Data base per schede prodotto BTP Italia - NEW

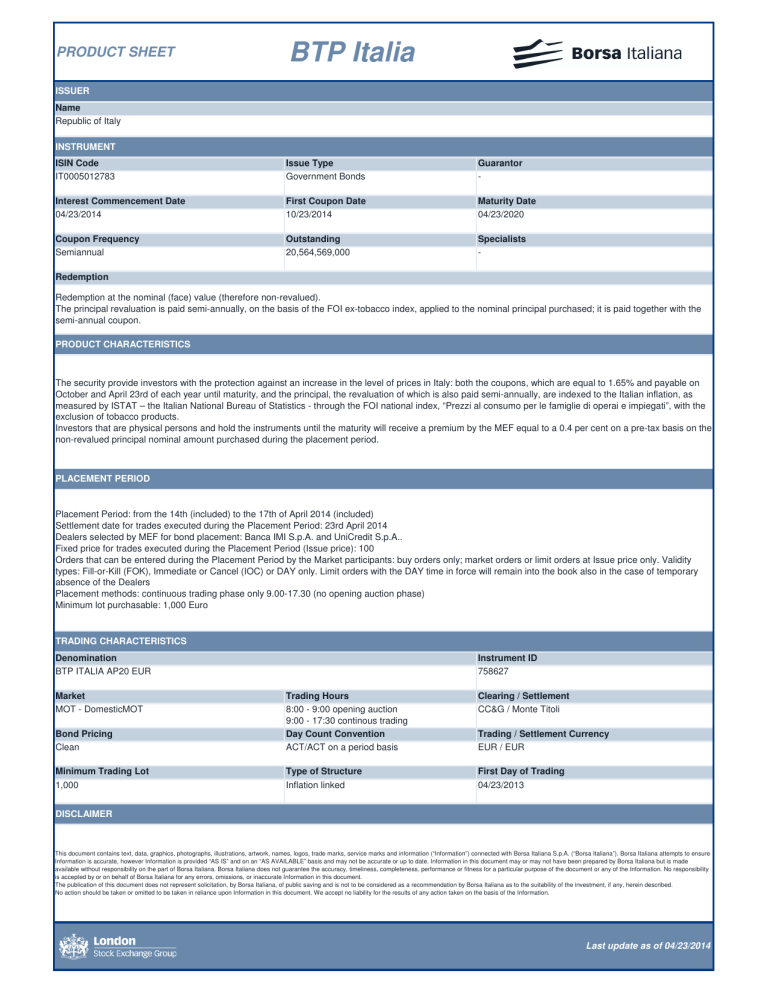

PRODUCT SHEET

BTP Italia

ISSUER

Name

Republic of Italy

INSTRUMENT

ISIN Code

IT0005012783

Interest Commencement Date

04/23/2014

Issue Type

Government Bonds

First Coupon Date

10/23/2014

Guarantor

-

Maturity Date

04/23/2020

Coupon Frequency

Semiannual

Outstanding

20,564,569,000

Specialists

-

Redemption

Redemption at the nominal (face) value (therefore non-revalued).

The principal revaluation is paid semi-annually, on the basis of the FOI ex-tobacco index, applied to the nominal principal purchased; it is paid together with the semi-annual coupon.

PRODUCT CHARACTERISTICS

The security provide investors with the protection against an increase in the level of prices in Italy: both the coupons, which are equal to 1.65% and payable on

October and April 23rd of each year until maturity, and the principal, the revaluation of which is also paid semi-annually, are indexed to the Italian inflation, as measured by ISTAT – the Italian National Bureau of Statistics - through the FOI national index, “Prezzi al consumo per le famiglie di operai e impiegati”, with the exclusion of tobacco products.

Investors that are physical persons and hold the instruments until the maturity will receive a premium by the MEF equal to a 0.4 per cent on a pre-tax basis on the non-revalued principal nominal amount purchased during the placement period.

PLACEMENT PERIOD

Placement Period: from the 14th (included) to the 17th of April 2014 (included)

Settlement date for trades executed during the Placement Period: 23rd April 2014

Dealers selected by MEF for bond placement: Banca IMI S.p.A. and UniCredit S.p.A..

Fixed price for trades executed during the Placement Period (Issue price): 100

Orders that can be entered during the Placement Period by the Market participants: buy orders only; market orders or limit orders at Issue price only. Validity types: Fill-or-Kill (FOK), Immediate or Cancel (IOC) or DAY only. Limit orders with the DAY time in force will remain into the book also in the case of temporary absence of the Dealers

Placement methods: continuous trading phase only 9.00-17.30 (no opening auction phase)

Minimum lot purchasable: 1,000 Euro

TRADING CHARACTERISTICS

Denomination

BTP ITALIA AP20 EUR

Market

MOT - DomesticMOT

Bond Pricing

Clean

Minimum Trading Lot

1,000

DISCLAIMER

Trading Hours

8:00 - 9:00 opening auction

9:00 - 17:30 continous trading

Day Count Convention

ACT/ACT on a period basis

Type of Structure

Inflation linked

Instrument ID

758627

Clearing / Settlement

CC&G / Monte Titoli

Trading / Settlement Currency

EUR / EUR

First Day of Trading

04/23/2013

This document contains text, data, graphics, photographs, illustrations, artwork, names, logos, trade marks, service marks and information (“Information”) connected with Borsa Italiana S.p.A. (“Borsa Italiana”). Borsa Italiana attempts to ensure

Information is accurate, however Information is provided “AS IS” and on an “AS AVAILABLE” basis and may not be accurate or up to date. Information in this document may or may not have been prepared by Borsa Italiana but is made available without responsibility on the part of Borsa Italiana. Borsa Italiana does not guarantee the accuracy, timeliness, completeness, performance or fitness for a particular purpose of the document or any of the Information. No responsibility is accepted by or on behalf of Borsa Italiana for any errors, omissions, or inaccurate Information in this document.

The publication of this document does not represent solicitation, by Borsa Italiana, of public saving and is not to be considered as a recommendation by Borsa Italiana as to the suitability of the investment, if any, herein described.

No action should be taken or omitted to be taken in reliance upon Information in this document. We accept no liability for the results of any action taken on the basis of the Information.

Last update as of 04/23/2014