available here

advertisement

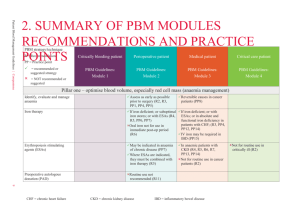

Clarity PBM Practices PBM Practices 1. Charge client administration fees for drugs that were not dispensed – – 2. Makes false claims regarding “pass-through” pricing – – – – 3. PBM use contract terms such as “claims” that are not clearly defined or defined in ways to allow PBMs to bill clients for “duplicate”, “reversed”, and “rejected” claims Auditors estimate that 20 percent of all “claims” are for “duplicate”, “reversed”, and “rejected” “claims” PBM agrees to “pass-through” to health plan its actual drug cost It may do this on drugs dispensed at retail However, PBM continues to take a “profit spread” (pays for drug at one price but invoices the health plan at a far steeper price) on mail and specialty drugs Fake pass-through pricing usually adds cost to care since PBMs will recoup any savings afforded in retail through steep profit spreads for mail and specialty drugs Hidden “Profit Spreads” can be created on virtually any drug related expenditure – – So-called rebate management fees are charged health plans above and beyond the PBM retention of client generated manufacturer rebates Savings generated from generic drugs are pocketed by PBM if health plan overachieves PBM guaranteed generic dispensing rate (GDR) PBM Practices 4. Restricts or limits disclosure and reporting regarding health plan drug expenditures and PBM profits generated from those expenditures – PBM concealment of vital reporting data through broad interpretation of contract terminology such as “proprietary” – This means that PBM will not disclose key information such manufacturer fees paid to PBMs for health plan’s aggregated clinical data. 5. PBMs requires “mutual approval” of any auditor that health plans designates to conduct an audit of the PBM – PBM can veto any selected auditor – PBM can limit the number and/or frequency of audits – PBM require auditors to sign PBM “Confidentiality Agreements” that typically require auditors not to disclose key information to their own clients, i.e. the health plan that requested the audit PBM Practices 6. Re-Defining “Brand” and “Generic” – The intentional blurring of the definitions of "brand drugs" and" generic drugs" by PBMs to suit their financial interests. This includes improperly classifying drugs, charging brand prices for generic products, retaining rebates for brand drugs by calling them generics, and misstating a payer's generic drug utilization rate – PBMs overcharge health plans by classifying many generic drugs as brands – Experts believe that this practice is very widespread and involves dispenses that can account for up to 10% of typical utilization – This tactic represents several percentage points in undisclosed PBM revenues, costing payors tens of millions of dollars annually – PBM contracts intentionally do not define these terms or are ambiguous, such as "branded generics” – a brand drug that is so cheap it’s considered the generic of itself and equal in cost as either a brand or generic, and "multi-sourced brands“, another term that is used to provide wiggle room in the miscategorizing of products – PBMs miscategorize brand and generic drugs for the purposes of: invoicing a generic drug as a brand drug to charge higher prices (e.g.,AWP–17%) rather than the true price (e.g.,AWP–65%) – Labeling a brand drug a generic to keep the rebate, as almost all contracts require that rebates be passed on only on brand drugs – Counting a brand drug as a generic to meet the generic fill level necessary to earn a bonus or meet a guaranty requirement PBM Practices 7. PBMs can retain a significant or all “recoveries” from PBM conducted retail pharmacy audits – PBM creates a revenue and profit from stream from pharmacy audits that health plans don’t always share – Clerical errors/typos ”recoveries” can become a focus as opposed to fraud, waste and abuse 8. Spread Pricing – The difference between what the PBM charges a payor for drugs and what it pays a retail pharmacy – – – – – – – This amounts to marking up claims! Typical spread:$4-$6/script or $9-$13 PEPM (Per Employee/Per Month) For generics, PBMs use multiple Maximum Allowable Cost (MAC) lists PBMs may charge payors the MediSpan AWP and pay pharmacists the lower Redbook AWP PBMs that own mail-order facilities keep the full spread on these drugs Encourages PBMs to push drugs with highest spreads by manipulating the formularies PBMs hide the fact that they create spreads by claiming that their contracted AWP rates with their pharmacies are confidential PBM Practices 9. Manufacturer Rebate Schemes – – – – – – – – Drug manufacturers “reward” PBMs for promoting their brands Offered only for single-source drugs for which there are no generics Rebates represent a very significant source of PBM revenues Average rebates are 10% of AWP or $3 -$6/script or $6 -$12 PEPM Average rebate for the top 25 rebatable drugs is > $20/script Often PBMs promote drugs that yield the highest rebates, not ones that are necessarily in the patient's best interest (most efficacious) PBMs have historically kept rebates, now they’re being forced to share Retaining interest on rebates by collecting monthly, remitting quarterly or even less frequently 10. Mail Order “Blackbox” Schemes – – – – – – Mail order is still very much a “blackbox” and a component of pharmacy benefit management that is still largely out of control PBM-owned captive mail-order facilities can create a significant conflict of interest as the pharmacy administrator is also a seller PBMs with captive facilities have been accused of engaging in non-transparent mail-order practices to increase profits including drug switching, repackaging and failing to promote starter dosages: pushing mail-order scripts for 90-versus 30-day supplies PBMs boast that the discounts for mail-order dispenses are always greater than discounts for retail, but in actual practice they are not because of the “blackbox” profiteering that routinely occurs Mail-order is much more profitable than PBM administration; indeed, industry experts report that the average profitability of a mailorder dispense is four times that of a retail prescription Mail order pharmacy audits are largely controlled by their PBM owners