Long-Term and Short-Term Interest Rates

advertisement

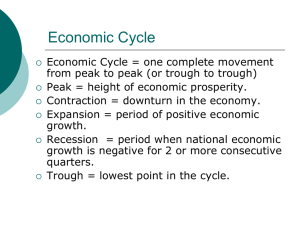

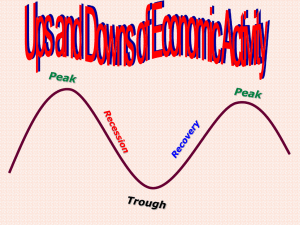

Economic Cycle Economic Cycle = one complete movement from peak to peak (or trough to trough) Peak = height of economic prosperity. Contraction = downturn in the economy. Expansion = period of positive economic growth. Recession = period when national economic growth is negative for 2 or more consecutive quarters. Trough = lowest point in the cycle. Economic Cycle Peak % Nat. Econ Growth 4 3 2 Expansion Contraction 1 0 -1 Recession -2 -3 -4 Trough Time ===> Four Stages of an Economic Cycle Unemployment Rate Inflation Rate & Interest Rate Peak low rising Contraction rising Hit the high point early in the contraction, and then falling Trough high falling Expansion falling Hit the low point early in the expansion, and then rising Examples of historical cycles (trough to trough): 1959-1969, 1969-1975, 1975-1980, 1980-1989, 1989-1991, 1991-2001 Long-Term and Short-Term Interest Rates What is “short term” and what is “long term?” Short Term: U.S. T-Bills (8/20/12) 3-month 0.09 6-month 1-year 0.13 0.18 Long-Term and Short-Term Interest Rates Longer-Term Investments: U.S. Treasury Bonds... Time Period Rate 5-year 10-year 30-year 08/20/2012 Interest .79 1.81 2.93 Interest rates on long-term investments can be thought of as the average of future short-term rates expected by investors. The Spread - The difference between longterm and short-term interest rates. 10 8 Fed. Res. Funds Rate T-Bills (10yr) Rate 6 4 Spread 2 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 98 0 -2 Source: Board of Governors of the Federal Reserve. What does the difference between long-term and short-term interest rates tell us? Large positive difference (i.e., longterm r minus short-term r is positive and large) investors think that interest rates will rise in the future short-term interest rates will rise at a faster pace than long-term interest rates What does the difference between long-term and short-term interest rates tell us? Large negative difference (i.e., longterm r minus short-term r is negative and large) investors think that interest rates will fall in the future short-term interest rates will fall at a faster pace than long-term interest rates fall Since 1975... In all instances where the spread was negative, interest rates subsequently fell. The more negative the spread, the bigger the decline in interest rates that occurred. In instances where there were large positive spreads, interest rates subsequently rose. Other info the difference between long-term and short-term interest rates gives us... The spread tells us something about what is likely to happen to national economic growth in the near future. Important information regarding forecast for future employment Important information regarding what is likely to happen to financial markets and interest rates Important information regarding future inflation Making Economic Forecasts Why do families and households care about economic forecasts? Implications for the costs of borrowing Implications for the benefits of saving Implications for the mix of human, physical, and financial capital families should hold Implications for risk management What indicators can/do help families make accurate forecasts? Business cycle information - i.e., what is happening to real national economic growth. Where have we been recently? Recent rates of inflation (look to CPI) The spread between long- and shortterm interest rates (comparison between 10-yr bonds and 3-6 month T-bills)