poster template v1 - ideals - University of Illinois at Urbana

advertisement

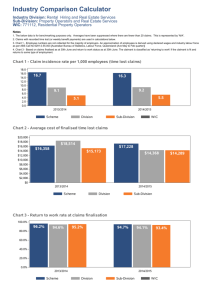

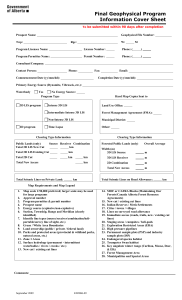

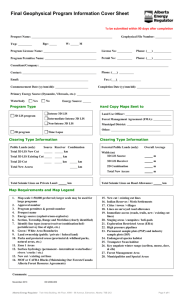

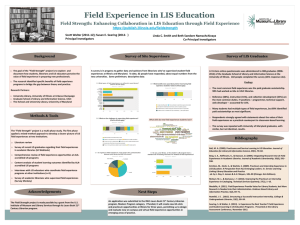

Mind the Gap: Financial Management Education in LIS Curricula Amy L. Atkinson, Robert H. Burger, and Paula T. Kaufman University Library, University of Illinois at Urbana-Champaign INTRODUCTION FINDINGS T Financial management education within LIS programs2 largely fails to equip graduates with skills needed for responsible financial leadership: “It appears to us that there is in fact an increasing need for library managers at all levels to be knowledgeable about financial management.”1 • LIS program graduates moving quickly into management positions Management Courses Across Fifty-Six Programs 50 • Increased accountability to tax payers 40 As such, “graduate schools preparing people to work in libraries have at least as much obligation to teach financial management as they do to teach the many other subjects that are commonly found in LIS curricula. “1 To that end, how do LIS programs prepare their graduates for financially savvy leadership? Financial Management Courses Only 18% of programs offered courses devoted to financial management; 70% were semesterlength, 30% were truncated or otherwise irregular. 60 • Budget cuts and other financial constraints pose continual challenges General Management Courses Over 40% had no identifiable finance training. School Library Management Courses 100% devoted at least one class session and/or course assignment. 30 20 Other, Non-Management courses 56% devoted all or part of one class session and/or project; none spent more than one class session. 10 0 Management Courses Offered Management Courses Required Financial Management Courses - Offered Financial Management Courses - Required METHODOLOGY Survey the English-language websites of fifty-six Library and Information Science programs, locating and examining: • Course catalogs and schedules • Degree requirements • Responses to email queries • Sixty-two syllabi, gathered online and by request Analyze relevant textbooks – identified through the surveyed courses, previous exposure, and a literature search – for quality of content, including: • Accuracy of information – reliable, current, and conforms to national standards. • Connection of budgeting to higher financial management concepts. • Discussion of meaning and importance of cost control and managerial accounting. • Linking of financial management concepts and practices to related matters, e.g. contracts and employment law. 1 Burger, R. et al. (2014) Disturbingly Weak: The Current State of Financial Management Education in Library and Information Science Curricula, Library Continuing Education Venues, and Library Literature. Manuscript submitted for publication. 2Based 3See on available syllabi. handout. CONCLUSIONS Textbooks None met all of the established criteria. RECOMMENDATIONS Management and Other Courses with Attention to Finance: Purported Content v. Actual Content To meet increasing demand for sound financial management within libraries, we recommend: • That LIS schools revisit the composition and length of their graduate programs. 60 • That LIS schools and professional organizations bolster their menus of Continuing Education courses.3 50 40 Attention to Finance Indicated by Course Descriptions 30 Syllabi Reviewed 20 Attention to Finance - Actual 10 • That the professional literature surrounding LIS both further investigate the issue and help close the knowledge gap by providing accurate, accessible guidance to practitioners.3 ACKNOWLEDGMENTS 0 Financial Management General Management School Other Special thanks to Scott Bennett, Marsha Grove, and Rachel Rubin for their review of the paper on which this poster is based. Thanks also to Dan Tracy for his assistance with the printing of this poster.