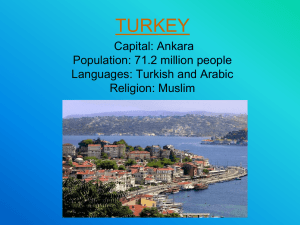

Turkey Construction sector

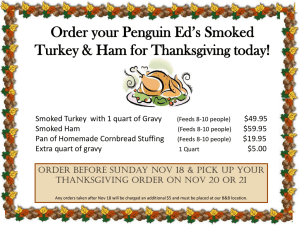

advertisement