Jay Hutchin`s Presentation - Bean Hamilton Corporate Benefits

advertisement

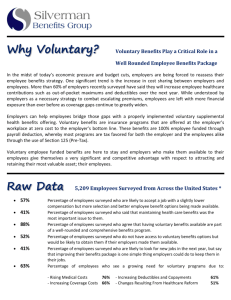

How to Use Voluntary Benefits to Reduce Your Benefit Costs Pressure Jay Hutchins Vice President Broker Marketing & Sales Costs continue to rise Health insurance premiums for family coverage up 131% in past decade Average cost of group health coverage expected to rise 8.8% from 2010 to 2011* Smallest employers pay 18% more for health plans Sources: Kaiser Family Foundation and Health Research & Educational Trust, “Employer Health Benefits,” 2009; Hewitt Associates, “U.S. Health Care Cost Rate Increases Reach Highest Levels in Five Years, According to New Data” Competitive benefits are critical 62% 59% 52% 49% 42% Source: LIMRA: Navigating the Employee Benefits Marketplace, 2011 38% Most important factors when considering a new job with comparable salary 4 keys to benefits cost control Redesign Utilization Eligibility Wellness Benefits Plan Redesign Employers respond to rising costs Absorb rate increase at renewal Shift more contributions to employees Shift more contribution to Employee Direct impact to employer’s bottom line Direct impact to employee’s pocket book Redesign with highdeductible health plan Increases employee’s out-of-pocket exposure Current plan New plan Employee out-of-pocket costs Expenses covered by Expenses health plan covered by health plan Employee out-of-pocket costs Expenses covered by health plan Source: National consumer study, Financial Industry Regulatory Authority Investor Education Foundation in consultation with the U.S. Department of Treasury and President’s Advisory Council on Financial Literacy, 2009. Voluntary solution Employee out-of-pocket costs Medical gap coverage Expenses covered by health plan ● Employer saves money by redesigning health plan ● Employees receive benefits to help pay outof-pocket costs from a hospital confinement or other covered health care event Types of voluntary benefits Supplemental health Accident Disability Life Critical illness and cancer Employers value voluntary benefits Source: Ron Neyer, “The Voluntary Benefits Report Card,” LIMRA International, 2007 Common misconceptions Administration is too complex Employees aren’t interested Enrollment takes too much time Designed for large corporations Workers value voluntary benefits Flexibility in using claim payments Portability Stable coverage and premiums More lenient underwriting Convenient payment Utilization Benefits understanding is critical Importance Level of Knowledge 5% 21% 90% Source: Colonial Life, SHRM national conference survey, June 2008 74% Human resources challenges Source: Colonial Life & Accident Insurance Company, “Colonial Target Model and Larger Case Research,” May 2008 Employers agree 1-to-1 communication works 91% Yes 3% No Source: Colonial Life, SHRM national conference survey, June 2008 Employees say 1-to-1 works Value of Meeting Not important Important Very important Source: Colonial Life post-enrollment surveys, Jan.-Dec. 2010 Benefits Understanding Not improved Improved Significantly improved Eligibility Dependent verification Dependents in Plan 100 500 Estimated Ineligible 5% 5% Average Annual Cost per Dependent $1,900 $1,900 Potential Savings per Year $9,500 $47,500 Source: Continuous Health company records Benefits of dependent verification Efficient process in 1-1 enrollments High return on investment Clear communication Prevent claims problems Wellness Wellness programs Exercise Smoking cessation Online health assessments Onsite health screenings Telephone nurse line 4 keys to benefits cost control Redesign Utilization Eligibility Wellness Questions?