Bessemer Trust Asset Class Performance

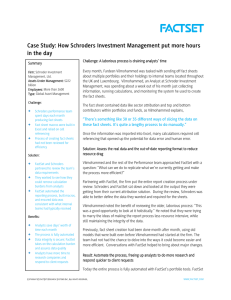

advertisement

The Year Ahead: Looking for Surprises January 2014 Rebecca H. Patterson Chief Investment Officer Bessemer Trust Agenda 1. What The CFA Thinks 2. Where You Might Be Surprised 3. Macro and Market Views For the Year Ahead 4. Key Takeaways 3 What CFA Members Think: Getting More Upbeat Percent of Members Expecting Global Economy to Expand in Coming Year Percent of Members Expecting a Global Financial Bubble to Burst in 2014 63% 47% 40% 34% 26% 13% 10% 4% 2012 2013 2014 Asset Class of Potential Bubble As of October 17, 2013. Source: CFA Institute 4 Room For At Least Three Surprises 1. Emerging-Market Growth 2. Geopolitics 3. Shift in Federal Reserve Policy 5 Emerging Markets: Not Enough Focus? Biggest Risk to Global Capital Markets in 2014 35% 30% 25% 20% 15% 10% 5% 0% Weak Economic Conditions Political Systemic Growth Rates Excess Instability Disruptions Among Regulation Emerging Economies Weak Regulation Other As of October 17, 2013. Source: CFA Institute 6 U.S. Dollar and Yields: Headwinds for Emerging Markets Rising Dollar Suggests Emerging-Market Underperformance1 1.8 130 Emerging Markets Outperform 1.6 Trade-Weighted U.S. Dollar Index (R) 1.4 120 Current Account Balance2 % GDP 6 Emerging Markets 5 4 110 1.2 3 2 1 100 1 Developed Markets Outperform Surplus 0 0.8 90 0.6 -2 EM Index/DM Index (L) 0.4 0.2 1995 -1 80 70 2000 2005 -3 -4 1980 Developed Deficit 1985 1990 1995 2000 2005 2010 2010 1As of December 31, 2013. EM/DM reflects MSCI Emerging Markets Index divided by MSCI World Index, with both indices in U.S. dollars and indexed at 1 on January 4, 1995. The Trade-Weighted U.S. Dollar Index is a weighted average of the foreign exchange value of the U.S. dollar against the currencies of a broad group of major U.S. trading partners. 2Reflects IMF estimates for 2013. Source: FactSet, Federal Reserve, International Monetary Fund 7 2014 Elections Create Policy Uncertainty, Especially in Emerging Markets Country E.U. U.S. Brazil 2014 Election May November October India Indonesia Turkey Sweden May/June April/July August September 1,758 868 822 552 Belgium South Africa May April/July 507 354 World % of World GDP GDP ($B) 17,267 16,724 2,190 73,454 56% As of November 30, 2013. European Union includes 28 member states. GDP is based on IMF estimates for 2013. Source: International Monetary Fund 8 Geopolitical Risks: Could History Repeat? Percent Change in Price of Oil During Periods of Conflict 205% 163% 132% Yom Kippur War/Oil Embargo 1973-1974 Iranian Revolution 1979-1980 Invasion of Kuwait 1990 Source: Bloomberg #twitter-hashtag 9 U.S. Economy To Positively Surprise this Year? NetNet Federal Stimulus/Drag FederalFiscal Fiscal Stimulus/Drag Jobs and Housing % GDP 1.5% Thousands 1,100 Building Permits (L) 550,000 1,000 500,000 900 450,000 800 400,000 700 350,000 Actual Estimate d Stimulus Stimulus 1.0% 0.5% 600 500 Jan 10 Jobless Claims (R) Jan 11 Jan 12 2009 Billions (5) (10) (15) (20) 2010 2011 -0.5% 300,000 -1.0% 250,000 -1.5% Jan 13 2012 Drag Drag 2003 U.S. Energy Trade Balance 0 0.0% 2013 2005 2007 2009 2011 2013 2015 2017 Oil and Inflation $/bbl YoY % Chg 130 3.0 125 Crude Oil Price (L) 120 115 105 1.5 100 95 85 Feb 12 2.5 2.0 110 1.0 90 (25) 2019 CPI (R) 0.5 Aug 12 Feb 13 Aug 13 As of December 31, 2013, except for Building Permits and CPI (as of November 30, 2013). Crude oil price represents Brent. Source: Commodity Research Bureau, FactSet, Federal Reserve, Strategas Research Partners, U.S. Census Bureau, U.S. Department of Labor 10 European, Japanese Economies Also Showing Relative Improvement % EMU Borrowing Costs Lower, Confidence 10-YearHigher Bond Yields Bank of Japan Adding Liquidity BoJ Balance Sheet 8.0 7.5 200 Spain 7.0 6.5 180 6.0 5.5 5.0 4.5 4.0 3.5 Jul 12 Low Italy Risk Oct 12 160 Jan 13 Apr 13 Jul 13 Oct 13 High Risk 140 Euro Area Consumer Confidence 2010 0 2011 2012 2013 120 (5) (10) (15) 100 (20) (25) (30) 80 2006 2007 2008 2009 2010 2011 2012 2013 As of December 31, 2013. Consumer confidence is measured on a scale of -100 to 100, where -100 indicates extreme lack of confidence about the economy, 0 indicates a neutral view, and 100 indicates extreme confidence. Bank of Japan’s balance sheet assets are indexed at 100 on December 31, 2006. Source: Bank of Japan, European Commission, FactSet, Strategas Research Partners 11 China: Longer-term Challenges Remain but Near-term Looks Stable Exports by Region: Looking Up % Change, 50YoY Domestic Rebalancing Still Needed % GDP 50 48 40 Investment 46 30 44 20 42 Asia, exU.S. HK EU 10 40 38 0 36 -10 34 -20 -30 2008 Household Consumption 32 30 2009 2010 2011 2012 2013 1992 1996 2000 2004 2008 2012 As of December 31, 2013, except for right chart, which is as of December 31, 2012. Exports shown represent a 5-month moving average. Source: Bloomberg, The World Bank 12 Cyclical Assets Helped by Global Liquidity, Not Just Fed % % of GDP 5.2 30 G-4 Central Bank Balance sheets (R) 4.2 25 3.2 20 2.2 15 Global Policy Rate 1.2 2007 10 2008 2009 2010 2011 2012 2013 2014 Actual as of October 31, 2013 with J.P. Morgan estimates thereafter. Source: Bank of England, Bank of Japan, European Central Bank, Federal Reserve, J.P. Morgan 13 Bottom-Up: U.S. Equity Valuations Not at Highs The S&P 500 Index 2000 1800 1600 +106% Mar 24, 2000 Level = 1527 P/E = 25.2x +101% 1400 1200 Oct 9, 2007 Level = 1565 P/E = 15.2x Dec 31, 2013 Level = 1848 P/E = 15.4x -57% +173% -49% 1000 800 600 1997 Dec 31, 1996 Level = 741 P/E = 1999 15.9x 2001 2003 Oct 9, 2002 Level = 777 P/E = 2005 13.8x 2007 2009 Mar 9, 2009 Level = 677 P/E = 2011 10.2x 2013 As of December 31, 2013. P/E ratio represents price-to-earnings ratio for next 12 months, based on FactSet aggregated consensus estimates. Source: FactSet, Standard & Poor’s 14 Market Positioning Not Even Close to Stretched Cumulative Net Fund Flows Four Most Recent Bull Markets Billion Total Percent Return Start End Duration (Months) 8/12/82 8/25/87 60 229% $1,200 12/04/87 7/16/90 31 65% $1,000 10/11/90 3/24/00 113 417% $800 10/09/02 10/09/07 60 101% --- 57 203% $1,600 Bonds $1,400 1,346 $600 $400 Equitie 496 s 3/09/09 $200 $0 2007 2008 2009 2010 2011 2012 2013 Left chart as of November 30, 2013. Right table as of December 31, 2013. Fund flows reflect cumulative net flows into mutual funds and ETFs from January 1, 2007 through November 30, 2013. Source: FactSet, Strategas Research Partners 15 Key Taper Transmission Channels Taper Begins Higher LongerDated U.S. Treasury yields Stronger U.S. Dollar Pressure on Commodity Prices • Pressure on Emerging Markets • • • • • Low inflation Moderate EM demand Greater supplies EM debt positioning Focus on deficit countries with inflation 2014 political risk 16 Positioning Going into 2014 Asset Class Outlook Traditional Government Bonds Credit Commodities Developed Market Equities Emerging Market Equities and Debt U.S. Dollar #twitter-hashtag 17