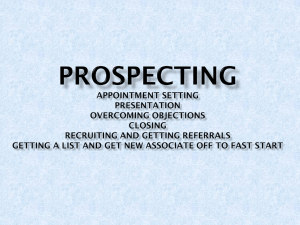

PowerPoint - My PFS Training

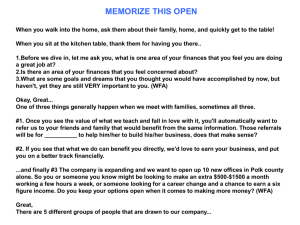

Referrals/Earn Your Business/Expansion

Not to be used in New York.

The Financial Services Company For the 21

st

Century

• Founded in 1977 with 85 people

• Approximately 100,000 licensed representatives

• 6 million clients in the United States,

Canada and Puerto Rico

• Largest Financial Services marketing organization in North America

The research has been done!

1. Warburg Pincus, Baron Fund & 200 other companies invested in Primerica.

2. Better Business Bureau A+

3. Rated A+ (Superior) by A.M. Best

• (PRI) Listed on NYSE

All of this without any national TV or radio advertising!

Primerica Life ’ s, National Benefit Life ’ s and Primerica Life Insurance Company of Canada ’ s financial strength is rated A+ (Superior) by A.M. Best, the oldest and most prominent rating agency in the industry.

1.**A.M. Best ratings range in order from the highest ratings as follows: A++, A+, A, A-,

B++, B+, B, B-, C++, C+, C, C-, D, E, F. Primerica ’ s term life insurance is underwritten by

National Benefit Life Insurance Company, Home Office: Long Island City, NY, in New York

State, Primerica Life Insurance Company, Home Office: Duluth, GA, in all other U. S. jurisdictions; and Primerica Life Insurance Company of Canada, Home Office: Mississauga,

Ontario, in Canada.

We Are a One-Stop Financial Supermarket

With Home Delivery!

Life Insurance Managed Accounts 1,4

Annuities 1,3

Debt Solutions 1,2

Primerica

DebtWatchers™

Offered by Primerica Client

Services, Inc. through contractual agreement with

Auto & Home Insurance

Referral Program

401(k) Plans 1,3

Mutual Funds 3,5

Quotes from such companies as:

Travelers

Safeco

Long Term Care

Progressive

Legal Protection

Our Mission: Help Families Become Properly Protected, Debt

Free and Financially Independent

“ The average household now owes $15,788 in credit card debt.

”

AARP Bulletin, July- August 2010

“ More than half of all Americans have no emergency savings.

”

Time.com, August 2011

“ Study shows that 1.5 million Americans filed for bankruptcy in 2010.

”

CNNMoney.com, January 3, 2011

“ 68 million adult Americans have no life insurance.

”

National Underwriter Life & Health, October 8, 2007

“ Nearly half of all workers have less than $25,000 set aside for retirement.

”

2008 Retirement Confidence Survey.

How real and serious are these problems?

The Problem: No Financial Education,

Coach, or Plan.

The Solution: Working with a financial coach that educates and provides a plan for you to become financially independent.

People Don

’

t Plan to Fail, They Fail to Plan!

Financial Independence Number

Your financial independence number is the amount of money you need to accumulate so that when you retire you won ’ t run out of money and have to go back to work!

You want $2,500 per month to retire today… 30 years from now , after

3% inflation… you will need $6,083 per month to buy what $2,500 buys today. Which is

$73,000

per year!

Your FIN is $1,080,000

To get there, invest $585 per month for 30 years at 9% = $1,080,000

How important is it to know your Financial Independence Number?

This hypothetical example assumes 20 years of retirement income needed, at a 6% post-retirement rate of return and 3% inflation. Hypothetical investment rates assume a nominal 10% rate of return, compounded monthly, and is not indicative of any specific investment. Any actual investment may be subject to taxes and fees, which would lower performance. This example shows a constant rate of return, unlike actual investments, which may fluctuate in value. It is unlikely an investment would grow 10% on a consistent basis, given current market conditions.

The Rule of 72…

Sometimes called the Bankers Rule

Divide your interest rate into 72 to find the approximate number of years it takes for money to double!

Years

0

6

12

18

24

30

36

42

48

54

1%

$2,000

$2,123

$2,254

$2,394

$2,542

$2,699

$2,866

$3,043

$3,231

$3,500

12%

$2,000

$4,000

$8,000

$16,000

$32,000

$64,000

$128,000

$256,000

$512,000

$1,024,000

• How do you win a game if you don ’ t know the rules?

• Do banks or insurance companies have any incentive to teach us this rule?

• Who would benefit from learning this rule?

• Shouldn ’ t we have learned this rule in school?

Without introducing us to family and friends, how would they learn the “ Rule of 72?

”

The table serves as a demonstration of how the Rule of 72 works and is only an approximation of accumulations. It is not intended to represent any specific investment.

The chart uses constant rates of return, unlike actual investments, which will fluctuate in value. It does not include fees or taxes, which would lower performance.

The Theory of Decreasing Responsibility

How Life

Works

Today

1. Young children

2. High debt

3. House mortgage

Loss of income would be devastating

At Retirement

1. Grown children

2. Lower debt

3. Mortgage paid

Retirement income needed

What Life Insurance company do you know of that teaches people how to eliminate the need for Life Insurance?

Cash Value Life Insurance vs.

Buy Term and Invest the Difference

Cash Value Life Insurance

Whole Life, Universal Life, Variable Life

Buy Term and Invest the Difference

SAME

$298

$150,000 $150,000

John age 35

Mary age 33

?

?

?

Cash

Value

$300,000 $300,000

$175

@9%

$123

$298

Monthly

Premium

John age 35

Mary age 33

Monthly

Premium

(35-year Level Term, $25,000 on two children)

Investment at 70

Which program would you want?

Monthly premium for cash value policies is an average of whole life policies from three major North American life insurance companies for male, age 35, standard risk and female, age 33, standard risk. Cash value life insurance can be universal life, whole life or variable life, and may contain benefits in addition to a death benefit, such as dividends, interest, or cash value available for a loan or upon surrender of the policy. Whole life usually has a level premium for the life of the policy. Primerica monthly premium for age 35, non-tobacco use for 35-year Custom Advantage policy (C535) and spouse age 33, non-tobacco use for 35-year

Custom Advantage rider (C5SR), both with rates guaranteed for 20 years, plus a child rider of $25,000 each on two children, underwritten by Primerica Life

Insurance Company, Executive Offices: Duluth, GA. Term insurance provides a death benefit only and its premiums increase at certain ages. The accumulation figure reflects continued investment at the same rate over 35 years at a 10% nominal rate of return compounded monthly and does not take into consideration taxes or other factors, which would lower results. This example uses a constant rate of return, unlike actual investments, which will fluctuate in value. This is hypothetical and does not represent an actual investment. It is unlikely an investment would grow 10% on a consistent basis, given current market conditions.

Solution: Build Your Financial House

Other Goals and Dreams

College Savings

Retirement

Debt Elimination

Emergency & Short term Savings

Term Life Insurance & Will*

“ A good rule of thumb is that you need between eight to ten times your annual salary in life insurance coverage.

”

— The Wall Street Journal, April 12, 2006

* Primerica Legal Protection program. Exclusions and limitations may apply. See plan for details.

Primerica representatives do not provide legal, tax or estate planning advice.

On a scale of 1-10,

10 being the highest, how would you rate your desire to have a strong financial house and a crack free foundation?

Four Ways to Earn Income

Employee

Has a job.

Income based on position, not the person.

Self-Employed

The Cash Flow Quadrant*

Owns a job.

Dentist, doctor, lawyer, hair stylist, real estate agent, salesperson.

Business

Owns a system.

Has others working for him/her.

Unlimited income potential via manufacturing, marketing, etc.

Investor

Has money working for him/her.

Enjoys complete freedom and lives the dream.

Which two ways to earn income appeal to you most?

*The Cash Flow Quadrant, CASH FLOW Technologies, Inc.; used with permission.

The Real Estate Model

Agent

Limited Income Potential

No Security

No Time Freedom

Broker

Unlimited Income Potential

More Security

Time Freedom

6% Broker Fee

$100,000 House =

$6,000 Fee

Agent

50%

$3,000

Agent

50%

$3,000

Broker

50% Override:

$3,000

Agent

50%

$3,000

A Broker with 5 agents

Earning $3,000/month

Agent

50%

$3,000

Earns $15,000/month

Agent

50%

$3,000

Commission

Which would you rather be — an agent or a broker?

PP/SR/37938/8.08/V8.0/02PFS344-29

Primerica representatives market term life insurance underwritten by the following companies in these respective jurisdictions: National Benefit Life

Insurance Company, Home Office: Long Island City, NY, In New York State: Primerica Life Insurance Company, Home Office: Duluth,

GA, in all other US Jurisdiction. Primerica Life Insurance Company of Canada, Home Office: Mississauga, Ontario, in Canada.

Primerica Secure: A personal lines insurance referral program in which representatives may refer individuals to Answer Financial Inc. which offers insurance products and services through its licensed affiliates. Primerica, its representatives and the Secure Program™ do not represent any of the insurers in the program.

Primerica Legal Protection Program: a legal services contract from PrePaid Legal Services, Inc.

Securities: In the United States, securities are offered by PFS Investments Inc., 3120 Breckinridge Blvd., Duluth, Georgia 30099-0001.

Using Primerica ’ s Custom Advantage 35 (form CS35); Primary: male, age 30, preferred plus, Spouse: female, age 30, preferred plus.

This example is for illustrative purposes and does not represent an actual investment. This example shows a constant rate of return, unlike actual investments which will fluctuate in value. It does not include fees and taxes, which would lower results. Distributions before 59 ½ may be subject to a 10% tax penalty. Consult your tax advisor with any questions.

Rates of return used in the above illustration are hypothetical and do not represent the returns of an actual investment, which will fluctuate in value.

The figures show a 10% nominal rate of return compounded monthly and do not take into consideration taxes or other factors.$25.00 per month.

Compensation examples are based on 2-year advances in full-benefit states for the PLPP product. Representatives of Primerica are independent contractors and are paid commissions on sale of products. Life commissions are based on a 75% advance. Life Bonus is based on 67% QBI.

Primerica Life Insurance:

1. Monthly premium is an average of whole life policies from three major North American life insurance companies for male, age 35, standard risk and female, age 33, standard risk. Cash value life insurance can be universal life, etc., and may contain benefits in addition to a death benefit, such as dividends, interest, whole life, or cash value available for a loan or upon surrender of the policy. Whole life usually has a level premium for the life of the policy.

2. Primerica monthly premium for age 35, non-tobacco use for 35 year Custom Advantage policy (C535) and spouse age 33, non-tobacco use for

35 year Custom Advantage rider (C5SR), both with rates guaranteed for 20 years, plus a child rider of $25,000 each on two children, underwritten by Primerica Life Insurance Company, Home Office, Duluth, GA. Term insurance provides a death benefit only and its premiums increase at certain ages. The accumulation figure reflects continued investment at the same rate over 35 years at a 10% nominal rate of return compounded monthly and does not take into consideration taxes or other factors, which would lower results.

This example uses a constant rate of return, unlike actual investments, which will fluctuate in value.

This is hypothetical and does not represent an actual investment.

11. Term insurance provides a death benefit and its premiums can increase at certain ages. Cash value life insurance can be universal life, whole life, etc., and may contain certain features in addition to death protection, such as dividends, interest, or cash value available for a loan or upon surrender of the policy. Cash value insurance usually has level premiums for the life of the policy; term insurance premiums increase after initial premium periods. This example is for illustrative purposes and does not represent an actual investment. This example shows a constant rate of return, unlike actual investments which will fluctuate in value. It does not include fees and taxes, which would lower results. Distributions before 59 ½ may be subject to a 10% tax penalty. Consult your tax advisor with any questions. Rates of return used in the above illustration are hypothetical and do not represent the returns of an actual investment, which will fluctuate in value. The figures show a 10% nominal rate of return compounded monthly and do not take into consideration taxes or other factors.

Primerica Legal Protection Program. Exclusions and limitations may apply. See plan for details.

PP/SR/37938/8.08/V8.0/02PFS344-29