • The ability for clients to interact directly when appropriate (e.g.. direct settlement or status information) • How quickly decisions / money get to the client Removal of Londonisms • Carriers should look at ways to reduce the burden placed upon brokers through the possibility of greater/alternative use of central services Benefits Focus • Consensus exists that central services can be improved but changes must be business benefits led 9 CSRP - Driving Market Submission ……particularly around the “input” side……. Customer Service Remove Londonisms Value Risk Availability of Information • Timely access to richer information • The way that information is presented should be easier to use • Differentiating between notification and information held for subsequent processing Classification of Information • Centrally record information classified in a way that maximises efficient downstream utilisation Harmonisation • To have common processing and integration between markets and originator types • Help organisations better integrate their systems with central services • Make central services available from any location in any time zone 10 CSRP - Driving Market Submission …..and the operation of central processes Customer Service Remove Londonisms Value Risk • Great benefit in receiving data ‘right first time’ • Achieving standardisation by moving burdens from brokers to Central Services • Carriers can directly add Information to the central record • Higher quality information allows for better underwriting operations • Maximise re-use and availability of high quality information to inform and anticipate actions • The ability to make use of the large volume of centrally held information • Great benefit in the ability to reconcile information without manual intervention • More granular information would be valuable to carriers, especially where they do not lead 11 Future - Market Submission Landscape ► Market Submission aims to make Central Services ‘easier to do business with’, principally for brokers, but also for carriers too. ► The scope for Market Submission is expected to include moving London market specific processes, or “Londonsims”, to the centre. ► Market Submission is expected to enable interfaces to become more global; improve referencing and enable better, richer risk data. 12 Market Submission – 6 Core Elements 13 Market Submission and Genesis ► Market Submission complements and is complemented by Genesis ► The LMA team have agreed that the CSR team have sign-off of key elements relating to data so as to ensure alignment in the use of standards; recognising that the DCS is logically at the start of the CCR ► Market Submission can support the DCS irrespective of whether central services passes the data onto the recipients, or centrally stores the data for reporting purposes only 14 Market Submission and Broker Needs ► LIIBA requirements of the Lloyd’s and London Market broadly split across: ► Placing ► Binders & Coverholders ► Accounting & Claims ► 30 high level statements of need; of which ► CSR can provide, based upon initial analysis and assessment a solution to 20 and supports improvements for another 6 ► Market Submission can provide, based upon initial analysis and assessment a solution to 17 (of the 20) and supports improvements for another 5 (of the 6) ► Market Submission has the potential to deliver material improvements to the broking community; particularly in areas relating to “Londonisms” ► Work on-going with LIIBA to better understand the detail and areas of benefit. 15 Market Submission and the Utility Platform ► Can treat the Utility Platform as any other Originator of data, assuming the Central Services have a role to play in the related business processes ► Supports the early capture of common data to eliminate re-keying and associated re-work ► Can help to deliver on the provision of an electronically agreed record of the contract via the CCR and Cross Referencing; in conjunction with the utility platform’s own centrally held placing data ► Provision of centralised business rules to ensure market standards are met ► Supports the desire to see the acceptance and implementation of a single common data standard (ACORD), coupled with a minimum structured data set 16 Market Submission and LMG ALIGNMENT ► CSRP shares with Future Processes the fundamental principle that:: “Any insurer/service provider combination (including a bureau) will interact with brokers in the same way as other insurers i.e. not involving unique processes, data or query types.” 17 Market Submission – 6 Core Elements ► Lloyd’s & Londonisms – Removes or dilutes restrictive Lloyd’s and Londonisms - intended to make market access easier. Centralised Business Rules ► Insulation - Mask central service complexity through the introduction of standard interfaces e.g. Cross Referencing & CCR. Master Data Management ► Multiple Types of Originator Common Core Record Cross Referencing Enablement – Market Submission enables subsequent developments. For example carriers settling claims automatically because standard interfaces are implemented ACORD Messaging 18 For MORE INFORMATION ► For more information on CSRP; contact your association: ► IUA - John Hobbs. Telephone: 020 7617 4445, Email: john.hobbs@iua.co.uk ► LIIBA – James Livett. Telephone: 020 7280 0152, Email: james.livett@liiba.co.uk ► LMA – Rob Gillies. Telephone: 020 7327 8377, Email: robert.gillies@lmalloyds.com 19 Questions? 20 Control Framework Progress on Phase 2 • Initial meeting to introduce CF2 under way • 55 managing agents in scope (13 new to Phase II) • 42 face to face meetings completed • Brokers on-board • 80 broker meetings on CF2 to date • Broker event on 17th September 21 © Lloyd’s Control Framework Progress on Phase 2 Managing agents commenced analysis phase - key activities for year end are: 1. Project resources in place 2. Coverholder risk rating exercise 3. Risk rating reflected in audit schedule 4. Confirm project delivery timeline to Lloyd’s The risk rating exercise 1. Review and validate list of coverholders provided by Lloyd’s 2. Risk rate each coverholder 3. Provide list back to Lloyd’s 4. Lloyd’s to coordinate approach with managing agents where there are overlapping coverholder relationships with high/ medium risk ratings. 22 © Lloyd’s Control Framework Top 3 issues raised 1. Responsibilities of lead vs. follow 2. Delivery timeline 3. Validation of coverholders 23 © Lloyd’s Control Framework Brainstorm in your groups 15 minutes to brainstorm! Question 1 What should the responsibilities of lead vs. follow be in implementing the Control Framework? Question 2 What controls does the following market have over delegated business? 24 © Lloyd’s Control Framework Q&A 25 © Lloyd’s Control Framework Close Further information on CSRP – samantha.nowell@lloyds.com Further information on Control Framework – jaana.rouvari@lloyds.com Phase II Broker conference – Tuesday 17th September 2013 Next Breakfast Meeting – Tuesday 24th September 2013 Control Framework Phase I end of project celebration – Thursday 26th September www.lloyds.com/controlframework 26 © Lloyd’s