Reading Response 9.doc

advertisement

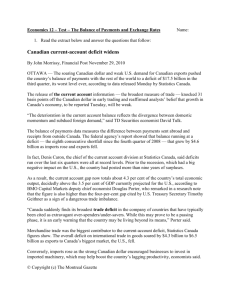

Reading Response 9 Econ 811 Ashita Samant Answer1: Main accounts of the US balance of payments: Current Account: This account records the monetary value of the international flows associated with transactions in goods and services, income flows and unilateral transfers. Capital and Financial Accounts: This account includes all the international purchases and sales of assets. Transactions include both private sector and central bank transactions. Capital transactions consist of capital transfers, acquisition and disposal of certain nonfinancial assets. For the US economy, the policy concerns are over the trade deficits than the trade surplus. Trade deficit may result in the fall in the international currency markets as dollar outpayments exceed dollar impayments. A current account deficit of 668.1 billion in 2004, where imports exceed exports resulted in decreasing net foreign investment for the United States. At the same time in 2004, US generated a trade surplus of $47.8 billion on service transactions, implying that the US transferred fewer goods to other nations than it received from them during this period. Overall, the US balance of payments has been in surplus until recent times of the financial crisis. This means that any force leading to an increase or decrease in one balance of payments account sets in motion a process leading to exactly offsetting changes in the balances of other accounts. Answer 2: There are many views to nation carrying a trade deficit. Some of them are: A country can have a trade deficit either because it is borrowing or because it has lent some loans in the past for which it is currently being repaid. A trade account deficit occurs when a country spends more than its own borrowing capacity. According to Alessandria, a trade account deficit proves to be beneficial because it shifts world production to the most productive sectors of the economy and allows individuals to smoothen out their consumption over the entire length of the business cycle. Also, a trade account deficit occurs when a country’s firm or government invests in physical capital to take advantage of productive opportunities. These investments expand the infrastructure and take advantage of new technologies. This increase in investment is financed in part by borrowing in international financial markets. When the firms or governments repay this borrowing the trade balance increases leading to a trade surplus. So in many ways, a trade deficit may prove to be a robust boost for the economy. Answer 3 The strengthening or weakening of the dollar can affect many parties, consumers, tourists, investors, exporters and importers. Advantages to the Appreciating dollar are as follows: US consumers see lower prices on foreign goods which helps keep US inflation low. With a strong dollar, US tourists can benefit when they travel abroad. Disadvantages of a Strong Dollar: US exporting firms find it difficult to conduct business in foreign markets. Importcompeting US industries are unable to compete with low priced foreign goods and Foreign tourists find it more expensive to visit the US. Advantages of a Weak Dollar: US firms find it easier to sell their goods in foreign markets. Firms in the US face less pressure to keep prices low and more international tourists could afford to visit the US. Disadvantages of a Weak Dollar: US consumers face higher prices on foreign goods. This contributes to higher inflation making it more difficult for US consumers/citizens to travel to foreign locations for holidays.