A Comparison of Keynesian, Austrian, and Monetarist theories on

advertisement

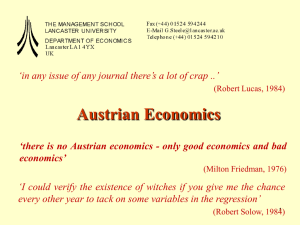

Elizabeth Dalzen University of Wisconsin—Superior Keynesian Theories Money Illusion/“Animal spirits” Keynes on Say’s Law Liquidity Trap Non-keynesian • Austrian economics Austrian Business Cycle Theory • Classical Classical vs. Keynes • Monetarism Quantity Theory of Money Inflation and Side Effects Government Spending People think in nominal terms, not real terms Deflation • ↓price level, ↓nominal wages, ↔real wages • ↓price level, ↔nominal wages, ↑real wages ⇒ surplus Involuntary unemployment Animal spirits: • “A spontaneous urge to action rather than inaction…”* • Decisions are made in the short-run, “In dead.”** the long run, we are all • Confidence *Keynes, The General Theory of Employment, Interest, and Money **Keynes, A Tract on Monetary Reform Say’s Law: People produce in order to consume • No general gluts What if suppliers don’t spend? • Hoarding (saving without investing) • ↓AD ⇒ ↑unemployment ⇒ ↓AD ⇒ · · · Recession As the interest rate approaches zero, stronger liquidity preference • Individuals don’t save (invest), banks don’t lend Flat LM curve • Impotent monetary policy Confidence If • Money illusion • Glut of unemployment • Low interest rates • Deflation • Low consumer and business confidence • Hoarding/Liquidity Trap • Dearth of investment Then • Increase national income by shifting IS curve, increasing AD Gov’t. should spend, spend, SPEND! Expansion of credit by banks A central bank is necessary for banks to expand credit • “if banks were truly competitive, any expansion of credit by one bank would quickly pile up the debts of that bank in its competitors, and its competitors would quickly call upon the expanding bank for redemption in cash”* *Rothbard, Economic Depressions: Their Cause and Cure expansion ⇒ Inflationary Boom Domestic prices bid up ⇒ ↑imports Gold flows out of the country as payment for imports As banks’ gold stores dwindle, panic! Credit • Fractional reserve banking Banks call in loans, ↓Money supply (deflation) Economy contracts Interest rate artificially depressed Malinvestment • Low i rate is only temporary Overinvestment in capital goods • Not enough savings to buy all producers’ goods Capital is heterogeneous Gold Standard Money supply shouldn’t increase, even if the population or supply of goods increases • Deflation problems Government sanctioned ↑M ≈ counterfeiting Smallest decision making unit: the individual Homo economicus • Rational • Self-interested • Utility maximizing Assume perfect information Money illusion/stickiness • Example: Deflation • Workers resist ↓nominal wages • Businesses have 2 options: Raise prices ⇒ cost-push inflation Lay off wokers Workers seek new jobs Businesses offer wages that reflect workers real worth (if no minimum wage laws, labor unions, etc.) Stickiness due to: • Time lags with change in price level • Contract length • Labor unions Misrepresentation of Say’s Law • Say never said that depressions and unemployment are impossible Say’s Law: supply creates its own demand, so no general gluts • requires flexible, self-correcting markets • A temporary glut in the labor market is not a general glut Hoarding: why? Keynesian economic man: • Ruled by “animal spirits” • Doesn’t make decisions for the long-run • Incapable of thinking in real terms • But somehow responds rationally to lower interest rates by investing less of his money…? Also has roots in classical economics Disagree with both Keynesians and Austrians on inflation and the business cycle Milton Friedman Quantity theory of money: • M*V=P*Q M=quantity of money in circulation V=velocity of money P=price level Q=index of the real value of final expenditures Keynes: V is inherently unstable • M, V move in opposite directions Friedman: direction M, V move in the same Inflation is always a monetary phenomenon • M and P are not independent • ↑M⇒↑P Since M*V=P*Q, we have ∆M+∆V=∆P+∆Q • Assume velocity is stable (∆V=0) • ∆P=0 if and only if ∆M=∆Q • To avoid inflation, the growth rate of the money supply should be set equal to the growth rate of output Monetarists want monetary policy that creates a stable framework Reducing inflation is not technically difficult, but there are political barriers Possible side effects of reducing inflation: • Recession • Unemployment In a liquidity trap: • Even if the Fed increases M, banks hesitate to lend (low interest rates) • Bypass the banks, give money directly to consumers • Aggregate Demand boosted without increasing government spending Where does the money come from? • Increased tax revenue Borrowing from the private sector Government spends money that otherwise would have been spent in the private sector • Printing money Implicit tax on holders of dollar denominated assets No legislation involved Keynesian Theories Money Illusion/“Animal spirits” Keynes on Say’s Law Liquidity Trap Non-keynesian • Austrian economics Austrian Business Cycle Theory • Classical Classical vs. Keynes • Monetarism Quantity Theory of Money Inflation and Side Effects Government Spending References • Blinder, Alan S. "Keynesian Economics." The Concise Encyclopedia of Economics. David R. Henderson, ed. Liberty Fund, Inc. 2008. Library of Economics and Liberty [Online] available from http://www.econlib.org/library/Enc/KeynesianEconomics.html; accessed 8 May 2009; Internet. • Caplan, Bryan. Why I am not an austrian economist. Bryan Caplan [cited 04/09 2009]. Available from http://www.gmu.edu/departments/economics/bcaplan/whyaust.htm (accessed 04/09). • Friedman, Milton. 2006. The optimum quantity of money. With a new introduction by Michael D. Bordo; New Brunswick, N.J. and London:; Transaction, AldineTransaction. • ———. 2004. Reflections on A monetary history. Cato Journal 23, (3) (Winter): 349-51. • ———. 2002. Capitalism and freedom. Fortieth anniversary edition; With a new preface by the author. With the assistance of Rose D. Friedman; Chicago and London:; University of Chicago Press. • ———. 1991. Monetarist economics. IEA Masters of Modern Economics series; Oxford and Cambridge, Mass.:; Blackwell. • Friedman, Milton, and Anna J. Schwartz. 1999. Money and business cycles. In The foundations of monetary economics. volume 2., ed. David Laidler, 384-416 Elgar Reference Collection; Cheltenham, U.K. and Northampton, Mass.:; Elgar; distributed by American International Distribution Corporation, Williston, Vt. • Hazlitt, Henry. 1959. The failure of the new economics. Princeton, New Jersey: D. Van Nostrand Company, INC. • Nobel Web. The sveriges riksbank prize in economic sciences in memory of alfred nobel 1974. in Nobel Web [database online]. Sweden, 2009 [cited 6/30 2009]. Available from http://nobelprize.org/nobel_prizes/economics/laureates/1974/press.html (accessed 6/30/09). • Reisman, George. 1998. Capitalism: A treatise on economics. Ottawa, Illinois: Jameson Books. • Rothbard, Murray N. 2000. America's great depression. 5th ed. The Ludwig von Mises Institute. • ———. 1997. The Austrian theory of money. In The logic of action one: Method, money, and the Austrian school. 297-320. Cheltenham, UK: Edward Elgar Publishing Ltd. • ———. 1997. The present state of Austrian economics. In The logic of action one: Method, money, and the Austrian school. p. 111-172. Cheltenham, UK: Edward Elgar Publishing Ltd. • ———. Economic depressions: Their cause and Cure. In http://mises.org [cited 6/30 2009]. Available from http://mises.org/tradcycl/econdepr.asp; accessed 6/30/09). • Smiley, Gene. "Great Depression." The Concise Encyclopedia of Economics. David R. Henderson, ed. Liberty Fund, Inc. 2008. Library of Economics and Liberty [Online] available from http://www.econlib.org/library/Enc/GreatDepression.html; accessed 8 May 2009. • Tullock, Gordon. 1988. Why the austrians are wrong about depressions. In The review of austrian economics. volume 2., eds. Murray N. Rothbard, Walter Block, 73-78Washington, D.C.:; Ludwig von Mises Institute. • Wikipedia contributors. Rational choice theory. Wikipedia, The Free Encyclopedia. http://en.wikipedia.org/w/index.php?title=Rational_choice_theory&oldid=285627674 (accessed 05/08, 2009).