O21.3

advertisement

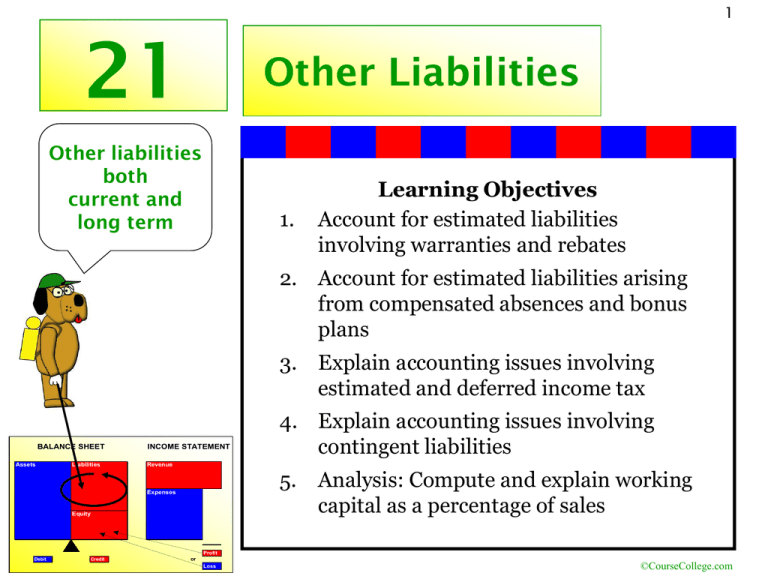

1 21 Other Liabilities Other liabilities both current and long term 1. Learning Objectives Account for estimated liabilities involving warranties and rebates 2. Account for estimated liabilities arising from compensated absences and bonus plans 3. Explain accounting issues involving estimated and deferred income tax BALANCE SHEET Assets Liabilities INCOME STATEMENT Revenue 4. Explain accounting issues involving contingent liabilities 5. Analysis: Compute and explain working capital as a percentage of sales Expenses Equity Profit Debit Credit or Loss ©CourseCollege.com 2 Liabilities -definition The FASB definition of a liability includes these 3 essential elements: 1. It is an obligation in effect that must be settled by giving up cash, goods or services in the future. 2. It is an obligation that cannot be avoided. 3. The event that created the obligation has already occurred. In this chapter we will study several liabilities that could meet this definition but may: Require an estimate as to the size of the liability, the date it must be paid and the party to whom it will be paid Exhibit uncertainty as to whether the liability will occur ©CourseCollege.com 3 Objective 21.1: Account for estimated liabilities involving warranties and rebates Estimated liabilities are known obligations of an uncertain amount. They often also exhibit uncertainty as to the date they must be paid and the party to whom they will be paid. O21.1 ©CourseCollege.com 4 Account for estimated liabilities involving warranties and rebates Firms often guarantee their products and services under a warranty agreement. Based on the expected occurrence of claims, they must follow the Matching Concept and expense the warranty repair or replacement in the same fiscal period as the sales that involved the warranty. WARRANTY We guarantee. O21.1 .. Matching Concept ©CourseCollege.com 5 Account for estimated liabilities involving warranties and rebates Firms also offer inducements to generate sales and develop customer loyalty through the use of marketing innovations such as cash rebates. This additional expense, must follow the Matching Concept and be included in the same fiscal period as the sales that these inducements helped generate. $25 Rebate With the purchase of. . . O21.1 Matching Concept ©CourseCollege.com 6 Account for estimated liabilities involving warranties and rebates Problem -When the warranty or rebate is expensed, the firm doesn’t know precisely: •Who will be paid •How much or how many will be paid •When they will be paid Solution -Estimate the warranty and rebate expense expected O21.1 ©CourseCollege.com 7 Account for estimated liabilities involving warranties and rebates Warranty liabilities After sale obligations arising from guaranty agreements for products and services Estimates must be used to predict expected warranty claims Warranty liability and expense must be recorded in the same period as sales subject to the warranty WARRANTY We guarantee. . . O21.1 ©CourseCollege.com 8 Account for estimated liabilities involving warranties and rebates Rebate liabilities Subject to a sale, cash, product or service obligation to a customer Estimates must be used to predict amounts that must be paid based on expected redemption rates Rebate liability and expense must be recorded in the same period as the sales subject to the incentive $25 Rebate With the purchase of. . . O21.1 ©CourseCollege.com 9 Example WARRANTY–On January 1, Greenline Engine Rebuilders began to offer a 2 year 20,000 mile parts and labor warranty on their rebuilt auto and truck engines. Management estimates that warranty expenses will average 3% of net sales. As of December 31, net sales = $2,350,000. Estimated warranty claims are: $2,350,000 x 3% = $70,500 GENERAL JOURNAL Date Description Page 19 PR Debit Credit Adjusting Entries 12/31/10 ¢Warranty Expense 565 ¢Estimated Warranty Liability BALANCE SHEET Assets Liabilities INCOME STATEMENT Revenue Expenses 238 70,500 70,500 Greenline will report $70,500 less net income as a result of this adjustment. Equity O21.1 Profit Debit Credit or Loss ©CourseCollege.com 10 Example WARRANTY–In January following the first year of the warranty agreement, a customer submitted a claim for $500 for warranty repairs made on a Greenline engine. GENERAL JOURNAL Date Description 1/1/11 ¢Estimated Warranty Liability Assets Liabilities 238 Debit Credit 500 100 ¢Cash BALANCE SHEET PR Page 20 500 INCOME STATEMENT No change in net income as a result of this transaction Revenue Expenses Equity Profit Debit Credit or Loss Note that the debit does not go to an expense account, it reduces the Warranty Liability. This obligation has already been expensed in the prior fiscal period. O21.1 ©CourseCollege.com 11 Example REBATE –On January 1, YardMax Tools began to offer a $25 mail-in rebate on the purchase of their new garden tiller. Management estimates that 40% of customers will submit the mailin rebate. The sales price for the new tiller is $425. Sales totaled $850,000. Estimated rebate expense: $850,000/$425 = 2000 tillers x 40% x $25 = $20,000 GENERAL JOURNAL Date Description Page 56 PR Debit Credit Adjusting Entries 1/31/11 ¢Rebate Expense 590 ¢Estimated Rebate Liability BALANCE SHEET Assets Liabilities 241 20,000 20,000 INCOME STATEMENT Revenue YardMax will report $20,000 less net income Expenses Equity O21.1 Profit Debit Credit or Loss ©CourseCollege.com 12 Objective 21.2: Account for estimated liabilities arising from compensated absences and bonus plans Compensated absence plans include: Vacations Sick pay Holidays Family leave earned by employees O21.2 ©CourseCollege.com 13 Account for estimated liabilities arising from compensated absences and bonus plans FASB rules indicate these expenses should be accrued if the following conditions are met: •The obligation to compensate for absences arises from services already rendered by the employee. •The obligation is related to rights for time off that vest or accumulate •Payment is probable •Amounts can be reasonably estimated O21.2 ©CourseCollege.com 14 Account for estimated liabilities arising from compensated absences and bonus plans Vested rights exist when the employee has a right to the benefit even if terminated Accumulated rights exists when benefits can be carried forward into future periods if not used in the current period O21.2 ©CourseCollege.com 15 Compensated absences -example Consider start up firm Barrier Systems who began operation on July 1 (FYE 6/30). Barrier has 10 employees who earn, on average, $625 per week. During the year employees earned 20 weeks of paid vacation and none was used. $625 x 10 employees x 20 weeks = $125,000 GENERAL JOURNAL Date Description PR Page 62 Debit Credit Adjusting Entries 6/30/11 ¢Vacation Wages Expense ¢Vacation Wages Payable O21.2 560 240 125,000 125,000 ©CourseCollege.com 16 Compensated absences -example In the first month of the subsequent fiscal year, employee Ralph Tonga takes his 2 week vacation. His weekly wage, net of all payroll costs and deductions, is $725. GENERAL JOURNAL Date Description PR 7/31/11 ¢Vacation Wages Payable 240 ¢Cash 100 Page 64 Debit Credit 1,450 1,450 Additional entries (i.e. debits to the Vacation Wages Payable & credits to various payroll payable accounts) for employee deductions and the employer payroll costs would be necessary to complete the payroll recording. (See Chapter 8) O21.2 ©CourseCollege.com 17 Bonus agreements -example Ridlow Corporation’s bonus plan pools 20% of net profits (after the expense of the profit sharing is deducted) for distribution to all employees weighted by their total annual compensation. Ridlow’s net income before any bonus plan deductions is $1,500,000. Let B equal the amount of the bonus, then: B = 20% x ($1,500,000—B) B = $300,000 - .20B 1.20B = $300,000 B = $250,000 GENERAL JOURNAL Date Description PR Page 26 Debit Credit Adjusting Entries 12/31/10 ¢Employee's Bonus Expense ¢Profit Sharing Bonus Payable O21.2 595 265 250,000 250,000 ©CourseCollege.com 18 Objective 21.3: Explain accounting issues involving estimated and deferred income tax The regular C-corporation is subject to federal income taxes which must be accounted for on the corporate financial statements Estimates are recorded during the tax year based on anticipated taxable income levels Corporations are required to make estimated quarterly income tax payments to the IRS to avoid penalties O21.3 ©CourseCollege.com 19 Explain accounting issues involving estimated and deferred income tax At month end, Nappy Corp estimates the first quarterly tax payments due April 15 to be $22,000. GENERAL JOURNAL Date Description PR Page 33 Debit Credit Adjusting Entries 3/31/10 ¢Income Tax Expense ¢Income Taxes Payable BALANCE SHEET Assets Liabilities 598 22,000 235 22,000 INCOME STATEMENT Note that the estimate is expensed Revenue Expenses Equity Profit O21.3 Debit Credit or Loss ©CourseCollege.com 20 Explain accounting issues involving estimated and deferred income tax On April 15, the tax payment is made GENERAL JOURNAL Date Description 4/12/10 ¢Income Taxes Payable Page 33 Debit PR 235 22,000 100 ¢Cash Credit 22,000 Quarterly estimated IRS payment BALANCE SHEET Assets Liabilities INCOME STATEMENT Revenue Expenses Equity The payable is satisfied with the cash payment Profit O21.3 Debit Credit or Loss ©CourseCollege.com 21 Explain accounting issues involving estimated and deferred income tax Deferred Income Tax Liabilities income under GAAP and income under IRS rules is usually different most differences are temporary* due to timing issues over longer periods of time (years) different income amounts between IRS and GAAP due to timing are eliminated *except for some permanent differences O21.3 ©CourseCollege.com 22 Explain accounting issues involving estimated and deferred income tax Consider the different income for the same year under GAAP and IRS for Vision Corporation: O21.3 Vision Corporation 12/31/10 Vision Corporation 12/31/10 GAAP IRS Pre-tax net Income $30,000 Pre-tax net Income $10,000 ©CourseCollege.com 23 Explain accounting issues involving estimated and deferred income tax Why is the income (GAAP vs IRS) different? For temporary and permanent reasons. Some examples of permanent reasons are: Permanent GAAP IRS Is municipal bond interest revenue? Yes No Are fines for legal violations expenses? Yes No O21.3 ©CourseCollege.com 24 Explain accounting issues involving estimated and deferred income tax Why is the income (GAAP vs IRS) different? Due to temporary timing differences in the recognition of revenues and expenses Some examples of temporary reasons are: (eventually results will be same for GAAP & IRS) •Straight line depreciation could be used for GAAP but an accelerated depreciation for IRS •Uncollectible account expense and warranty expense is accrued under GAAP but IRS only allows these to be expensed when cash is actually paid O21.3 ©CourseCollege.com 25 Explain accounting issues involving estimated and deferred income tax These differences often result in a deferred income tax liability (or asset) Keep in mind that we are preparing GAAP statements here Vision Corporation 12/31/10 GAAP Vision Corporation 12/31/10 IRS Net Income $30,000 Net Income $10,000 We are obliged to record the federal income tax expense based on the $30,000 GAAP income –NOT the $10,000 IRS taxable income. O21.3 ©CourseCollege.com 26 Explain accounting issues involving estimated and deferred income tax If the tax rate is 15% for Vision Corporation, this would require: 15% x $30,000 = $4,500 debit to income tax expense GENERAL JOURNAL Date Description 12/31/10 ¢Income Tax Expense Page 36 PR 598 Debit Credit 4,500 ¢Income Taxes Payable 235 1,500 ¢Deferred Income Tax Liability 298 3,000 The amount currently due (must be paid this period) to the IRS: 15% x $10,000 = $1,500 The balancing entry of $3,000 is the deferred amount (will be paid in future years) O21.3 ©CourseCollege.com 27 Explain accounting issues involving estimated and deferred income tax These differences can also result in a deferred income tax asset Consider Cascade Corporation net income of $20,000 under GAAP and $50,000 under IRS. GENERAL JOURNAL Date Description PR 6/30/10 ¢Income Tax Expense ¢Deferred Income Tax Asset ¢Income Taxes Payable BALANCE SHEET Assets Liabilities Debit 598 3,000 198 4,500 235 Credit 7,500 INCOME STATEMENT The deferred tax asset will be used up in future periods. Revenue Expenses Equity O21.3 Page 97 Profit Debit Credit or Loss ©CourseCollege.com 28 Objective 21.4: Explain accounting issues involving contingent liabilities Contingent liabilities are potential liabilities arising from an existing set of circumstances Example: Consider a product defect lawsuit pending against PNC Corporation. If the firm loses the suit they may be required to pay substantial amounts. O21.4 ©CourseCollege.com 29 Explain accounting issues involving contingent liabilities Depending on how future events unfold, PNC Corporation could suffer a loss based on the outcome of the lawsuit. BALANCE SHEET Assets Liabilities INCOME STATEMENT The loss is uncertain until the lawsuit is over Revenue Expenses Equity O21.4 Profit Debit Credit or Loss ©CourseCollege.com 30 Explain accounting issues involving contingent liabilities FASB rules regarding the recording of contingent liabilities are based on two questions: What are the chances the event will occur? Can the size of the potential loss be reasonably estimated? O21.4 ©CourseCollege.com 31 Explain accounting issues involving contingent liabilities FASB assigns three ranges of possibility to the first question. Probable –The future event is likely to occur Reasonably possible –The chance of the event occurring is less than likely but more than remote Remote –The chance of the future event occurring is slight O21.4 ©CourseCollege.com 32 Explain accounting issues involving contingent liabilities Likelihood of the Loss occurring Probable Reasonably Possible Remote Can be reasonably estimated Record the contingent liability Disclose the contingent liability in financial statement notes Take no Action Cannot be reasonably estimated Disclose the contingent liability in financial statement notes Disclose the contingent liability in financial statement notes Take no Action Only one of these situations require the liability to be recorded O21.4 ©CourseCollege.com 33 Explain accounting issues involving contingent liabilities Assuming that the PNC corporation product defect lawsuit has been determined to be both probable and can be reasonably estimated as a 500,000 potential loss. . . GENERAL JOURNAL Date Description 6/30/10 ¢Estimated loss from pending lawsuit Page 124 PR Debit Credit 599 500,000 ¢Estimated liability from pending lawsuit The loss is still probable, not 100% certain 299 500,000 BALANCE SHEET Assets Liabilities INCOME STATEMENT Revenue Expenses Equity Profit Debit O21.4 Credit or Loss ©CourseCollege.com 34 Explain accounting issues involving contingent liabilities Also: A set of circumstances could possibly result in a gain (i.e. the firm began a lawsuit against another party for damages) •If the firm wins, a gain could result • However, GAAP rules lean toward the Conservatism Concept in the case of gains and they are not recorded until they actually occur O21.4 ©CourseCollege.com 35 Objective 21.5: Analysis: Compute and explain average working capital as a percentage of sales Working capital answers the following question: How many dollars of current assets would remain if all current liabilities were paid using current assets? The higher the number, the more liquidity is displayed by the balance sheet. Current Assets O21.5 Current Liabilities Working Capital ©CourseCollege.com 36 Analysis: Compute and explain average working capital as a percentage of sales Average working capital = Working capital (beg.) + Working capital (ending) 2 Average working capital as a percentage of sales Average Working Capital Sales O21.5 ©CourseCollege.com 37 Analysis: Compute and explain average working capital as a percentage of sales Average working capital as a percentage of sales answers the question: “What level of working capital was necessary to achieve the reported sales for the year?” Average working capital as a percentage of sales O21.5 Average Working Capital Sales ©CourseCollege.com 38 Example Balance Sheet -Kauri Steel As of 12/31 2009 & 2010 Assets Cash Accounts receivable Inventory Current assets Prop, plant, equip Other assets Total assets 2009 8,500 41,200 76,500 126,200 28,400 2010 7,000 85,700 82,300 175,000 31,500 Liabilities Accounts Payable Current liabilities Long term debt 2009 121,400 121,400 5,000 2010 123,600 123,600 4,200 Total liabilities 126,400 127,800 0 154,600 1,000 207,500 Equity Ow ner, Capital 28,200 79,700 Income Statement For the year ended 12/31/10 Sales Cost of Goods Sold Wages expense Selling expenses Interest expense Miscellaneous expense Net Profit O21.5 598,700 449,025 31,500 1,250 450 64,975 Average w orking capital (WC) (WC for years 2009 +2010) / 2 WC as a % o f Sales (Net Income / Avg. WC) Current ratio 2010 28,100 4.7% 1.4 51,500 ©CourseCollege.com 39 End Unit 21 ©CourseCollege.com