The U.S. Individual Annuity Market by Matthew Drinkwater, Ph.D., FLMI, PCS

BeFi Web Seminar for February 28, 2007

The U.S. Individual Annuity Market by Matthew Drinkwater, Ph.D., FLMI, PCS

Assistant Director, Retirement Research

LIMRA International

The U.S. Individual

Annuity Market

Matthew Drinkwater, Ph.D., FLMI, PCS

Assistant Director, Retirement Research

LIMRA International

Behavioral Finance Forum Webinar

February 28, 2007

Annuities 101

What is an

annuity

?

Contract between an insurance company and an owner wherein the company pays a guaranteed income to the owner for the rest of the annuitant’s life and/or for a specified number of years in exchange for a single payment to the company.

Annuities 101

Owner

Insurance Company

Annuitant

March April May June…

Why Is Lifetime Income Important?

Source: Human Mortality Database, University of California, Berkeley (USA), and Max Planck Institute for

Demographic Research (Germany). Available at www.mortality.org

. Mortality rates based on 1999 experience. LIMRA International tabulations.

Annuities 101

Categories

Individual vs. group

Deferral length

Deferred

Immediate

Product type

Fixed

Variable

Tax-qualification

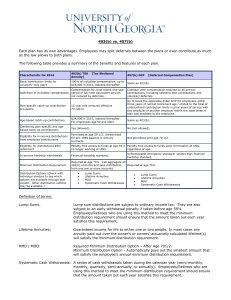

Annuities – The Essentials

Deferral Length

Deferred

Products

Annuitized payouts begin after deferral period

Mainly used for accumulation

Some allow multiple payments

Immediate

Products

Annuitized payouts begin immediately

Used for guaranteed income

Single payment

Annuities – The Essentials

Deferral Length

Deferred

Products

Immediate

Products

Fixed

Deferred

Variable

Deferred

Guaranteed minimum interest rate (during deferral period)

Investments performance reflects market

Not guaranteed*

*Usually

Annuities – The Essentials

Deferral Length

Deferred

Products

Immediate

Products

Fixed

Deferred

Fixed

Immediate

Variable

Deferred

Variable

Immediate

Equal payments

Payments increase or decrease based on market performance

Who Buys Annuities?

Need guaranteed accumulation and/or income

Age

Fixed annuity buyer avg. age = 65

Variable annuity buyer avg. age = 55

Immediate annuity buyer avg. age = 70

Higher income / assets levels

Have personal financial advisor, insurance agent, etc.

Sources: LIMRA International, Annuitization Study: Profiles and Attitudes (2004); Deferred Annuity

Owners (in progress)

Who Sells Annuities?

Must be licensed to sell life/annuity products in state

To sell variable products, must also be a registered representative

Distribution channels…

Direct Stockbrokers/wirehouses

Captive agents

Independent agents

Brokers/financial planners

Banks

Other channels

Who Sells Immediate Annuities?

Top 20 Sellers as of 3rd Quarter 2006

AEGON USA

AIG

Allstate Financial

Aviva Life

Fidelity Investments Life

Genworth Financial

IDS Life

ING

Jackson National Life

Lincoln Financial Group

Massachusetts Mutual Life

MetLife

Mutual of Omaha

Nationwide Life

New York Life

Old Mutual Financial Network

Principal Life Insurance Company

Protective Life

Thrivent Financial for Lutherans

Western Southern Group

Source: LIMRA International, U.S. Individual Annuities

What’s Selling?

Payout Annuity Sales Sluggish

Fixed immediate

3.0

3.6

4.8

4.8

5.3

5.4

5.9

Variable immediate

2.8

2.8

2.1

2.4

0.2

0.2

0.3

0.5

0.8

0.7

0.6

0.5

0.3

0.3

0.3

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006

Source: LIMRA International, U.S. Individual Annuities, Fourth Quarter 2006 (2007).

What’s Selling?

Annuitizations Are Infrequent

Annuitization rate

Annuitizations

($ bil)

Immediate annuities

2000

0.8%

$10.8

3.8

2001

0.7%

$9.2

4.3

2002

0.6%

$7.1

5.4

2003

0.8%

$11.1

5.3

2004

0.5%

$8.2

5.6

2005

0.6%

$10.1

5.7

Total Market $14.6

$13.5

$12.5

$16.4

$13.8

$15.8

Annuitization rate = Dollars annuitized divided by average deferred assets in force. Source: LIMRA

International, The 2005 Individual Annuity Market: Sales and Assets (2006).

What’s Selling?

Deferred & Variable Products Dominate

January through December, 2006

Deferred sales = $224.2 billion

Variable = $160.3 billion

Fixed = $63.9 billion

Immediate sales = $6.2 billion

Almost all fixed

Source: LIMRA International, U.S. Individual Annuities, Fourth Quarter 2006 (2007).

What’s Selling?

Guaranteed “Living Benefits” in VAs

Evolved from death benefits introduced in

1990s

Guaranteed Minimum Income Benefit

Guarantees value of base applied to payout will not fall below minimum amount

Amounts invested in separate accounts can grow beyond guaranteed amount

Benefit matures after 7 to 10 years

Annuitization required to exercise benefit

Mortality factors applied to payout may be less generous

What’s Selling?

Guaranteed “Living Benefits” in VAs

Guaranteed Minimum Withdrawal Benefit

Guarantees withdrawals until benefit base is exhausted, regardless of actual investment performance

Benefit base usually equals premiums paid less withdrawals

Usually annual maximum withdrawals of 7% of benefit base

Benefit can be used immediately

Annuitization not required to exercise benefit

What’s Selling?

Guaranteed “Living Benefits” in VAs

Guaranteed Minimum Withdrawal Benefit for Life

Guarantees withdrawals for life, regardless of actual investment performance

Benefit base usually equals premiums paid less withdrawals

Usually annual maximum withdrawals of 5% of benefit base

Benefit can be used immediately

Annuitization not required to exercise benefit

What’s Selling?

Guaranteed “Living Benefits” in VAs

New Variable Annuity Sales, 2 nd Quarter, 2006

Living

Benefit

Not

Available,

20%

Living

Benefit(s)

Available,

80%

Owner elected benefit(s),

60%

$18.9

billion

Sources: LIMRA International, U.S. Individual Annuities, Second Quarter (2006); and Variable

Annuity Guaranteed Living Benefits Election Tracking , Second Quarter 2006 (2006).

Why Aren’t More Selling?

Consumer Objections

Loss of control of assets

Inability to access money for emergencies; lack of liquidity

Untrustworthiness of co.; concerns about ethics/solvency

Fixed income won’t keep up with inflation

Missed investment opportunities

Dying too soon

Reduces value of estate for heirs

Costs and fees

Amount of income generated would be too small

Reduces total amount of assets

4

3

2

2

2

2

35%

12

11

4

Results represent categorized open-ended responses. Source: LIMRA International,

Retirement Income Preferences (2006).

Why Aren’t More Selling?

Desire for CONTROL

Converting some of your savings into guaranteed lifetime income and no longer having control of those savings

4%

1

7%

22%

Retirees

27%

2 3 4

Source: LIMRA International, Retirement Income Preferences (2006).

Average rating = 4.06

24%

5

15%

Keeping control of your savings and taking withdrawals that are not guaranteed to last for your lifetime

6

Why Aren’t More Selling?

Salesperson Objections

“Lack of liquidity”

“Not a good value for the money”

Customers too young

Limited knowledge of immediate annuities

“Withdrawal features on deferred products are superior”

“No inflation protection”

Source: LIMRA International, Sales Representatives’ Attitudes Regarding Immediate Annuities (2006).

Are GLBs The Answer?

Maybe…

Maintain control

Remain invested in market for long-term growth

Guaranteed

Helps to shift focus to income needs

They are selling!

…Maybe Not

Add to VA costs

Complicated!

Hedging requirements

Don’t maximize income

Not as tax-efficient as annuitization

Guarantees can be lost if too much is withdrawn

Interest In Annuitization Linked to

Lifetime Needs

Retirees

Will guaranteed lifetime income sources be enough to cover basic living expenses in retirement?

Interested in converting portion of assets into guaranteed income to fill this income-expense gap?

Not enough to cover basic living expenses

52%

Very or somewhat interested

37%

Source: LIMRA International, Retirement Income Preferences (2006).

Interest In Annuitization Linked to

Lifetime Needs

Pre-Retirees

Will guaranteed lifetime income sources be enough to cover basic living expenses in retirement?

Interested in converting portion of assets into guaranteed income to fill this income-expense gap?

Not enough to cover basic living expenses

62%

Very or somewhat interested

52%

Source: LIMRA International, Retirement Income Preferences (2006).

Future Developments

Products and Features

More guaranteed living benefits

On fixed products also

Smaller companies will be squeezed

“Longevity insurance”

Impaired-risk annuities

Medically underwritten immediate annuities

Higher payouts if long-term care is needed

Combination products (long-term care / annuity)

Future Developments

Other Trends

Retirement plan rollover market expansion

Erosion of tax-deferral advantage over taxable alternatives

Possible tax breaks on lifetime payouts

Return to “normal” interest rate environment should help fixed and immediate annuity sales

Growing awareness of retirement income and

“decumulation” issues

P R E S E N T E D B Y

Shlomo Benartzi

Co-Founder, BeFi

Associate Professor Co-chair of the

Behavioral Decision Making Group

The Anderson School at UCLA

Warren Cormier

Co-Founder, BeFi

President, Boston Research Group