The G20 – Emerging Powers and Transatlantic Relations

advertisement

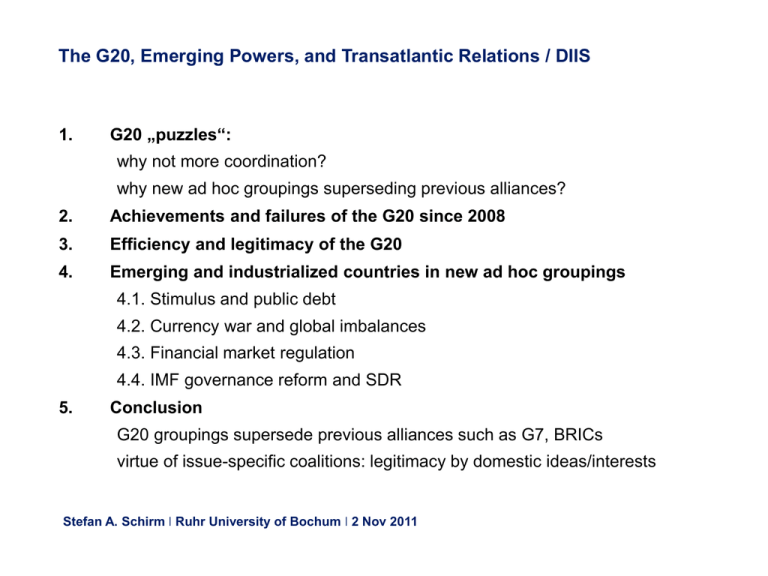

The G20, Emerging Powers, and Transatlantic Relations / DIIS 1. G20 „puzzles“: why not more coordination? why new ad hoc groupings superseding previous alliances? 2. Achievements and failures of the G20 since 2008 3. Efficiency and legitimacy of the G20 4. Emerging and industrialized countries in new ad hoc groupings 4.1. Stimulus and public debt 4.2. Currency war and global imbalances 4.3. Financial market regulation 4.4. IMF governance reform and SDR 5. Conclusion G20 groupings supersede previous alliances such as G7, BRICs virtue of issue-specific coalitions: legitimacy by domestic ideas/interests Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 1. G20 „puzzles“: why not more coordination? => global economic and financial crisis led to expectation that this critical juncture would induce systemic overhaul by joint action => however, domestic value-based ideas and material interests diverge considerably among G20 members and shape negotiations why new ad hoc groupings superseding previous alliances? => previous alliances (G7, trade G20, BRICs) and different developmental levels led to expectation that a confrontation of industrialized versus emerging countries would shape G20 => however, on most issues, some industrialized countries joined with some emerging countries in ad hoc groupings against other equally heterogeneous ad hoc groupings Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 2. Achievements and failures of the G20 since 2008 Innovations: leaders level summits (political clout), industrialized and emerging countries together (broader base), steering the world economy beyond specialized organizations such as IMF, WTO. Achievements: prevented major protectionist movement (...), unique forum for discourse -> shared understandings (blame game), enlarged participation compared to G7, BRICs etc. Failures: no regulation of all financial products/actors/locations as promised, disagreement on most issues, flawed legitimacy Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 3. Efficiency and legitimacy of the G20 Efficiency critics: no binding rules for governments and market actors, no coordination of new national/regional financial market regulation Efficiency proponents: shared understanding on each member‘s duty to cushion the crisis by stimulus programs, new protectionism stayed low Legitimacy critics: only 20 of 193 UN members, no representational system (IMF), intransparent choice of members, authoritarian regimes Legitimacy proponents: 90% of world GDP, 80% of world trade, twothirds of world population „represented“ in G20 Improvement through institutional reform: Global Economic Council with charter and obligations; members representing regional constituencies Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 4. Emerging and industrialized countries in new ad hoc groupings 4.1. Stimulus and public debt In 2008 all countries initiated national rescue packages for banks and stimulus programs for the economy to cushion the impact of the crisis programs differed according to societal ideas and domestic institutions: > US (and UK) entered huge deficit spending, US quantitative easing, following domestic acceptance of high debt and low savings > Germany and others relied largely on automatic stabilizers following domestic preferences for sound fiscal policy, welfare and high savings => these differences led to frictions: US demanding others to increase deficit spending; Germany, NL, China etc. urging for an „exit“ from debt => G20 split between these two ad hoc groupings on fiscal policy Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 4. Emerging and industrialized countries in new ad hoc groupings 4.2. Currency war and global imbalances Currency: US and China criticising each other for devaluating their currencies Brazil, Germany etc. criticizing US and China for provoking a „currency war“ (Brazilian finance minister Mantega) fearing for their export sectors Global Imbalances: Fearing for its domestic industry, US (+F) proposed a 4% cap for export surplus countries, which was rejected by Japan, Germany, China, Brazil => G20 split between opposing ad hoc groupings on both issues, which involved industrialized and emerging economies on both sides. All were following the interest of domestic industrial sectors. Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 4. Emerging and industrialized countries in new ad hoc groupings 4.3. Financial market regulation Financial transaction tax: proposed by France, Germany et.al, strongly rejected by US & UK, fearing for the profits of their financial services => G20 split in opposing ad hoc groupings following interests of banking lobby (US, UK) and societal demands (F, G). Emerging countries rather passive, since transaction tax already in place (Brazil) Basel III: delegated by the G20 to the Basel committee and accomplished in 2010. Higher capital requirements for banks but watered down by banking lobby (to be raised now in Euro debt crisis) => delegation to expert bureaucrats successful but high influence of banking lobby. China, Brazil rather passive, voluntaristic approach Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 4. Emerging and industrialized countries in new ad hoc groupings 4.4. IMF governance reform and SDR > G20 agreed to incease IMF funds by 750 bill US$ and to raise quotas of emerging countries: China, Brazil, Russia among top 10 in voting rights > Executive board reform led to major row between US and Europe: US refused to give up its veto and forced Europe to give up 2 board seats Emerging countries remain unsatisfied with quota reform and US veto > Special drawing rights were proposed as reserve currency alternative to US dollar by China (supported by France, Germany), rejected by US. => Agreement on increase of funds and quota reform, row on executive board between US and Europe and disgreement on SDR between US and Europe, China, Brazil, India over global dominance of US dollar Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011 The G20, Emerging Powers, and Transatlantic Relations / DIIS 5. Conclusions 1. Previous alliances (G7, BRICs, trade G20) were superseded by issuespecific ad hoc groupings in the G20 Different levels of economic development did not structure alliances 2. Transatlantic countries found themselves on opposed sides on most issues => no signs of transatlantic community of interests or ideas 3. All countries performed according to dominant domestic interests (e.g. exporters/importers) and value-based ideas (e.g. savings, fiscal debt) 4. No reason to worry: G20 is shaped by the virtue of issue-specific coalitions based on legitimate domestic ideas and interests: joint charta? Stefan A. Schirm ❘ Ruhr University of Bochum ❘ 2 Nov 2011