H1 2014 H1 2013

advertisement

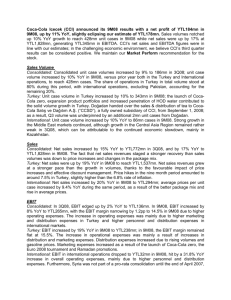

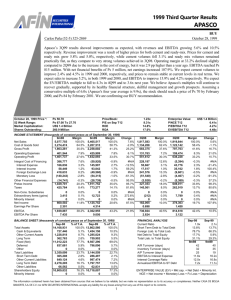

WIND Telecomunicazioni First Half 2014 Results August 7, 2014 H1 2014 Highlights • WIND continues to outperform the market with total revenue of €2,290 million, declining by 8.2% YoY Revenues • Mobile service revenue down 10.9% YoY, as a result of the rolling cannibalization effect of 2013 price competition, MTR cut and the material decline in SMS revenue • Mobile internet revenue confirms double digit growth, up 21.1% EBITDA • EBITDA at €865 million, declining by 7.6% YoY, with pressure on revenue partially compensated by cost efficiency measures • EBITDA margin increases 0.3 p.p. to 37.8% thanks to cost efficiency measures Op. FCF (EBITDA – CAPEX) NFI Debt Optimization • Continued strong Op. FCF generation of approximately €1.12 billion in H1 2014 LTM • Net Financial Indebtedness at €10,544 million vs. €9,145 million as of December 2013, increase mainly due to WAHF PIK notes refinancing • Net debt / EBITDA at 5.6x • Successful refinancing of approximately €8 billion of notes shifting the first material maturity to 2019 and reducing the average cost of debt by 3 p.p. providing significant interest savings of ~€300 million per year 2 Difficult Environment and Weak Market… GDP Growth* Highlights 1.2 0.6 0.2 2012 2013 2014E 1.0 • Family consumption index still negative 2015E • Unemployment remains the biggest concern with -1.9 -2.4 youth component steadily above 40% -1.9 -2.4 ECB CSC improving trend 12.8 12.5 12.2 • Italian TLC market value contraction in H1 2014 expected to continue also in H2 but with an Unemployment Trend* • Main operators maintain a more benign approach to promotions leading to: 12.6 • lower gross additions with negative net 10.7 ECB 2012 • GDP expected to return to mild growth in 2014 2013 2014E CSC 2015E additions for main players • churn reduction * Source: ECB (May ‘14), CSC (Jun ‘14) 3 …but WIND Strengthens its Market Position… Mobile Market Share (SIM)* Fixed Broadband Market Share** ~ 28% in consumer segment 22.8% 9.9% 32.4% 23.3% 10.3% 31.7% 24.3% 10.6% 31.0% 24.5% 11.0% 30.1% 34.9% 34.7% 34.1% 34.3% 2011 2012 2013 H1 2014 * Source: Internal estimates; excluding MVNO ** Source: Internal estimates Player 4 15.8% 16.3% 16.0% 15.8% 6.4% 6.1% 6.3% 6.2% Others 11.8% 13.1% 14.2% 14.5% Player 3 13.1% 12.6% 12.8% 13.1% Player 4 52.9% 51.9% 50.6% 50.4% Player 1 2011 2012 2013 H1 2014 Player 2 Player 1 4 …in Core Areas of its Proposition… Best Customer Relationship • • Leading Reputation Maintain leadership in mobile customer satisfaction Consistent outperformer on NPS • WIND Infostrada classified as the most appreciated telecoms operator in Italy in terms of customer experience by a primary customer satisfaction research observatory in July • WIND is the only telecoms operator ranked in the top twenty leading Italian companies by reputation* Player 1 Player 2 Player 4 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Positioning • Enhancing the focus on mobile data and digital services • Smart “value for money” proposition: clear, transparent and simple offer • Renewing the “All Inclusive” proposition • More than ~ 65% of mobile customers on bundle offerings * Source: Italy Rep. Track May 2014 issued by Italian Reputation Institute 5 …Evolving to the Digital World… WIND Digital • Self Care Areas Access increase 127% vs. H1 2013 • Digital top ups +74% vs. H1 2013 • WIND Digital innovative offering with customer interaction exclusively through digital channels (sale, selfcare, top-ups, etc) Social Approach • WIND leader in Italy as the fastest* company on answering customers via Facebook and Twitter My WIND App • My WIND App for smart-phones and tablets downloaded more than 5 million times Google Play • Revenue share model with Google play: • WIND the only operator in Italy with carrier billing active with approximately 3 million downloads YoY • Roll out for Windows phone© customers started in June * Sources: Blogmeter and Socialbakers 6 …and Investing on Network Performance and Quality Mobile Network • GSM network completed: 99.86% population coverage with GPRS/EDGE nationwide coverage CAPEX* (€mln / %) 16.7% 15.8% LTM CAPEX / revenue* • HSPA+ network developed: 96.65% population coverage at 21 Mbps and 42 Mbps in major Italian cities • LTE available in Rome, Milan, Bologna, Turin, Padua, Bari, Naples and main airports. • LTE plan: 30% of population coverage by the end of 2014 345 309 Fixed Network and Backbone • 1,458 LLU sites: c. 60% direct population coverage in all major Italian cities H1 2013 H1 2014 • Solid fiber optic backbone of 21,726 km, supporting both fixed and mobile businesses * CAPEX excludes LTE costs CAPEX 2013 excludes €134mln of non-cash increase in Intangible Assets related to the contract with Terna in relation to the Right of Way of WIND’s backbone Figures as of June 30 7 H1 2014 Operational Performance Maintaining Positioning in Mobile Customer Base Highlights (mln) • WIND’s customer base declines slightly (-1.9% YoY) to 21.9 million, although at a lower rate than 22.3 -1.9% 21.9 that experienced by the overall market, leading to an increase in market share, consumer market H1 2013 share approaches 28% H1 2014 • Data ARPU increases 2.7 p.p. reaching 39% of ARPU (€ / %) total ARPU 38.6% % Data on Total 33.4% • 2Q 2014 ARPU improving trend vs. 1Q 2014 • Increasing penetration of “All Inclusive” bundles 12.4 -11.0% 11.0 drives double digit growth in both usage and voice traffic H1 2013 H1 2014 9 Resilient Mobile Internet Growth Performance Mobile Internet Revenue Highlights (€mln) • The increased penetration in CB of “All Inclusive” +21.1% 222 269 bundles coupled with the take-up in smartphones penetration leads to a double digit growth in H1 2013 H1 2014 Internet revenue Mobile Internet CB* (‘000) • In line with other mature markets H1 is affected by +27.1% 9,667 a material decline in SMS revenue driven by 7,604 increased penetration of instant messaging apps H1 2013 H1 2014 * Mobile Internet includes customers that have performed at least one mobile Internet event in the previous month 10 Fixed-Line Delivering on Profitability Voice Subscribers (‘000) 3,040 Highlights 2,902 • Fixed LLU subscribers substantially stable (-1.4%) 2,450 -1.4% 2,415 Direct (LLU) reflecting the pull sales strategy and focus on 591 487 H1 2013 H1 2014 Indirect acquisition of high value customers in order to increase EBITDA margin ARPU (€) • Fixed-line ARPU declines 4.4% YoY with the 31.2 -4.4% 29.8 growth in data ARPU partially compensating the decrease in voice component H1 2013 H1 2014 11 Fixed Broadband ARPU Growth Broadband Subscribers (‘000) Broadband ARPU (€) 21.3 2,211 -1.4% H1 2013 20.8 2,180 H1 2014 Dual-play Subscribers (‘000) 20.2 20.2 Q1 2013 Q2 2013 20.4 20.5 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Highlights • Fixed Broadband customer base substantially stable in line with the strategy focused on quality and 1,863 +0.9% 1,881 on dual-play offerings selected by 1.9 million customers (+1% YoY) • BB ARPU increases thanks to the increased H1 2013 H1 2014 penetration of higher value dual play customers 12 H1 2014 Financial Performance Revenue and EBITDA – Total Total Revenues (€mln) 2,495 -8.2% 189 Highlights 2,290 216 Other rev. + CPE • Total revenue declines 8.2% with service revenue 2,306 -10.1% 2,074 TLC service revenue down 10.1% as a combined result of the rolling cannibalization effect of 2013 price competition, H1 2013 H1 2014 material decline in SMS revenue and the MTR cut EBITDA / Margin (€mln / %) 37.8% 37.5% • EBITDA declines 7.6% YoY with positive impact from cost savings partially compensating the pressure on top line -7.6% 936 865 H1 2013 H1 2014 • EBITDA margin increases 0.3 p. p. to 37.8% 14 Revenue and EBITDA – Mobile Total Revenues (€mln) 1,815 -8.6% 172 1,644 Highlights 1,660 194 Other rev. + CPE • Total mobile revenue declines 8.6% as a combined result of: 1,465 TLC service revenue • Impressive growth in mobile Internet revenue, up 21.1% -10.9% H1 2013 H1 2014 EBITDA / Margin 41.7% (€mln / %) 41.5% -8.2% 754 692 • Decline in voice revenue mainly driven by the mentioned intense price pressure in 2013 and MTR cut • Q2 service revenue (-11.1%) in line vs. previous quarter (-10.6%) • H1 2014 EBITDA declines 8.2% to €692 million mainly due to the service revenue decline • EBITDA Margin increases 0.2 p.p. H1 2013 H1 2014 15 Revenue and EBITDA – Fixed-Line Total Revenues (€mln) 680 Highlights -7.2% 631 17 22 Other rev. + CPE • Fixed-line total revenue decreases 7.2% YoY due to lower service revenue, down 8.1%, mainly due 663 -8.1% 609 TLC service revenue to the decline in the fixed-line customer base, as a result of the focus on higher margin LLU H1 2013 H1 2014 customers, and due to the ongoing decline in voice volumes resulting from fixed to mobile EBITDA / Margin substitution 27.4% (€mln / %) 26.7% • EBITDA at €173 million with 0.7 p.p. increase in margin thanks to the strategy focused on higher -5.0% 182 173 value customers and pull sales channels partially offsetting the decline in service revenue H1 2013 H1 2014 16 P&L Highlights (€mln) H1 2014 H1 2013 Change % Revenues 2,187 2,444 (10.5)% 104 52 n.m. 2,290 2,495 (8.2)% 865 936 (7.6)% D&A (612) (631) 3.0% EBIT 253 305 (17.1)% Financial Income and expenses (695) (430) (61.4)% EBT (442) (126) n.m. 39 (47) n.m. (403) (173) n.m. Other revenues Total Revenues EBITDA Income Tax Net result 17 Capitalization (€mln) As of As of June 30, June 30, 2014/ December 31, 2014 LTM EBITDA 2013 Cash and Equivalents (141) (84) * (0.0x) Bank Loan 2,420 2,519 1.3x Senior Secured Notes 2018 3,133 3,145 1.7x Senior Secured Notes 2019 150 150 0.1x Senior Secured Notes 2020 400 402 0.2x Total Bank Loan + SSN 5,962 6,132 3.3x Senior Notes 2017 2,779 - - Senior Notes 2021 - 3,786 2.0x Ministry LTE Liability 250 255 0.1x Derivatives and Other ** 154 371 0.2x 9,145 10,544 5.6x (938) (0.5x) 9,145 9,606 5.1x 9,013 217 (240) 154 9,338 142 (246) 371 Total Net Debt excluding Intercompany Loan Intercompany Loan to WAHF *** Total Net Debt Cash Net Debt Interest Accrued Fees to be amortized Derivatives MTM LTM EBITDA * Cash and cash equivalents net of the amounts held in escrow in relation to repayment on July 15, 2014 of the 2017 Senior Notes not tendered ** Includes receivable from Wind Telecom until Dec 2013, set off as part of April 2014 refinancing *** Loan to Wind Acquisition Holdings Finance S.p.A. for repayment of WAHF SA PIK Notes 1,873 18 Significant Improvement in Debt Maturity Profile Q1 2014 (€mln) 1,261 2,678 3,216 81 81 2014 TLA 340 2016 2015 TLB LTE Liability Italian State 81 2,015 425 150 2017 2018 Senior Secured Notes 2018 2019 Senior Secured FRN 2020 Senior Secured Notes 2020 2021 HY 2017 PIK H1 2014 Pro-forma for April and July Refinancing (€mln) 575 425 150 81 2014 TLA TLB 81 2015 LTE Liability Italian State 174 81 2016 2017 New Senior Secured Notes 2020 Notional amounts. USD tranche has been converted at CCS EUR/USD Exchange Rate 2018 Senior Secured FRN 3,495 3,779 1,608 2019 Senior Secured Notes 2020 2020 New FRN 2020 2021 New Senior Notes 2021 19 Thank you 20