gratuity schemes - Insure And Invest

advertisement

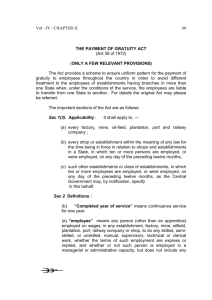

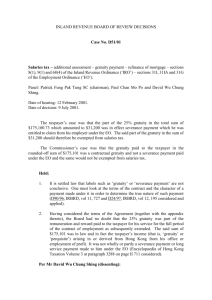

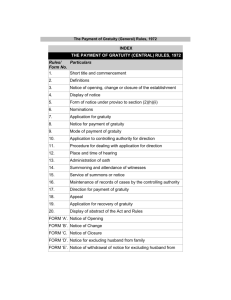

GROUP GRATUITY SCHEME PAYMENT OF GRATUITY ACT, 1972 APPLICABILITY : On Employers with ten or more Employees GROUP GRATUITY SCHEME GRATUITY: A Lump Sum Benefit 15 days’ salary for each year of completed service Service of 6 months or more taken as one year Maximum amount, Rs. 3.5 lakhs WHEN PAYABLE: On Death or disablement On Retirement or Superannuation On Resignation GROUP GRATUITY SCHEME Minimum service condition of 5 years does not apply in case of death or disablement Gratuity Act specifies minimum payable gratuity. An employer may pay more than it GROUP GRATUITY SCHEME METHODS OF MEETING THE LIABILITY PAY-AS-YOU-GO (PAYG) FUNDING GROUP GRATUITY SCHEME ADVANTAGES OF FUNDING Sound financial Principles require advance funding Liquidity or cash flow problems may arise in future, if not funded Overstatement of profit for taxation purpose hence advancement of tax, if not funded Security for employees GROUP GRATUITY SCHEME FUNDING THROUGH LIC’s GROUP GRATUITY SCHEME Flexibility of contributions Trustees relieved from investment of funds Full liquidity GROUP GRATUITY SCHEME FUNDING THROUGH LIC’s GROUP GRATUITY SCHEME (Contd..) Attractive experience based yield 100% security of capital Additional death cover based on prospective service at a nominal cost GROUP GRATUITY SCHEME ADDITIONAL SERVICES AT NO SEPARATE COST ACTUARIAL VALUATION CERTIFICATE AS PER AS - 15 DOCUMENTATION AND LEGAL ADVICE ADMINISTRATION YEAR END FUND ACCOUNT WITH FULL DETAILS GROUP GRATUITY SCHEME STEPS FOR INSTALLATION OF SCHEME DECIDE TO FUND (BOARD RESOLUTION) APPOINT THE TRUSTEES DRAFT AND EXECUTE TRUST DEED AND RULES CREATE A FUND APPLY TO COMMISSIONER OF INCOME TAX FOR APPROVAL GROUP GRATUITY SCHEME FOR EMPLOYER Annual and past service Contributions are allowed as business expense (Maximum limit is 8 1/3% of Annual Salary in respect of each member). (Section 36(1)(v)) Past Service contributions may be paid in lumpsum or in instalments (maximum five) Interest Income received by the trust is exempt from Income-tax (Section 10(25)(IV) GROUP GRATUITY SCHEME FOR EMPLOYEES Contribution paid by an employer is not treated as an income in the hands of the employee Gratuity amount is not taxable upto Rs. 3,50,000/(Section 10(10)(iii)) Amount payable on death of the member is not taxable