Japan GDP template.docx

advertisement

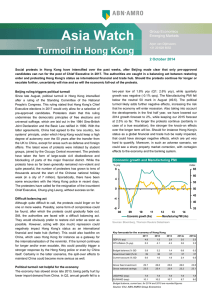

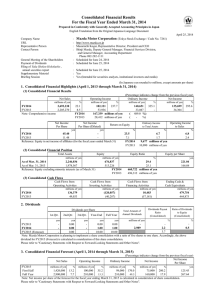

Japan Watch GDP growth revised down Group Economics Macro & Financial Markets Research Maritza Cabezas +31 20 343 5618 Roy Teo +65 6597 8616 29 October 2014 • We are revising our GDP growth forecast to 1% from 1.5% in FY 2014 as a result of disappointing economic data in the past months. We maintain our GDP growth of 1.4% for FY 2015. • Our inflation forecast (without VAT impact) is 1.3% in 2014, which combines the upside of monetary easing and downside of lower oil prices. Inflation should increase modestly to 1.6% in 2015. • At the end of 2014, we expect the BoJ will announce an expansion of quantitative and qualitative easing, while stronger wage growth should lift consumption growth next year. • The yen is projected to decline to 115 and 125 against the USD by the end of 2014 and 2015 respectively. Effect consumption tax larger than expected… Going forward we think that trends in consumption will be The consumption tax has had a far greater impact on Japan’s supported by lower food and energy prices. However, the key real economy than anyone anticipated. Real GDP shrank 7.1% will be whether we see improvements in the wage and qoq in April-June, exceeding the 6.6% expansion in the first employment situation. In Japan, the shift to non-regular quarter. Consumption had been performing fairly well before employees is a key factor in basic wage sluggishness, since the tax hike and in fact it was one of the main drivers of the this has held down fixed costs such as welfare and social recovery. But consumption expenditure saw a large drop in insurance in addition to wage levels. Lately there has been April-June of 19% on an annualized quarter on quarter basis. some improvement in wage growth and it will be further helped Even after soothing the fluctuations of the tax hike, by the reforms to reduce labour duality (regular vs temporary consumption in the period January-June 2014 compared to the workers). This refers to It is also the case that before the VAT same period a year before declined by 0.8%. Going into the hike, new job offers and overtime work hours were trending up. third quarter, August and September’s consumption data has We expect the labour market reforms to gain traction in 2015. been mixed. The real private consumption index of the Cabinet based consumption increased by 0.4% mom in August after a …while export growth still weak despite yen depreciation The effects of a weaker yen on export growth have been fall of 0.5% the previous month. Meanwhile, retail sales disappointing. Authorities anticipated that a weaker yen would Office, the most accurate indicator to track quarterly GDP recovered in September confirming stronger private fuel export volume, improve corporate earnings, increase fixed investment and wage growth. But so far the weaker yen has consumption ahead. not managed to revive export volumes. But the fall of the yen has expanded firm’s margins and likely boosted the earnings GDP growth shows weaker consumption of export firms. In the past, there was a strong link between the % yoy real effective exchange rate and the export volume index, with 10 volume rising as the yen weakened. On the one hand, 5 structural issues could be behind the weaker exports. Japan’s car manufacturers are, for instance, have moved their auto 0 production overseas, resulting in weaker exports to the US. On -5 Investment Government consumption Inventories Net exports Private consumption GDP growth -10 -15 the other hand, but to a lesser extent a moderate global economy has capped export demand. We expect that external demand will recover robustly in 2015 on the back of a stronger global economy. -20 Q1 2012 Q4 2012 Q3 2013 Source: Thomson Reuters Datastream Q2 2014 2 GDP growth revised down – 29 October 2014 The outlook Exports slow growth despite weaker yen Japan’s authorities need to maintain the reform momentum, while ensuring that further monetary easing is on the cards. index The consumption tax rate hike is now a topic of debate, but 120 70 110 80 100 90 community that Japan is serious about fiscal consolidation. We 90 100 think that this measure or an equivalent will be announced at 110 the end of this year and we expect this measure to be 120 implemented at the end of 2015. Meanwhile the effects of a 130 weaker yen are not having the intended impact, but lower oil 80 70 depreciation 60 00 02 04 06 08 10 12 14 this is basically seen as a goodwill sign for the international prices will help consumption with the increase in disposable Japan export volume (lhs) income. Japan real effective exchange rate (rhs inverted) Moreover, at the end of 2014, we expect the BoJ will announce Source: Thomson Reuters Datastream an expansion of Quantitative and Qualitative Easing (QQE). In any case, we are revising our GDP growth forecast to 1% from Fixed investment remains supportive to growth Business fixed investment has been moderately increasing. Machinery orders, a leading indicator of machinery investment fell back somewhat in the second quarter. Meanwhile construction starts, a leading indicator of construction has 1.5% in 2014. In 2015 we maintain our GDP growth of 1.4%. As for inflation, we forecast 1.3% in 2014 (CPI ex food and without VAT impact) as a result of the lower energy prices. We expect inflation to pick up slightly in 2015 as a result of higher wages. Finally, we expect the BoJ in its 31 October Monetary been more or less flat. The positive note is that corporate Policy Meeting in which it presents the semi-annual Outlook profits have continued to improve. Business sentiment has Report to cut its GDP forecasts, while the commitment to generally stayed at a favourable level. achieve the 2% inflation target by mid-FY will be maintained, despite the downside risks to the price outlook. Tankan business sentiment large firms positive Key forecasts for the economy of Japan (*) % yoy 40 GDP (% yoy) CPI inflation ex-food (average % yoy) without VAT impact 20 0 -20 Budget balance (% GDP) Government debt (% GDP) Current account (% GDP) -40 -60 -80 06 07 08 09 10 11 12 13 14 Source: Thomson Reuters Datastream Unemployment (%) 10Y rate (% end of period) USD/YEN (eop) 2013 1.5 0.3 0.3 2014e 1.0 3.3 1.3 2015e 1.4 2.6 1.6 -8.3 244 0.7 -7.0 244 0.1 -5.9 242 0.3 4.0 3.7 3.6 0.6 105 0.5 115 1.1 125 (*) data corresponds to FY April-March Implications for the Japanese yen Budget b alance, current acc. for 2014 and 2015 are rounded figures We expect the yen to decline to 115 by the end of this year. Source: ABN AMRO Group Economics The consensus is that the BoJ will implement more stimulus only in early 2015. Hence the surprise element of BoJ moving will exert further downward pressure on the yen. Furthermore the market is underestimating the pace of rate hikes in the US next year. We think that further adjustment in short term yields in the US will materialise in the coming months. As interest rate differentials between US and Japan widen, the US dollar is expected to continue its outperformance against the yen. We expect the JPY to decline to 125 against the USD in 2015. 3 GDP growth revised down – 29 October 2014 Find out more about Group Economics at: https://insights.abnamro.nl/en/ This document has been prepared by ABN AMRO. It is solely intended to provide financial and general information on economics.The information in this document is strictly proprietary and is being supplied to you solely for your information. It may not (in whole or in part) be reproduced, distributed or passed to a third party or used for any other purposes than stated above. This document is informative in nature and does not constitute an offer of securities to the public, nor a solicitation to make such an offer. No reliance may be placed for any purposes whatsoever on the information, opinions, forecasts and assumptions contained in the document or on its completeness, accuracy or fairness. No representation or warranty, express or implied, is given by or on behalf of ABN AMRO, or any of its directors, officers, agents, affiliates, group companies, or employees as to the accuracy or completeness of the information contained in this document and no liability is accepted for any loss, arising, directly or indirectly, from any use of such information. The views and opinions expressed herein may be subject to change at any given time and ABN AMRO is under no obligation to update the information contained in this document afterthe date thereof. Before investing in any product of ABN AMRO Bank N.V., you should obtain information on various financial and other risks andany possible restrictions that you and your investments activities may encounter under applicable laws and regulations. If, after reading this document, you consider investing in a product, you are advised to discuss such an investment with your relationship manager or personal advisor and check whether the relevant product –considering the risks involved- is appropriate within your investment activities. The value of your investments may fluctuate. Past performance is no guarantee forfuture returns. ABN AMRO reserves the right to make amendments to this material. © Copyright 2014 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO").