Introduction to Prices

advertisement

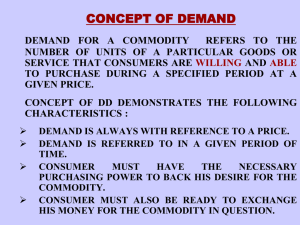

LOCAL AND REGIONAL PROCUREMENT 4. Introduction to Prices LRP Market Monitoring Training Prices Price is the cost or value of a good or service expressed in monetary terms. Price indicates the value that has been given to a particular commodity. Price signals carry information about the cost of production, transportation, storage, quality, perceptions and desires and, in some cases, government policies or distortions. Commodities have different prices at different market levels: Farmgate price Wholesale price Retail price Prices along the Commodity Chain Farmgate: prices paid to producers by brokers, aggregators, wholesalers and other market agents. Wholesale: intermediary prices paid during transactions among brokers, aggregators and wholesalers. We are concerned with the prices that retailers pay to wholesalers. Retail: prices paid by households or individual consumers. Prices within Commodity Chain Levels Along a commodity supply chain, each trader buys and sells at different prices Buying price – the price paid by a buyer of goods or services, e.g. the price the wholesalers pays the farmer. Selling price – the price the seller receives from a buyer of good or services, e.g. the price the wholesaler receives from the retailer. In most cases, the selling price will be greater than the buying price to reflect the value added at that level of the market chain. Determinants of prices Prices are a function of the supply and demand for a commodity in a market. Market supply – the amount of commodity being offered in the market. Can come from local production, private or public stocks, regional and international trade and food aid. Market demand – the amount of a particular good or service that a consumer or group of consumers will want to purchase at a given price. Only people who can pay for their food have effective demand. Supply and Demand How Supply and Demand Affect Prices Supply Prices ? Demand Prices ? Factors Affecting Supply and Demand Source: Timmer (2008) “Causes of High Food Prices.” Asian Development Outlook 2008 Update. P. 78 Global commodity prices driven by poor harvests, demand and speculation THE USDA's shockingly low yield projection for the US 2010 maize crop has re-ignited price momentum, propelling prices to new 26-month highs. World maize demand is seen 25m tonnes up this season as the US and China consume more in ethanol and feeds, while other users try to find alternatives for shortfall in Russian wheat supplies. Seasonality (Temporal Integration): Maize Calendar in Mozambique Seasonality: FEWs Average Maize Prices in Mozambique Trade flows (Spatial integration): Maize production and flows in Mozambique Policy Impacts on Prices Changing price Subsidies Price ceilings, floors Taxes and tariffs Shifting supply and demand Restrictions on imports Restrictions on exports Non-tariff barriers Public stockholding and sales Income transfers, food aid deliveries, LRP Exchange rates Inflation Inflation is an overall rise in the prices of good sand services in an economy, due to the decrease of the value of money. Nominal prices – the actual prices that you observe in the market. Real prices – prices that have been adjusted for inflation. Other Determinants of Price Type of product Product quality Amount of product Packaging Time of sale Place of sale Processing Marketing/contracts FEWs: Policy impacts (Lesson 3, p. 24) 16 FEWs: Policy impacts (Lesson 3, p. 24) 17 References Barrett, C. and E. Lentz (2010). Draft AEM 6940 MIFIRA Lecture Notes: Lecture 4. FEWs Net (2008) “Market Assessment and Analysis: Learners Notes.” FAO. Lentz, E (2010). Technical Guidance on Collecting Price Data : Sheet 1.