Demystifying Conduct Risk

advertisement

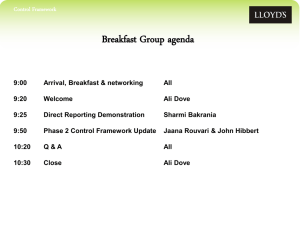

< Picture to go here > Demystifying Conduct Risk Gabriella Barker Lloyd’s Delegated Authorities © Lloyd’s 1 What is Conduct Risk? ► The risk that a managing agent (or its agents) will fail to pay due regard to the interests of Lloyd’s customers or will fail to treat them fairly at all times. © Lloyd’s 2 Why is Conduct Risk important? ► To achieve fair outcomes for policyholders. ► Increasingly conduct focussed regulatory environment. © Lloyd’s 3 What are the implications for coverholders? ► Coverholders are agents of Managing Agents. ► A Coverholder’s policyholders are the Managing Agents’ policyholders. ► Both have a responsibility to ensure fair outcomes are achieved for those policyholders. © Lloyd’s 4 What should Coverholders expect? ► Additional conduct focussed questions at renewal and for new binders. ► Closer oversight from Managing Agents. ► Increased data reporting requirements. ► The above will be proportionate to the product risk. © Lloyd’s 5 Why are Managing Agents requiring this? ► To demonstrate compliance with FCA requirements and expectations. ► To demonstrate compliance with Lloyd’s requirements and expectations. © Lloyd’s 6 What are we seeking to achieve? ► Fair outcomes for all customers. ► A consistent Lloyd’s market approach to managing conduct risk. ► Greater understanding of our coverholders. ► Improved/increased data to assess conduct risk. © Lloyd’s 7 Conclusion ► Focus on achieving fair outcomes for all our customers. ► Increased regulatory focus on conduct risk which must be addressed. ► As FCA regulated entities this is the responsibility of Lloyd’s, Managing Agents and Coverholders. © Lloyd’s 8 www.lloyds.com © Lloyd’s 9