“DRAFTING OF DEED, WILL AND DOCUMENTATION

advertisement

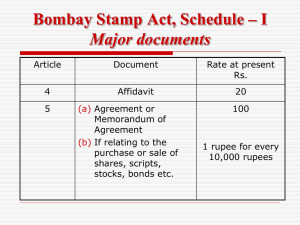

“DRAFTING OF DEED, WILL AND DOCUMENTATION AND ITS LEGAL IMPORTANCE” By DR. MAHESH THAKAR ADVOCATE B.Sc.,LLM, Ph.D., FCS, CAIIB “Reputation and learning are akin to capital assets, like the good will of an old partnership… For many, they are the only tools with which to hew a pathway to success. The money spent in acquiring them is well and wisely spent.” -----------------------Lawyers: “Persons who write a 10000 word document and call it a brief” -----------------------“There are two kinds of lawyers: those who know the law and those who know the judge.” POINTS OF DISCUSSION 1. WHAT IS A DOCUMENT? 2. VARIOUS STATUTORY DEFINITIONS OF “DOCUMENT” 3. DRAFTING OF DOCUMENTS: IMPORTANT INITIAL ASPECTS: 4. DOCUMENTS GENERALLY REQUIRED TO BE PREPARED UNDER VARIOUS ACTS: 5. IMPORTANT PRINCIPLES AND SUGGESTIONS FOR GOOD DRAFTING: 6. COMMON FEATURES OF A DOCUMENT: 7. DOCUMENTATION IN CYBER WORLD: 8. DOCUMENTS AND EVIDENCE ACT: 9. OFFENCES RELATING TO DOCUMENTS UNDER INDIAN PENAL CODE: 10. STAMP ACT (FAQs) 11. WILL 12. SOME IMPORTANT DOCUMENTS & STAMP DUTY 1. WHAT IS A DOCUMENT? A document is something that furnishes evidence and shall also include matter written, expressed or described upon any substance by means of letters, figures or marks or by more than one of those means which is intended to be used or which may be used for the purpose of recording that matter. 2. VARIOUS STATUTORY DEFINITIONS OF “DOCUMENT” Statute Section Definition General Clauses Act S. 3(18) “Document” shall include any matter written, expressed or described upon any substance by means of letters, figures or marks, or by more than one of those means which is intended to be used or which may be used for the purpose of recording that matter. Companies Act S. 2(15) “Document” includes summons, notice, requisition, order, other legal process and registers, whether issued, sent or kept in pursuance of this or any other Act or otherwise. Indian Evidence Act S. 3 The word “document” denotes any matter expressed or described upon any substance by means of letters, figures or marks, or by more than one of those means, intended to be used, or which may be used, as evidence of that matter. Information Technology Act, 2000 S. 2 “Document” includes an electronic record as defined in clause (t) of sub-section 1 of Sec. 2 of The I. T. Act, 2000 Registration Act Sec “Document” means a document which is legally enforceable. 50 3. DRAFTING OF DOCUMENTS: IMPORTANT INITIAL ASPECTS: • A document is intended to be an evidence and has to stand the test of law. Hence, knowledge of law is the basic essential requirement. Since the laws are many and multiple, the concept of super specialization within some branches involves specialization in the specific branch of law or practice. • The drafting professional should conceive the sketch or skin of the draft so that no important aspects or omitted or irrelevant aspects get admitted randomly. • The paragraphs in the draft should come in strictly logical order highlighting the purpose and scheme of the document. • Since a document is intended to operate within a legal framework, use of legal language is indispensable but it should be to utmost possible extent precise and accurate. The draft must be readily intelligible to layman. • The drafting professional should appreciate and use precise words to convey what he means to say, what he does not mean to say and what he need not say. • Document should be self-explanatory and unambiguous. • Prefer separate documents where subject matters are distinct or applicable rules of law are different. • Before releasing the draft, it be reconsidered/verified to satisfy that before it is too late, the draft means what it intends and terms are clear and definite. 4. DOCUMENTS GENERALLY REQUIRED TO BE PREPARED UNDER VARIOUS ACTS: (i) Indian Contract Act: Agreements, MOUs, guarantees, indemnities, power of attorneys and all other documents not specifically covered elsewhere. (ii) Companies Act: Memorandum and Articles of Association, resolutions, minutes, proceedings relating to takeovers, mergers, scheme of amalgamation, demergers and connected documentation, Prospectus. (iii) Indian Partnership Act: Partnership deeds, reconstitution, resolution, retirement of partners (iv) Transfer of Property Act: Sale deeds, lease deeds, gift deeds, exchange of property, mortgage, documents, agreement for sale, construction and development agreements, release deeds. (v) Intellectual Property rights: Copyright, relinquishment of copyright, trademarks and its assignments, patents’ registration and assignment, registration of designs, franchise agreements, etc. (vi) Banking transactions, related documentation: Sanction letters, board resolutions, hypothecation and mortgage documents, consortium documents. (vii) Industrial and labor laws: Appointment, apprenticeship, disciplinary proceedings, charge sheets, departmental inquiries, retrenchment, schemes for gratuity, provident fund trust, contract labor, etc. (viii) Insurance laws: Insurance policies, assignments and other connected documents (ix) Arbitration laws: Arbitration agreement, international arbitration agreements, notices for arbitration, submissions before arbitrators, proceedings for challenge to arbitration award, etc. (x) International agreements: Agreements between the parties/corporates having different nationality and governed by different laws, treaties and protocols, conventions applicable to and governing the situation. (xi) Testamentary and family laws: Will, codicil, cancellation of will, family settlement, creation of trust, family partition, marriage and divorce, intervous and testamentary succession, adoption deed. (xii) Other financial transactions: Commercial papers, related documentation, standby facility, consequences of default (xiii) Other miscellaneous documents: Formation of societies, NGOs, S. 25 companies, financial collaborations, joint ventures, bonds, agency, consultancy, supply. (xiv) Pleadings: The petitions, applications and written submissions made before any authority who has power to adjudicate normally comes within pleading. It contains the material fact on which the party pleading relies for his claim or defense. Generally, it follows the following chronology: • Original application/plaint/suit/petition usually filed by plaintiff/applicant initiating action. • Upon notice, the other side has to file Written Statement/affidavit-in-reply. • Thereupon the petitioner can file rejoinder in reply to the contentions in the W.S. • Affidavit-in-sur-rejoinder by the other side followed by additional affidavits depending on the issues involved. • Affidavits required to be filed The list is merely illustrative and not exhaustive 5. IMPORTANT PRINCIPLES AND SUGGESTIONS FOR GOOD DRAFTING: • Be clear.. through the document to any person who has a knowledge of the subject matter. Prepare scheme of facts and contents you propose to deal with through a instructions section. • Be satisfied.. as to what the document means to say, does not mean to say and need not say. Since client may not be as well-versed in law as you are, be sure as to within what legal framework such as Sections, Rules, notifications, if applicable, the document is recognized and operates. • Be unambiguous.. Avoid a situation where you are thinking that you are saying one thing but really saying more than one. • Be self-explanatory.. through the document • Have separate documents... Documents which are completely distinct or applicable rules of law differ • Use schedules... In respect of matters which are factual such as description of property, list of assets, etc. which may make the document otherwise complex, but cannot be dispensed with. • Be logical... So that the risk of omission and repetition is minimized. • Use words in the same sense... If in a specific context, meaning changes, use the word phrase “unless expressed otherwise or repugnant to the context or meaning thereof”. • Avoid passive voice... Unless in particular context, it makes the meaning more clear, active voice be preferred. • Comply with incidental mandatory requirements... such as stamping of documents, registration, vetting, etc. • Avoid self-complacency/unilateralism... be prepared for vetting, review without necessarily accepting casual and uncontextual suggestions. Clarity as to the bare minimum contents you require for protecting and safeguarding your interest has to be adhered to. • Respect precedent and forms... without converting yourself into a mechanical follower, so that allegations like “non-application of mind” or “cut and paste” technologist can be avoided. • Historical context... When documents are supplemental, be sure about what the principal document says and what is intended to be dealt with in supplemental documents. • In respect of documents having transborder effect... be sure as to law of which country will be applicable and ensure its compliance. • Prefer a Chapter of definitions... When few words are often repeated throughout the document, it is advisable to have in initial part a chapter giving definitions of those words. • In respect of corporate bodies... When they are a party to the documents, take additional care of the special provisions applicable to such party. Thus, for e.g., (i) a public limited company has restrictions u/s. 293 of Companies Act for borrowing. (ii) a public trust cannot mortgage or lease without prior permission of Charity Commissioner. (iii) a society has to follow its by-laws, (iv) Government has to execute the document through a person authorized by the governor/President or under departmental rules. 6. COMMON FEATURES OF A DOCUMENT: (a) Commencement/title of the deed Such as conveyance deed, gift deed, joint venture agreement, etc. (b) Description of parties to the deed and their legal character in the transactions. (c) Recitals: Usually it begins with the word “whereas” and it controls and narrates the background of the operative part of the document. It may narrate the circumstances and context in which the document is prepared. Followed by such narrative recital there may be the reference of agreement which is intended to be given effect. (d) Parcels: A phrase from English drafting which is popularly used refers to property sought to be conveyed and correct description thereof. (e) Operative part: In background of the recitals, usually the operative part comes as “in consideration of... The parties hereby agree/convey”, etc. (f) Arrangement: It narrates and elaborates para-wise how the recitals and operative part have been given effect. (g) Testimonial: It is the conclusive part and the usual phrase is “in witness whereof the said parties hereunto have executed this deed”. (h) Attestation: Certain documents require attestation which means person other that parties will witness the fact of the document being signed in his/her presence. Such documents are will, sale deed, lease deed, etc. 7. DOCUMENTATION IN CYBER WORLD: Legislative changes have been brought in to keep pace with the new millennium when speed is the hallmark of every individual’s initiative and India has to keep pace with the global developments. Accordingly, Information Technology Act, 2000 has been enacted and amended. It has brought corresponding changes in Indian Penal Code, Indian Evidence Act, Bankers’ Book Evidence Act and Reserve Bank of India Act. The United Nations adopted modal law on electronic credit named United Nations Commission on International Trade Law (UNCITRAL). Some of the important features of this law relevant for our today’s topic have been summarized below: • I.T. Act applies to whole of India except when specifically provided otherwise. In Sec. 2 of the Act, important and significant terms such as electronic signature, electronic record, data, computer system, etc. have been defined. • Sec. 3 deals with authentication of electronic record by use of asymmetric crypto system and hash function which envelop and transform the initial electronic record into another electronic record. Hash function is an algorithm mapping or translation of one sequence into another. Manner of authenticating digital signature and creation of digital signature also has been elaborated. Sec. 11 deals with attribution of electronic records to the originator who sends or authorizes sending of or sends through an information system program by originator. If originator does not stipulate receipt of electronic record in a particular form, any communication or conduct to that effect by the addressee is sufficient. • Sec. 13 stipulates that unless agreed otherwise, dispatch of electronic record occurs when it enters a computer resource outside the control of the originator. (It is like offer and acceptance under the traditional Contract Act). • Sec. 65, 66, 67 deals with the offences such as tampering with computer source documents, computer related offences and punishment. The punishment is imprisonment up to 3 years and/or five lac rupees and for subsequent offence, 5 years and ten lac rupees. • A statutory authority namely “Controller” has been constituted u/s. 68 and he has the power to give directions. The Central Govt. also has powers to issue directions for interception or decryption of any information through any computer source. • Following punishments/penalties have been prescribed Sec, Offence Punishment and/or penalty 71 Misrepresentation or suppression of fact to the controller/Certifying authority 2 years and one lac rupees 72 Breach of confidentiality and privacy 2 years and one lac rupees 73 Publishing false electronic signature certificate 2 years and one lac rupees 74 Publication for fraudulent purpose 2 years and one lac rupees Caution notes: • Even offences or contravention committed outside of India irrespective of nationality are also covered. • U/s. 76, computer or computer system, floppies, discs and accessories can be confiscated. 8. DOCUMENTS AND EVIDENCE ACT: • Evidence Act applies to all judicial proceedings where the facts and relevant facts have to be ascertained and on the basis of that, conclusions have to be arrived in all trials/cases both civil and criminal. • Usually all provisions of Evidence Act do not apply to Tribunals and such Sections are inserted in constituting Act of the Tribunal. • As stated in the initial part, a document, in case of dispute requires to be tested on the touchstone of evidence through a court trial. • Chapter 5 of Evidence Act deals with documentary evidence and it may be appropriate to look at some of the important provisions: • Sec. 61: Contents of documents may be proved either by primary evidence or secondary evidence. • Primary evidence means the document itself produced in the Court. • Secondary evidence means certified copies. • Sec. 64 stipulates that documents must be proved by primary evidence except when u/s. 65 the original is shown or appears to be in power or possession of a person against whom it is sought to be proved or its existence, condition and contents have been admitted by such person or when original is destroyed or lost or it is a public document, etc. • Contents of electronic record may be proved by producing the computer output contending the information with all its material parts and requirements of Sec. 65(b) are satisfied. • Sec. 67 requires that a document is alleged to be signed or written by any person’s signature or handwriting must be proved and onus lies on the party who asserts it. • A document required by law to be attested cannot be used as evidence unless atleast 1 attesting witness has been examined. • Sec. 71 says that if attesting witness denies or does not recollect execution of document, it may be proved by other evidence. The documents forming the acts or records of official bodies, tribunals, sovereign authorities, etc. are called public documents and a certified copy thereof can be produced as proof of the contents of “public documents”. • Chapter 6 of Evidence Act deals with “Exclusion of oral by documentary evidence”. U/s. 91, if terms of contract have been reduced to form of a document or required under law to be so reduced, oral evidence is not admissible. However, any fact which may invalidate such document such as fraud, intimidation, illegality, etc. can be proved. • U/s. 99, persons who are not parties to a document or their representative-in-interest may give evidence of any facts tending to show a contemperous agreement varying the terms of the document. • The responsibility of proving a document is called “burden of proof’ and it lies on the person who asserts or who’s case will fail if it is not proved. 9. OFFENCES RELATING TO DOCUMENTS UNDER INDIAN PENAL CODE: • Since ignorance of law is not an excuse and professionals including chartered accountants have the occasions to prepare or deal with or certify the documents, hence a brief reference of the provisions. • Sec. 463 of IPC deals with the definition of “forgery” and in short, it means making any false document or false electronic record with intent to cause damage or injury to the public or to any person. Sec. 464 elaborates false document and making it dishonestly, fraudulently, etc. An example from the statute book can enlighten as to how strict is the law on this point. • A, without Z’s authority, affixes Z’s seal to a document purporting to be a conveyance of an estate from Z to A, with the intention of selling the estate to B and thereby of obtaining from B the purchase-money. A has committed forgery. • A picks up a cheque on a banker signed by B, payable to bearer, but without any sum having been inserted in the cheque. A fraudulently fills up the cheque by inserting the sum of ten thousand rupees. A commits forgery. • U/s. 465, forgery is an offence punishable with 2 years imprisonment. • More serious offence is u/s. 466 and 467 where 7 years imprisonment for forgery of a court record or public register is prescribed. • Sec. 467 deals with forgery of valuable security, will, transfer of valuable property, receive money, etc. and such punishment may extend to 10 years. • U/s. 468, committing forgery for the purpose of cheating is punishable with 7 years. Forgery to harm reputation is punishable with 3 years. • U/s. 471, fraudulently or dishonestly using as genuine any document which one has reason to believe that it is false attracts the same punishment. • S. 472 deals with counterfeiting any seal or instrument for committing forgery and punishment is 7 years. • U/s. 489A, counterfeiting currency note is punishable with 10 years if done knowingly. Same punishment for selling, buying or receiving such currency notes or having reason to believe that it is forged. • S. 489C stipulates punishment of 7 years for being in possession of any counterfeit currency note knowing or with reason to believe that it is counterfeit. • S. 477A is in the same group of offences and deals with falsification of accounts with intent to defraud and punishment is 7 years. • Sec. 192 deals with fabricating false evidence for making entry in any book or record or electronic record or making such document which may be used as evidence before Court or arbitrator and if court may be misled by such evidence and form an opinion then it is offence of fabricating false evidence for which punishment is 7 years. 10.STAMP ACT (FAQs) Q. Why so important? • Even if the document is very accurately drafted, if it is not duly stamped, it is inadmissible in evidence. Q. Why Central & State Act operate together? • It is a concurrent subject. Indian Stamp Act lays down law or stamp duty on promissory notes, bill of exchange, Letter of Credit, foreign bills, etc. In respect of most other document, the local Stamp Act will apply. Q. Various methods of stamping? • Stamp papers/franking/electronic stamping, adhesive stamps for special purposes such as notary, insurance, share transfer, etc. If Act lays down that duty has to be paid in a specific manner, then it has to be so paid Q. What is adjudication? • Power is vested in the stamp authorities to adjudicate the proper value for stamp duty ignoring what the parties have shown. For immovable properties, the “jantri” is applicable. Q. What is impounding? • If any public officer (other than a police officer) in discharge of his duties and who has authority to receive evidence forms an opinion that document is not duly stamped, he can impound it and send it to stamp authority for adjudication. Q. Can an understamped document still be valid? • By payment of penalty up to 10 times the deficit stamp duty and the proper stamp duty, it can be except for promissory note, etc. 11.WILL • It is governed by Indian Succession Act and the capacity to dispose of is governed of by respective personal laws. • In case of extreme exigency like person from airforce, etc. at war, privileged will, i.e. oral will also permissible. • Will does not require stamp paper nor registration is required. • Will can be modified by a codicil or even cancelled. • Two attesting witnesses are required. • Will has to be proved before a Court and this is called probate. If there is no will then Letter of Succession has to be obtained. • Will can be interpreted by applying Armchair Rule. • Through will, tax planning can be made for future. • Nomination merely entitles a person to receive the property but does not extinguish the right of other heirs. • In respect of self-acquired property, will can be made even in favor of persons other than heirs. 12. SOME IMPORTANT DOCUMENTS & STAMP DUTY: Affidavit Rs. 20/- Development/Promoters Agreement for land 1% of market value of the property Equitable mortgage/hypothecation (Article 6) - for loan up to Rs. 10 crores 0.25% subject to maximum of 1,00,000 - for above Rs. 10 crores (separately for subsequent extension) Subject to maximum of 3,00,000 Articles of Association (Article 12) subject to maximum of Rs. 5,00,000/(A S. 25 company is exempted) 0.5% Memorandum of Association of a company (Article 35) - If accompanies by Articles Rs. 100/- Otherwise Same as Articles Arbitrators Award Rs. 100/- Cancellation of any document Rs. 100/- Conveyance/Sale deed (Article 20) Depends on value of property Gift (Article 28) Same duty as sale deed for immovable property Lease Depends on lease period Leave & licence 0.5% on the premium Letter of Allotment (Article 31) 1 rupee for every one thousand rupees or part thereof Letter of Guarantee Rs. 100/- Mortgage deed - With possession - When possession not given Same duty as conveyance Same as per Article 6 Partnership deed For alteration/dissolution of partnership Power of attorney 1% of the capital subject to maximum of Rs. 10000/Rs. 100/Rs. 100/- except when power to sell the property is given to attorney. In such case, stamp duty as per sale deed THANKING YOU You can contribute your suggestions/views on dr_thakar@indiatimes.com