Generic Pitch Template

advertisement

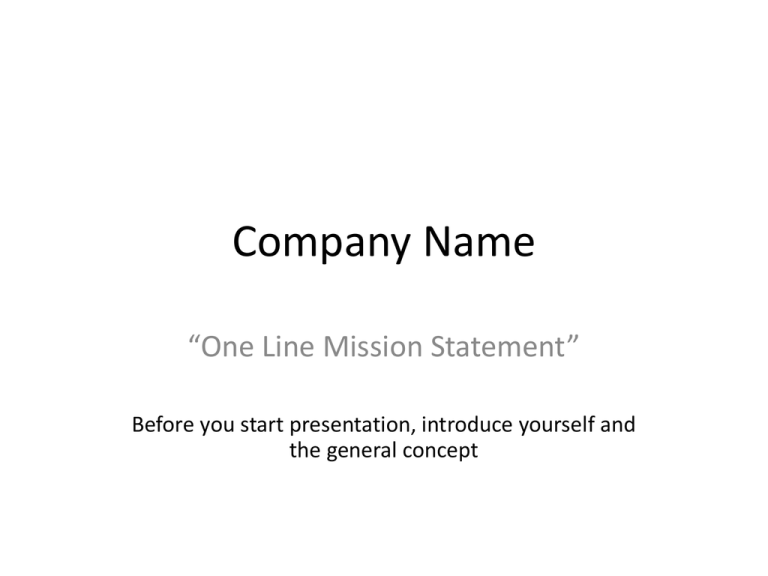

Company Name “One Line Mission Statement” Before you start presentation, introduce yourself and the general concept The Problem • Clearly define the problem – Who is this a problem for? – The problem(s) should be unserved by competition Solution • How are you solving the problem – tie the solution to the specific pain point you identified in the previous slide. This creates continuity in the story • How does this solution The Product • One or two slides on the product – preferably screen shots or a pre-recorded video that show how the product meets the specifications you described earlier • Add additional slides in the appendix with key detailed product features. Keep these out of the presentation to allow time to discuss the business opportunity. Leadership Team (add a few comments about relevant experience) • CEO – relevant experience should include company name and job title. Highlight any specific experience in this space • CFO Advisory board (add a few comments about relevant experience) • Who is on the advisory board, and what do you rely on them for (i.e. advisor for CEO coaching) • CFO Market • How “big” is the market – investors want to see this in $ at a minimum. Add other measures sparingly if appropriate. Convince me this is a big opportunity for my investment • What market dynamics are making this the right move now? • What are the key market segments (if appropriate)? • What is the TAM and SAM – for SAM generate a bottoms up analysis • Have a slide in the appendix that goes into detail on the TAM and SAM analysis Competition • Both direct and indirect • Highlight how your solution fills gaps in the competitions service • Recommend using a graphic on this slide. A common chart puts competition on the X axis title and key features on the Y axis. Highlight how your solution provides the right key features. Alternative is to have two primary considerations on X & Y and develop scatter plot of competitive landscape • Have back-up slide in appendices that goes into the detail on the competition Business Model • How do you make money Go-To Market Strategy • How will you launch this? – Who is your target customer now, in 12 months, 36 months? – What are existing channels you can leverage • Direct vs. Indirect sales • This is where the rubber hits the road in many investors minds. Having an advisor for this topic is a plus. This should be relatively detailed (“SEO” is not a go-to market strategy) • How will you acquire customers in a cost-effective manner? Financial Projections • Five year pro-forma – This should be simple • Revenue, COGS, Gross Margin, Key Opex (three or four line items) EBITDA, Cash • Have a slide in appendix with detailed five year for discussion if needed Capital Raise • How much money has gone into the company – What form, if priced round what was post-$ • How much are you raising this round? – (Convertible note or equity?) – Valuation – How much soft-circled? – Specific milestones (i.e. use of funds) – these milestones should be specifically tied to value creation for the company. What will this $ help you accomplish? Future raises • Sample chart below – show what $ you will need in the future. Highlight CFP point (not on graph). • Be ready to talk to exit points and drivers for exit Exit • Who are potential acquirers? • What are comparable transactions? – Seller, buyer, valuation, multiples (revenue and EBITDA), key driver • What is most likely exit as you see it now? Which do you prefer?