Powerpoint Presentation ()

advertisement

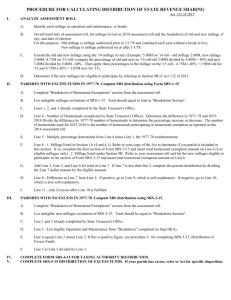

2014 REAL PROPERTY REASSESSMENT 1 • This is the County’s sixth reassessment • The 2013 property values for property tax purposes are as of December 31, 2008 from the last reassessment performed for 2009 with implementation postponed until 2010. Properties qualifying as ATI’s (Assessable Transfers of Interest) have been reassessed based on 12/31 of the year of sale • The 2014 reassessment values are as of December 31, 2013 3 • • The total estimated decrease in our real property value from prior tax year is -2.87%. The 2014 reassessment is the first reassessment in Horry County’s history resulting in a total decrease in market value. Some prior reassessments have had total value increases in excess of 40% The values from the 2014 reassessment that impact the real property tax revenue is determined by adjusting for the impacts of the properties for which revenue is allocated to TIFs (Tax Incremental Financing districts), adjustments for the property values associated with Fee In Lieu of Taxes(FILOT)amounts relating to the Multi County Business Parks, and adjustment for the growth in value due to improvements. PRELIMINARY REAL PROPERTY TOTAL ASSESSED 2014 ASSESSED 2014 ASSESSED 2013 ASSESSED VALUE W/O VALUE PLUS VALUE BILLED GROWTH GROWTH $1,719,200,237 $1,680,332,326 $1,696,268,598 Change in value from 2013 Assessed Value -$38,867,911 -$22,931,639 1. Constant change in real estate market 2. Increased number of multiple lot discount applications (new legislation) 3. Increasing number of owner occupied residence applications reducing assessed values (new legislation) 4. Builder Exemptions 5. Decline in farm/timber tract developments resulting in longer periods of agriculture special assessment 6 Reassessment History Reassessments #Parcels Market Capped Assessed 1982 81,985 4,270,000,000 0 179,011,256 1987 112,157 8,591,653,840 0 391,431,783 1999 169,003 17,289,920,052 0 753,477,812 2004 postponed to 2005 207,493 27,588,501,430 0 1,198,786,174 2009 postponed to 2010 245,143 40,282,779,946 36,482,779,946 1,738,243,535 *2013 247,000 41,005,667,065 37,448,350,220 1,781,059,941 2014 250,000 39,826,247,727 37,295,210,066 1,772,646,689 2014 Assessed Value Exempt by CAP * Prior tax year to 2014 reassessment (99,186,954) Reassessment Appeal History Tax Year # Appeals % of Parcels Appealed 1982 9,838 12.0% 1987 18,538 16.5% 1999 15,187 9.0% 2004 *2005 11,012 5.3% 2009 *2010 11,865 19,843 4.9% 8.1% *2004 reassessment postponed until 2005 *2009 reassessment postponed until 2010 • Legal Residence (New Legislation) • Agriculture • Builder’s Exemption • Multi Lot Discount (New Legislation) • Homestead Exemption • Commercial ATI • HOA • Military Exemption (New Legislation) • Historic Exemption (freezes value up to 15 years) • Roll Back Taxes 14 Rollback millage calculation revised, uniform millage imposed SECTION 3. A. Section 12-37-251(E) of the 1976 Code is amended to read: "(E) Rollback millage is calculated by dividing the prior year property taxes levied as adjusted by abatements and additions by the adjusted total assessed value applicable in the year the values derived from a countywide equalization and reassessment program are implemented. This amount of assessed value must be adjusted by deducting assessments added for property or improvements not previously taxed, for new construction, for renovation of existing structures, and assessments attributable to increases in value due to an assessable transfer of interest." C. This section takes effect for rollback millage calculated for property tax years beginning after 2010 Taxable Value x Assessment Ratio = Assessed Value Assessed Value x Millage = Billed Revenue Roll Back Millage = Previous Year’s Billed Revenue New Assessed Value 16 1 Fund General Fund Debt Service HGTC Higher Ed Senior Citizens Recreation Waste Management Rural Fire - Operating Rural Fire - Apparatus Socastee Recreation Commission Mt. Gilead Hidden Woods Arcadian Shores 2 Regulatory TY Calculation 2013 of Rollback Millage Millage 35.6 36.6 5.0 5.1 1.8 1.9 0.7 0.7 0.4 0.4 1.7 1.7 6.0 6.1 19.5 19.9 1.7 1.7 1.8 1.8 7.0 7.7 84.6 91.2 32.3 36.2 3 4 MillageThat Would Generate 2013 Tax Year Revenue When including Growth 35.8 5.0 1.8 0.7 0.4 1.7 6.0 19.3 1.7 1.8 7.6 91.1 35.9 TY 2014 Millage approved by Budget Ordinance 35.6 5.0 1.8 0.7 0.4 1.7 6.0 19.5 1.7 1.8 7.0 84.6 32.3 Rollback calculation results in a rollup from the TY 2013 millage 5 Projected Revenue (including growth) variance from 2015 Revenue Budget ($420,401) ($59,046) ($21,260) ($8,256) ($4,716) ($20,057) $38,699 $177,781 $6,931 $2,559 ($2,524) ($6,839) ($6,431) 6 Proposed Millage requested by Special Tax Districts (Amendment to FY 2015 Budget through Ordinance 68-14) 1.8 mills 7.0 mills 84.6 mills Capped at 35 mills