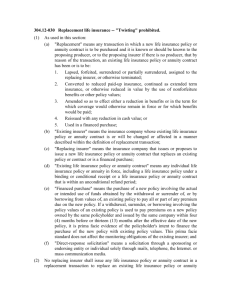

State of the US Life Insurance Industry

advertisement

State of the U.S. Life Insurance Industry Robert Gomez March 1, 2012 Question What was the significance of the Corporation for Relief of Poor and Distressed Presbyterian Ministers and of the Poor and Distressed Widows and Children of Presbyterian Ministers? Answer • The first life insurance company in the U.S. • Established 1759 Today’s Discussion 1. 2. 3. 4. Industry Outlook Life Insurance Trends Annuity Market On the Horizon Industry Outlook • Strengths – Capitalization restored to pre-crisis levels – Liquidity position significantly improved – Credit losses on corporate bond portfolios declining – Stronger enterprise risk management Industry Outlook • Weaknesses – Persistent low interest rate environment – Eurozone contagion risk – Fragile global economic recovery – Potential further downgrade of U.S. credit rating • Overall Outlook for 2012 = Stable (unchanged from 2011) Industry Outlook • Qualities of Top Insurers – Strong brand name – Broad & varied distribution channels – Product diversity – Top quality service – Advanced technology – Pricing power Question • Which life insurer held the most assets at year-end 2010? Answer • Met Life • How much? • $290 billion Market Outlook • Uncertainties – Investments – Interest Rates – Distribution 16 20 14 18 16 12 14 10 12 8 10 6 8 6 4 4 2 2 0 0 1975 1980 1985 1990 1995 2000 2004 2009 Policies Sold (million) Annualized Premium ($bil) U.S. Individual Life Sales Trends Term Life Insurance • Most popular product • From insurer’s perspective: – Competitive market – Little flexibility in premium changes – Sensitive to mortality Whole Life • High level premiums, not flexible for policyholder • From insurer’s perspective: – Mutual company uses dividends to reflect experience – Profits affected by mortality, interest, expenses, and persistency • Resurgence in popularity Universal Life • Flexible premiums • Unbundled product • Secondary Guarantees – Specified Premium – Shadow Accounts – Concern over profitability & level of reserves Variable Universal Life • Sales followed stock market • Peaked in 2000 • Equity-Indexed UL Variable Market Share U.S. Individual Life Annualized Premium Market Share 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1976 1981 1986 Whole Life 1991 Term Life 1996 Universal Life Source: LIMRA’s U.S. Individual Life Insurance Sales Trends, 1975-2010 2001 2006 VL/VUL US Life Insurance Ownership (Percent of Households) Source: LIMRA Household Trends in U.S. Life Insurance Ownership Life Insurance Ownership Amount of Life Insurance Annuity Market • • • • Variable or Fixed Deferred and Immediate Tax-qualified and Non Tax-Qualified Longevity Annuity Sales ($billion) 200 180 160 140 120 100 80 60 40 20 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Deferred Variable Deferred Fixed Immediate Annuity Sales % Change 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% -10.00% -20.00% -30.00% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 -40.00% Deferred Variable Deferred Fixed Immediate Source: LIMRA U.S. Individual Annuity Yearbook & U.S. Individual Annuities Variable Annuities • Sales following stock market trends • Guarantees on account value – Guaranteed minimum death benefit – Guaranteed living benefits • Accumulation • Withdrawal • Income • From insurer’s perspective: – Risk management and hedging – Asymmetrical risk – Revenues derived from % assets • When stocks decline, so do revenues collected Fixed Annuities – Deferred • Guaranteed interest rates • Book Value Surrenders vs. Market Value Adjustments • Equity Indexed – Growing market 100% share 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2000 2002 2004 Deferred Variable 2006 Indexed 2008 2010 Other Deferred Fixed Fixed Annuities - Immediate • Mitigates post retirement uncertainties • Most popular types have fixed period of guaranteed payments with life contingencies • Difficult purchase for many consumers • Potential for strong growth in the future Question • Which state was the first to forbid gender discrimination in insurance rate-setting? Answer • Montana, in 1985 On the Horizon • Regulation • Principle Based Approach • Baby boomers – LTC combination products – Longevity insurance • Pandemic Scenario • Life Settlements • Genetic Testing Robert Gomez ASA, MAAA State Farm Life/Health Actuarial robert.gomez.psa0@statefarm.com