Washington Health Benefit Exchange

Qualified Health Plans

SUMMER 2013

NAVIGATOR/IN-PERSON ASSISTER PROGRAM

Purpose

Purpose:

This presentation will provide a high level overview of

Qualified Health Plans (QHPs) available through the

Washington Healthplanfinder.

More in-depth information and procedures will be

included in the Healthplanfinder system training

module.

Course Summary

•

Program rules and guidelines related to Individual

Eligibility and Enrollment for Qualified Health Plan

(QHP) programs.

•

Application, eligibility results, QHP enrollment

and payment for individuals and households

applying for coverage.

•

Pediatric dental plans

3

Learning Objectives

Upon completing this module, you will

• Understand the different types of health care

coverage available through the Healthplanfinder

• Know program rules and guidelines related to

Qualified Health Plans for either an individual or for

an entire household

• Understand basis for eligibility results

• Know the steps to facilitate plan selection and

enrollment

Learning Objectives (Continued)

Upon completing this module, you will also

understand:

• The functions performed through the Federal Hub

in verifying applicant information

• Reasons for non-eligibility (incarceration,

citizenship, non-WA resident, etc.).

5

Exchange – A Single Doorway

Public Insurance

Private (commercial) Insurance

Medicaid (Apple Health)

Subsidized (tax credits)

<138% FPL

139-400% FPL

Unsubsidized

>400% FPL

Exchange

6

What is a Qualified Health Plan?

▪ A health insurance plan that has been certified by

The Office of Insurance Commissioner as meeting

all state rules and requirements.

▪ Approved by the HBE as meeting the requirements

of a Qualified Health Plan to be offered through the

Washington Healthplanfinder.

▪ A plan that provides comprehensive coverage by

meeting the standard of “10 Essential Benefits”

7

Qualified Health Plans

Key Point

▪ Commercial insurance plans offered through the

Healthplanfinder

▪ The same insurance carriers as outside the

Exchange (Group Health, Regence, Lifewise, etc.)

▪ Subject to open enrollment periods

▪ Regulated/certified by the Office of the Insurance

Commissioner

▪ Approved by the Health Benefit Exchange Board

8

In General…

▪ Plans with higher PREMIUMS have lower cost

sharing and/or richer coverage

Key Considerations

for Selecting a Plan

▪ Premium – monthly payment to be insured

▪ Cost sharing – you pay some, insurance pays some

▪ Deductible

▪ Co-insurance – a percentage

▪ Co-pay – a predetermined amount per visit

▪ Coverage – what services are part of the “package”?

▪ Providers – which ones participate in the plan?

10 Essential Benefits

Ambulatory Services

Laboratory Services

Emergency Services

Prescription Drug

Hospitalization

Rehabilitative/Habilitative

Maternity/Newborn Care

Preventive/Wellness

Mental Health and Substance

Abuse

Pediatric (including vision

and dental)

Key Point

11

Metal Tiers

Key Point

Bronze Level

Silver Level*

Gold Level

Platinum Level

Bronze plan

benefit coverage

is equivalent to:

Silver plan

benefit coverage

is equivalent to:

Gold plan

benefit coverage

is equivalent to:

Platinum plan

benefit coverage

is equivalent to:

60%

70%

80%

90%

* All plans are eligible for tax credits.

Actuarial Value: The amount (%) of the bill that the insurer pays

12

Health Insurance Premium Tax Credits

(HIPTC)

Key Point

▪ Designed to make premiums affordable for individuals

and families with lower incomes

▪ Only available to individuals and families with income

up to 400% Federal Poverty Level (FPL)

▪ Can be used to reduce monthly premiums

▪ Can be claimed as a credit on annual tax return

▪ Applications must be completed through Washington

Healthplanfinder

13

Premium Tax Credit and Cost Sharing Reductions

Key Point

Premium Tax Credits

Income Level

Up to 133% FPL

Cost Sharing Reductions

Premium as Percent of Income

Income Level

2% of income

133-150% FPL

3-4% of income

150-200% FPL

4-6% of income

200-250% FPL

6-8% of income

250-300% FPL

8-9% of income

300-400% FPL

9.5% of income

*Of the second lowest cost Silver plan

14

Reduction in Out-of-Pocket Liability

100-150% FPL

94% of the actuarial value*

150-200% FPL

87% of the actuarial value

200-250% FPL

73% of the actuarial value

Insurance Carriers in Exchange

as of September 4, 2013

▪

Community Health Plan of Washington

▪

Molina Health Care of Washington – King Pierce & Spokane

▪

Group Health Cooperative – Benton, Columbia, Franklin,

Island, King, Kitsap, Kittitas, Lewis, Mason, Pierce, San Juan,

Skagit, Snohomish, Spokane, Thurston, Walla Walla,

Whatcom, Whitman, and Yakima

▪

Lifewise – All 39 counties

▪

Premera Blue Cross – All counties except Clark

▪

Bridgespan – King, Kitsap, Pierce, Skagit, Snohomish,

Thurston, and Spokane

▪

Kaiser Foundation Health Plan – Clark and Cowlitz

15

Pediatric Dental Plan

Insurance Carriers in the Exchange

as of September 4, 2013

1) Delta Dental of Washington

2) Kaiser Foundation Health Plan

3) LifeWise

4) Premera Blue Cross

Health Insurance Programs and Benefits

Competitively Priced Qualified Health Plans (QHP)

• Individuals or families with income above 400% of the Federal

Poverty Level (FPL) can purchase a QHP at the insurance

carrier’s published premium cost

• QHPs are offered through commercial carriers such as Blue

Cross Blue Shield, Aetna, etc.

• Consumers choose a plan that best meets their health and

financial needs

• Families with children under 19 must enroll the children in a

pediatric dental plan

• Parents can cover children up to age 26 under a family plan

17

Health Insurance Programs and Benefits

Free and Low-Cost Opportunities

• Individuals or households with income below 400 % of the Federal

Poverty Level (FPL) are eligible for free or low-cost options.

• Based on household size and income, applicants can qualify for

either:

• Washington Apple Health (Medicaid) – no cost

• Health Insurance Premium Tax Credit (HIPTC) – reduced premium

rates (must get a Silver Plan to qualify)

• Additional reductions are available to those with the lowest incomes

(< 250% FPL) to reduce out of pocket expenses such as deductibles

and co-pays

18

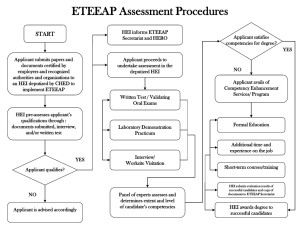

Eligibility & Enrollment Flow - QHP

Account Creation

Application Data

Collection

Eligibility

Determination

Post Application

Shopping

QHP Enrollment &

Pediatric Dental

Enrollment

Payment

19

Primary Applicant

The primary applicant is an individual who creates an account on Washington

Healthplanfinder and initiates one of three types of applications types.

Individuals:

Household:

1. Myself

2. Myself and others

3. Other household members

20

Questions

21

Lesson 1

Application Type ‒ Individual

22

Account Creation

Account Creation

Application Data

Collection

Eligibility

Determination

Post Application

Shopping

QHP Enrollment &

Pediatric Dental

Enrollment

Payment

23

Account Creation

From the homepage there are two paths to creating an account:

Anonymous

Browsing

Projected Plan

Options

Qualified Health

Plan (QHP)

Free and LowCost Health

Insurance

Required to

Create and

Account

Not Required

to Create

Account

Create Account

Qualified Health

Plan (QHP)

Free and LowCost Health

Insurance

Required to

Create and

Account

Not Required

to Create

Account

24

Application Data Collection

Once an account is created – the first step in applying for

coverage is Application Data Collection.

The following data pages need to be completed:

1.

2.

3.

4.

5.

6.

About You

Contact Information

Additional Questions

Tribal Membership

Application Review

eSignature

25

Application Options

For Qualified Health Plan (QHP)

Programs, the Applicant would

select “No.”

For Free and Low Cost Health

Insurance programs, the Applicant

would select “Yes.”

26

Confidential Information

▪ Personal information must be disclosed throughout

the application process

▪ The primary applicant and all household members

who reside in the applicant’s household

▪ Income information and tax filing status

▪ Family composition and relationships, including

custody

27

Federal Hub Verification

The primary applicant’s social security number will be verified by the Federal

Hub.

Application Data

Collected:

Social Security

Number

Homeland

Security

Federal Hub

Response:

Verified

INS

IRS

Unverified

Federal Hub Data Verifications are stored in the Healthplanfinder and are not

visible to the consumer.

28

Conditional Eligibility

If any member of the household is

deemed conditionally eligible,

additional documentation will be

required as shown in these screens.

The primary applicant will have 90 days

to submit required documentation.

29

American Indians/Alaska Natives

▪ Special provisions

▪ Tribal members can be served by a non-tribal InPerson Assister or a Tribal Assister

▪ Training Module for serving AI/AN

30

Eligibility & Enrollment Flow (Qualified Health

Plan (QHP))

Account Creation

Application Data

Collection

Eligibility

Determination

Post Application

Shopping

QHP Enrollment &

Pediatric Dental

Enrollment

Payment

31

Eligibility Determination – Federal Hub

In order for an individual to be eligible for a Qualified Health Plan

(QHP) on Washington Healthplanfinder, he or she must be:

1. A U.S. citizen or lawfully present

Homeland

Security

2. Not incarcerated

INS

3. A resident of the State of Washington

IRS

When the Federal Hub verifies the individual’s SSN, it also looks for

Citizenship and Incarceration status associated with that SSN.

32

Eligibility Results

▪ Eligibility determined for each family member

▪ Coverage options displayed based on eligibility

▪ If eligible for Qualified Health Plan, the consumer will use

tools to compare and select a Plan

▪ Plan details can be viewed side by side

▪ Payment entry finalizes the transaction

33

Eligibility Rules

(what the system uses to “decide” eligibility)

Eligibility Determination

Business Rule

Eligible

• SSN verified

• Citizenship or lawful presence verified

• Resident of Washington

Conditionally Eligible

• SSN not verified or SSN is verified as “Match

for Death”

• Citizenship or lawful presence not verified

• Primary applicant has 90 days to provide

documentation

Denied

• Incarcerated – unless entered the disposition

question as “Yes”

• Not resident of Washington

34

Knowledge Check

What are the three different application types for

eligibility on Washington Healthplanfinder?

a. Myself

Myself and Others

b. _______________

Other Members of My Household

c. __________________________

35

Knowledge Check

Who creates an account on Washington

Healthplanfinder and initiates one of three types of

applications types?

a. Exchange Administrator (EA)

b. Primary Applicant

c. Household

d. Myself and Others

36

Knowledge Check

What organization verifies the social security number

of the primary applicant?

a. Federal Hub

b. eHealth

c. Eligibility Services

d. Washington Healthplanfinder

37

Knowledge Check

Which of the following it not true about Qualified

Health Plan (QHP) programs?

a. Households can claim children up to age 26 under

the parents' plan.

b. Consumer choice offered through plan selection

and metal levels.

c. Applicants eligible for QHPs only.

d. Applicants automatically enrolled in plans.

38

Questions

39

Lesson 2

Application Type – Household (All

Eligible Members)

40

Application Types

The primary applicant is an individual who creates an account on Washington

Healthplanfinder and initiates one of three types of applications types.

Individuals:

Household:

1. Myself

2. Myself and others

3. Other household members

41

QHP Eligibility & Enrollment Flow

Account Creation

Application Data

Collection

Eligibility

Determination

Post Application

Shopping

QHP Enrollment &

Pediatric Dental

Enrollment

Payment

42

Application Data Collection

When the primary applicant enters data for themselves and their

household, the data collected will be the same as for an individual.

The sections bolded below will be completed for both the primary

applicant and the other household members.

1.

2.

3.

4.

5.

6.

7.

About You

Contact Information

About Your Household*

Additional Questions*

Tribal Membership*

Application Review

eSignature

43

Household Composition Rules

To be considered part of the same household, the household

member must have one of the following relationships to the

primary applicant:

1. Legal Guardian

2. Child (up to age 26)

3. Spouse (including same sex marriage)

4. Spouse (including domestic partners)

Other family members living in the same home, such as

nieces/nephews, aunts/uncles, cousins, and grandmothers/

grandfathers would not be considered part of the household

application for eligibility determination.

44

Children Up to Age 26

▪ Children up to age 26 are eligible to be covered under

their parent’s plans.

• Common Examples:

College Students

Young Professionals

• Children do not need to live in the

same

household or location as the parents to qualify.

• For instance, a child away at college would still be

covered under his or her parent’s plan.

45

Eligibility Determination

Primary Applicant

Completes “About

You”

Primary Applicant

Enters Contact

Information

SSN Verification

HS

INS

Primary Applicant

Completes “About

Your Household”

IRS

SSN Verification

IRS

Primary Applicant

Completes

Additional

Questions

HS

Primary Applicant

Completes

Application Review

INS

IRS

Primary Applicant

Completes

eSignature

Eligibility Results

Displayed

46

Eligibility & Enrollment Flow (QHP)

Account Creation

Application Data

Collection

Eligibility

Determination

Post Application

Shopping

QHP Enrollment &

Pediatric Dental

Enrollment

Payment

47

QHP & Pediatric Dental Plan Enrollment

For household members over the age of 19:

• The primary applicant will enroll each eligible household

member in a QHP.

For household members under the age of 19:

• The primary applicant will enroll each child in a QHP and is

required to also enroll each child in a pediatric dental plan.

48

Knowledge Check

In order for an individual to be eligible for a Qualified

Health Plan (QHP) on Washington Healthplanfinder,

he or she must:

A. Live with the individual.

B. Not live with the individual.

C. Not be incarcerated.

D. Be employed.

49

Knowledge Check

To be considered part of the same household, the household

member must have one of the following relationships to the

primary applicant:

A. Niece

B. Aunt

C. Grandparent

D. Legal Guardian

50

Knowledge Check

The primary applicant will be required to select and

enroll their qualifying children (up to age 19) in…

A. A health insurance policy of their own.

B. A pediatric dental plan

C. Pediatric health care coverage

D. Summer school

51

Knowledge Check

In a Qualified Health Plan (QHP) scenario, which of the following

family members qualify as members of the primary applicant’s

household?

a. Spouse (including same-sex marriage)

b. Grandfather

c. Child (up to age 26)

d. Answers a and c

52

Knowledge Check

The primary applicant is required to enroll any children under 19

in a pediatric dental plan.

a. True

b. False

53

Knowledge Check

To be eligible for insurance coverage through Washington

Healthplanfinder, you must be:

a. U.S. Citizen or Lawfully Present

b. Not Incarcerated

c. Washington Resident

d. All of the Above

54

Agents-Brokers

• Key partners with IPAs

• Must complete Exchange training

• Must be registered with Exchange

• Listed on Exchange website

• Receive commission for QHP enrollments (paid by carrier)

• No charge to consumers

55

Questions

56

Congratulations! You have completed the

QHP Rules and Guidelines course!

Thank you!

58