GIOA Workshop :

Effective Agency Strategies

Stephen Manning, CFA

Director – Institutional Branch Services

March 16, 2011

2

Developing Portfolio Strategies Using Agencies

Risk Management Overview

The Portfolio Process

A Brief discussion on Duration and Convexity

Agency Alternatives:

Agency Bullets

Fixed Coupon Callables

Step Ups

Fixed to Float

The Cost of “Waiting”

Useful Bloomberg Tools

3

Risk Management Overview

4

Investment Decision Process

Investment Policy / Guidelines

SAFETY

LIQUIDITY

Interest Rate

Risk

Yield Curve

Risk

Market

Trends

Cash Flow

Risk

Credit

Trends

Credit Risk

Liquidity Risk

Social Screens

Macroeconomic

Trends

Implement

Portfolio Strategy

5

Quantifying Risk

Interest Rate

Risk

Yield Curve

Risk

Cash Flow

Risk

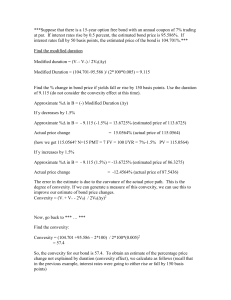

Effective Duration – Expected Change in

Price For every 100bp Shift in Rates

Convexity – How will my duration Change as

yields change.

Partial Durations – Shift a Single Point on the

curve to Determine Where on the curve your

risk exposure is concentrated.

Cash Flow Simulation – Run Cash flows

across multiple horizon rate scenarios to

ensure there are no liquidity gaps

6

Duration

Duration – Expected %Change

in Price For a 100bp Shift in

Rates

Bond Price

Graphically - The Slope of

the Price Yield Function

Duration is the slope of a line drawn tangent to the

price-yield curve and shows the % change in bond

price for a given change in yield.

Yield

7

Duration

Example: the price of a bond

with a duration of 3.0 is

expected to:

Increase by 3% when rates fall

(rally) 100bp.

However: The price/yield

relationship is rarely linear (a

straight line).

Bond Price

Fall by 3% when rates rise by

100bp

Out

Performance

Yield

8

Bond Price

Convexity

Convexity – Expected Change

in Duration For a 100bp Shift

in Rates

Negative Convexity – When

rates rally, the bond will

underperform its duration.

Bond A

Bond B

Duration

Bond Price

Positive Convexity - When

rates change, the bond

outperforms the duration.

*P

**P

**P

*Y

**Y

**Y

*Y

Yield

*P

Yield

9

Agency Alternatives

10

Bullets: No Optionality

Key Features:

Fixed Coupon throughout life

Certainty of Cash Flow

Start with HIGHER Duration

than callable.

LOWER Yield/Coupon than

callable.

Slight Positive Convexity

Best Performer when rates

moving lower (Bullish).

Better Liquidity

Bloomberg: FIT <GO>

Ticker

Update Market to “Agency” if

not the default.

Spread to TSY

Yield

11

Finding Carry: Callable Agencies

Fixed Coupon Callables

1X Call (Euro):

Higher Coupons than Bullets,

and initial Step-Up Coupons.

1x Calls become bullet

alternatives if not called on the

call date.

Berm and Cont. Call:

Higher Coupon than 1x Call

(Selling more optionality).

Better Convexity Profile.

Duration does not extend as

quickly as 1x call, as the “next

call” keeps it shorter.

12

Finding Carry: Defensive Step-Ups

Synthetic Premiums

One time step-up, with above market back end coupon.

Increases the probability the bonds will get called, even

with rates higher.

1X Call, with in-the-money back coupon.

Give up some income on the front coupon

Higher probability of call

Price yield off the Maturity, while synthetically keeping

your duration much shorter.

5NC2 Example?

Multi-Step Multi Call

13

Finding Carry: Defensive Step-Ups

Defensive Multi-Step Structures

Starting coupons significantly higher than short cash

rates to the first call

Coupons set to step up in line with future expectations

in rates, to improve price performance, and keep

durations short in rising rate environment.

14

Defensive Strategies

Fixed To Float

ABOVE Market Initial Coupon – Increase Cash Flow

Below market spread on back end floater, but with

frequent resets, bond remains near par in back up.

Take on “Basis Risk” of spread widening, which should

be much lower than the pure duration risk of a fixed

coupon bond.

15

Discount Callables

Euro Calls (1X)

Viewed as Bullet Alternatives

Depending on strike, call date, many already extended in their

durations.

Look for Yield Pick-Ups to Bullets

Bermuda / Continuous Calls

Steep Yield Curve / Roll Down means some of the forward call

options are still in the money despite discount price.

Look for Pick Up to bullets.

Many trading to the expected call date, as opposed to the

maturity, which can make them look rich optically.

Look for opportunities to pick up yield to Maturity, with

excellent upside if the market does not back up more, and the

bonds are called early.

16

Cost of “Waiting”

17

Buy and Hold – Carry Still Important

With the steep yield curve, look for Carry and Roll down.

Callable agencies such as the one above offer significant pick up

to cash, while taking on moderate duration risk.

Over a 1 year time period, the Callable Agency outperforms the

theoretical cash pool even in a +100bp rate shift.

If it takes 2 years to sell off, this Callable outperformed even

through the +200bp scenario.

Callable Agencies represent a good sector to pick up yield, and

reduce duration vs. similar maturity bullets in the agency and

credit markets.

Always Keep your Liquidity Needs in mind, and evaluate the full

extension risk of callables.

18

Income Break Even

Break Even Income Analysis After 1 Year

The above callable agency generates 840k in interest over 4 yrs

Starting with a cash rate of 23bp for 1 year (1yr Tsy) you would need to

reinvest at a rate of 2.72% to break even.

Implies a back up of 94bp in Treasuries to attain that.

3YR Treasury Rate, 1YR Forward is currently 2.21%, implying just a 100bp

Backup over the next year.

19

Useful Bloomberg Tools

20

New Issue Monitor: NIM2

NIM2 <GO>

Shows all the announced new issue deals, and upsizes in the market.

Ordered by date, and time, newest to oldest

21

Option Adjusted Spreads (OAS1)

OAS is an Extremely useful pricing tool

“Spread” to the CURVE after taking out the value of optionality.

CUSIP Govt OAS1 <GO>

Spread to Treasury Curve (I111).

14 Vol is standard for street pricing, but does not reveal value.

22

AOAS Screen – Relative Value

“A”OAS – Spread to the Agency Curve

CUSIP Govt AOAS <GO>

Spread to Relevent Agency Benchmark Curve, with Live Volatility

Spread to Treasury Curve (I111).

14 Vol is standard for street pricing, but does not reveal value.

23

Forward Rates

FWCM <Go>

Can look at US Treasury and Swap Forward Rates

24

Forward Rates

FWCV <GO>

Forward curve for agency bullets is projecting higher yields

25

Forward Rates - Series

FWCV <GO> ; 3 <GO>

Useful to see the path of single rate forward in time.

26

Break Even Analysis

GA3 <Go>

27

Looking at the Complete Picture

28

Disclaimer

Conflicts Disclosure: RBC Wealth Management’s Policy for Managing Conflicts of Interest in Relation to Investment Research is available from us on request and is also made

available on our website at http://www.rbccm.com/GLDisclosure/PublicWeb/DisclosureLookup.aspx?EntityID=2. We reserve the right to amend or supplement this policy at any

time. For the current policy, please check our website.

The author(s) is/are employed by RBC Wealth Management, a division of RBC Capital Markets, LLC, a securities broker-dealer with principal offices located in Minnesota and

New York, USA.

Disclaimer

The information contained in this report has been compiled by RBC Wealth Management from sources believed to be reliable, but no representation or warranty,

express or implied, is made by Royal Bank of Canada, RBC Wealth Management, its affiliates or any other person as to its accuracy, completeness or correctness.

All opinions and estimates contained in this report constitute RBC Wealth Management’s judgment as of the date of this report, are subject to change without notice

and are provided in good faith but without legal responsibility. This report is not an offer to sell or a solicitation of an offer to buy any securities. Past performance is

not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Every province in Canada, state in the U.S. and most

countries throughout the world have their own laws regulating the types of securities and other investment products which may be offered to their residents, as well

as the process for doing so. As a result, any securities discussed in this report may not be eligible for sale in some jurisdictions. This report is not, and under no

circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted

to carry on the business of a securities broker or dealer in that jurisdiction. Nothing in this report constitutes legal, accounting or tax advice or individually tailored

investment advice. This material is prepared for general circulation to clients, including clients who are affiliates of RBC Wealth Management, and does not have

regard to the particular circumstances or needs of any specific person who may read it. The investments or services contained in this report may not be suitable for

you and it is recommended that you consult an independent investment advisor if you are in doubt about the suitability of such investments or services. To the full

extent permitted by law neither RBC Wealth Management nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct or

consequential loss arising from any use of this report or the information contained herein. No matter contained in this document may be reproduced or copied by any

means without the prior consent of RBC Wealth Management. RBC Wealth Management is a division of RBC Capital Markets, LLC, which is an indirect whollyowned subsidiary of the Royal Bank of Canada and, as such, is a related issuer of Royal Bank of Canada. Additional information is available upon request. Copyright

© 2011 by RBC Capital Markets, LLC. Member NYSE/FINRA/SIPC. All rights reserved

THANK YOU!