Structural Shifts Affecting The Supply Chain in Fresh Produce

Structural Shifts

Affecting The Supply

Chain in Fresh Produce

AEC 317

Fall 2012

Increases in vegetable consumption

Source: Vegetable & Melons Situation and Outlook, ERS, 2012

1992-2002 Produce Acreage Changes

(thousand acres)

+105

-25

+823

+3

-28

-7

+11

0

0

-9

-7

0

+1

+2

0

+34

-57

-9

-92

-50

-5

+17

-30 +2

0

-11

-5

0

+5

-2

-2 -11

+45

-13

-1

-1

-2

-9

-12

0

-6

-5

0

-4

-2

+5

-24

1 to +10,000 acres gain

11,00 to 45,000 acres gain

Source: USDA Census of Agriculture 1992 –

2002

-69

Produce Acres in U.S.

Increase in Marketing Formats

• Farmers Markets

• Organic and Health Food Stores

– Whole Foods (Wild Oats), Fresh Market, and other natural foods merchandisers

• Convenience Stores

• Club Stores

• Conventional Supermarket

• Even fast food moving strongly toward distributing more produce

Fresh Fruit and Vegetable Marketing Channels

2007 - $5.0

2007 -$20.5

- - -

Supervalu

Fleming

+ + +

Castellini

Sysco

Alliant, GFS

2000 - $75.8

2007 - $100

2007 - $9.0

Net trade of Fresh Fruit and Vegetables

8

Terminal Markets

Louisville Terminal Market

Terminal Markets

Diminish in importance

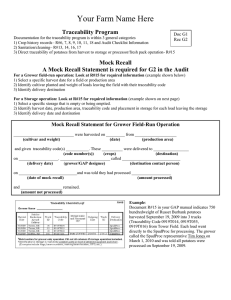

Fierce competition places multiple demands on produce suppliers while perishability limits power!

Retail consolidation

Fewer buyers

Oversupply

Specific buyer requirements:

• packaging

• palletizing

• JIT delivery

• traceability

• temperature

• shelf life

• safety

• consistency

• volume

Factors Driving Scale Economies

• On-Farm production technology

• Distribution economies

• Buyer scale – (imposing supplier standards)

• Food safety and quality demands

Grower/Shipper Responses to Influence Price

Expand control – horizontally or vertically

• Consolidate horizontally: acquire, merge, or form alliances with other grower/shippers to become multi-regional or multicommodity shippers

• Coordinate vertically: newly forged “partnerships” between produce shippers and retailers, even in the form of contracts.

Grower/Shipper Responses to Influence Price

Adopt differentiation strategies

• Adopt cost-reducing technologies that also affect marketing (e.g. plasticulture)

• New hybrids/varieties/crops

(e.g. maroon carrot)

• Specialized products/forms

(fresh processed; value added products)

• New packaging schemes & POP

• Undertake demand expansion programs

(including alternative market windows)

Defining SCM

• SCM – a continuous channel-level management process of shaping and reshaping intracompany performance, information technology tools, products and services, and organization to meet emerging customer opportunities

– D. Ross, Competing Through Supply Chain

Management

Defining SCM

• Never totally attained

• Unique chain strategies - What works in one chain does not necessarily work in another

Supplier Enterprise

Channel Network Programs

Inventory Planning

Production Management

Purchasing

Customer Service

Transportation

Warehousing

Customer Enterprise

Defining SCM

• Coordination with a view toward…..

– Creating customer value

– Total focus on continuous improvement

– Formalization of quality processes

– Development of quality process methods

– Developing effective performance methods

Why SCM for Horticulture Sector?

• Large retail networks with their own distribution centers

• Chain-wide quality assurance requirements

• International sourcing

• Efficient Consumer

Response initiatives from the packaged food manufacturer

• Increases in SKU’s

Retail Produce SKUs

700

600

500

400

300

200

100

0

19

60

19

70

19

80

19

90

19

94

19

99

20

06

Some Supply Management Factors

Produce Shrinkage

4

3

2

1

0

8

7

6

5

0.9

6.1

Warehouse Retail Store

7

Total

Role of Electronic Technology

• Electronic data interchange

• Cross docking

• Case coding

• Continuous replenishment

• Vendor-managed inventory

Shared responsibilities

• Retailers and growers expect to see significant sharing in responsibilities

– Promotion support/planning

– Demand forecasting

– Inventory management

– Category management

– Cross docking and other functions

System wide supply chain priorities

Issue

Food safety

Quality specifications

Cold chain maintenance

HACCP standards

Inventory turns

Vendor partnerships

Product traceability

Decreased order time

E-commerce

VMI

Flow through/cross dock

Percent of participants rating issue as a high priority

Retailer Grower/shipper

100.0

100.0

100.0

97.5

95.0

90.0

87.5

60.0

52.5

42.5

45.0

90.9

95.5

77.2

81.8

70.0

91.0

95.5

61.9

86.4

86.4

60.0

Source: Perisio, et al., 2001

Preferred Supplier

Attributes

1. Consistent quality (aesthetics & shelf life)

2. Consistent on-time delivery (JIT).

3. Consistent volume (supplies sufficient to fill majority of stores in a “region”).

4. Price protection on rising markets.

5. PLU/UPC/COOL labeling or coding capabilities (traceability).