Typical participation - Barham Benefit Group

advertisement

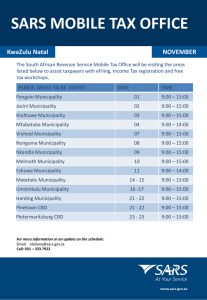

A SUCCESS STORY (in 142 seconds) THAT COULD BE Group Insurance Navigation Experts YOUR SUCCESS STORY Question What if you could offer your entire workforce benefits.. • they could not get on their own • guaranteed issue – no one turned away • at no cost to the employer & affordable rates for employees • with turnkey education and administration (minimal effort on your part) According to the Towers Watson 2013 Survey The percentage of employers that expect voluntary benefits to be very important to their total rewards strategy will more than double over the next five years jumping to 48%. The primary reasons companies adopt these voluntary options are to provide personalized benefits that fit employees’ needs/lifestyles and to enrich their total reward packages. The most popular voluntary offerings currently provided by employers include life, long-term disability, vision, dental, accident, critical illness, identity theft and financial counseling. Employees Want Options A recent success story… Central Illinois municipality interested in providing their employees with new benefit options. Yet they wish to do this without adding cost to their operating budget, while at the same time minimizing internal administrative resources for education and enrollment. Goals • Augmenting current employee benefit options • Utilize voluntary benefits options • Provide opportunity across diverse job & income levels • Include employee groups covered by union contracts • Utilize turnkey system Central Illinois Municipality Partners with BBG Results • Augmenting current employee benefit options – 4 benefit options offered • Utilize voluntary benefits options – 4 voluntary products offered; short-term disability, long-term disability (augments current plan), vision, term-life • Provide opportunity across diverse job & income levels - yes • Include employee groups covered by union contracts – yes • Utilize turnkey system – done, using proprietary GIS system provided free of charge Highlights Employee paid long-term disability 50% 45% 47% 40% Firefighter 71% participation 30% 30% 20% 15% 10% 5% Typical participation 25% Total Municipality Participation 35% 0% Typical (SHRM 2013 ) • • Municipality Success Plan works in conjunction with employer paid 50% plan Issue included all employee groups (including fire and police) Police 53% participation Highlights Employee paid term-life insurance 90% 80% 79% 60% Firefighter 85% participation * 3 times normal participation rate! 50% 40% 30% 20% 10% 0% 30% Typical (SHRM 2013 ) • • Total Municipality Participation Police 88% participation * Typical participation Nearly 70% * Guarantee issue term-life products are typically difficult to procure in these professions. Municipality Success Guaranteed Issue up to $150,000 Issue included all employee groups (including fire and police) Other Facts • Interest in vision benefit was consistent with industry average of 30% • Short-term disability numbers affected by generous employer provided sick and vacation benefits. • Education and enrollment completed quickly and within deadline with minimal resource allocation of municipality. Group Insurance Navigation Experts Barham Benefit Group (BBG) • Proven ability to partner with employers to provide employees with popular top-shelf benefit options while controlling cost. • Employees maintain core coverage with access to voluntary benefits at group rates to provide for their personal and financial needs. • Education and administration occur seamlessly utilizing turnkey enrollment and administration software provided to you at no cost. Savings Choice Benefit Options Available through BBG Traditional Core benefits (including dependent coverage options) • Health • Dental • Vision Voluntary Benefit Options (with portability options) • • • • • • • • • Guaranteed Issue Term-Life Insurance Whole Life Long-term disability Short-term disability Accident Critical Illness Home Auto Identity Protection Why Wait? In 6 short weeks, you can receive a FREE full benefit analysis and your employees can have an improved set of cost effective benefit choices. Contact us today Barham Benefit Group 919 W Kirby Ave, Champaign, Illinois