efficient

advertisement

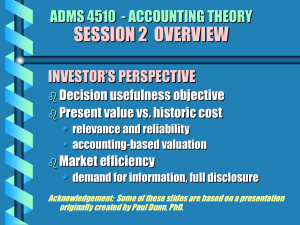

An Alternative View of Risk and Return The Arbitrage Pricing Theory Arbitrage Pricing Theory An asset’s return is related to common risk factors 2 Example: Fama French Model Returns are a function of three risk factors Size factor Return on the averages small firm minus the average large firm Value factor Return on the average value firm minus the average growth firm Market Factor Same as CAPM R βSML(SML) βHML (HML) βM (MKT ) 3 Multi-Factor Betas Since we are allowing for multiple risk factors, how will b change? 4 Example What is a stock’s expected return if its betas are: SML: 0.5 HML: 3.0 Mkt: 2.0 SML is 8%, HML is 5%, the market risk premium is 4%, and the risk free rate is 3% 5 Why We Care Another investment rule 6 Corporate Financing Decisions and Efficient Capital Markets News and Returns All news, and announcements contain anticipated and unexpected components The market prices assets based on the anticipated component of the news This is where expected return comes from The surprise is what creates un-expected return 8 Breaking Returns Down A security’s actual return is comprised of: 1. 2. The expected return The un-expected return Therefore, a stock’s return is: R R U where R is the expected part of the return U is the unexpected part of the return 9 Where does U come from? Systematic Surprises: Unique Surprises: 10 Breaking Returns Down (2) We defined returns as: R R U We can break U down further: R R m m is the return earned because of unexpected movements in systematic risk is the return from unique surprises 11 Example Lets use the Fama French factors: SML, HML, and Mkt Our model is: R R βSML FSML βHML FHML βMkt FMkt ε 12 Surprises Expected SML to be 3%, but it was 8%; surprise is? Expected HML to be 4%, but it was 1%; surprise is? Expected Mkt to be 10%, but it was stable; surprise is? Finally, the firm attracted a “superstar” CEO, and this unanticipated development contributes 1% to the return. 13 Example Betas The stock’s betas are: 1. bSML = -2.30 2. bHML = 1.50 3. bMkt = 0.50 Remember the stock’s expected return was 8% 14 Example’s Actual Return R R βSML FSML βHML FHML βMkt FMkt ε 15 Underlying Assumption The assumption we made, and that drove the last example, is that the stock is priced in an efficient market 16 What is an efficient market? A market is efficient when it uses all available information to price assets. Information is quickly incorporated into prices Efficiency is the degree to which prices reflect available information. Stock prices only respond to surprises, which arrives randomly, so prices follow a random walk Price tomorrow = today’s price + random (+/-) 17 Price: Today and Tomorrow Do you see a pattern that you want to put money on? 18 Reactions to Beating Expectations Over Reaction Under Reaction Efficient Response 19 Reaction to Not Meeting Expectations Under Reaction Efficient Reaction Over Reaction 20 Potential Causes of Efficient Markets Investor Rationality Everyone is rational → Everyone makes the right decision Independent Deviation from Rationality No one is rational → Everyone makes the wrong decision but each makes a different wrong decision Average out the wrongness Arbitrage Only some people are rational → Smart money takes 21 from less smart money Types of Efficient Markets Strong Semi-Strong Weak 22 Weak Form Efficiency Prices reflect all information contained in past prices and volumes No investor is able to form a trading strategy based on historic prices and volumes and earn an excess return 23 Disbelievers Chartists, or Technical Analysts Analyze Chartist believe in identifiable and predictable patterns in these characteristics Make “charts” of a stock‘s Price and/or Volume investment decisions based on these patterns Brokerage firms tend to love chartists 24 Head and Shoulders 25 Stock Price Why Technical Analysis Fails Investors will eliminate any opportunities associated with stock price patterns If there is a profitable pattern, everyone would do it, and the profits would be competed away. Sell Sell Buy Buy Time Semi-Strong Form Efficiency Security prices reflect all publicly available information. Encompasses weak form efficiency Publicly available information includes: Historical price Published and volume information accounting statements Information found in the WSJ 27 Disbelievers Fundamental Analysts Use revenues, earnings, future growth forecasts, return on equity, profit margins, and other data to determine a company's underlying value and potential for future growth (Financial Statements) These guys make more sense than technical analysts. Why? 28 Strong Form Efficiency Strong form efficiency says that anything pertinent to the stock price and known to at least one investor is already incorporated in the security’s price. Public & Private Implies: Insider trading will not earn excess return Strong form efficiency incorporates weak and semi-strong form efficiency. 29 Disbelievers Pretty much everyone Insiders trading is generally profitable Martha Stewart Galleon 30 What EMH Does and Does NOT Say Investors can throw darts to select stocks. Kind of: We still need to consider risk Prices are random or uncaused. Prices reflect information. Price CHANGES are driven by new information, which by definition is random 31 Implications of Efficient Markets Purchase or sale of any security can never be a positive NPV transaction. Trust market prices Stocks with similar risk are substitutes Mutual fund managers cannot systematically outperform the market 32 The Evidence The record on the EMH is extensive, and generally supportive of the market being semi-strong form efficient 33 Event Studies Event Studies examine returns around information release dates EX: Earnings, Dividend announcements A test of semi-strong form efficiency Look at how quickly prices adjust to the information Looking for under-reaction, over-reaction, early reaction, or delayed reaction around the event. 34 Event Study Results The studies generally support the view that the market is semi-strong form efficient. Studies suggest that markets may even have some foresight into the future, i.e., news tends to leak out in advance of public announcements. 35 Cumulative abnormal returns (%) Event Studies: Dividend Omissions Cumulative Abnormal Returns for Companies Announcing Dividend Omissions 1 0.146 0.108 -8 -6 0.032 -4 -0.72 0 -0.244 -2 -0.483 0 -1 2 -2 -3 -3.619 -4 -5 4 6 8 Efficient market response to “bad news” -4.563-4.747-4.685-4.49 -4.898 -5.015 -5.183 -5.411 -6 Days relative to announcement of dividend omission 36 The Record of Mutual Funds If the market is semi-strong form efficient, then mutual fund managers, should not be able to consistently beat the average market return When we compare the record of mutual fund performance to a market index, we see that mutual funds are not able to CONSISTENTLY beat the market. Consistent with the market being semi-strong form efficient 37 Mutual Fund Performance All funds Smallcompany growth Otheraggressive growth -2.13% Growth Income -0.39% -2.17% Growth and Maximum income capital gains Sector -1.06% -0.51% -2.29% -5.41% -8.45% Taken from Lubos Pastor and Robert F. Stambaugh, “Mutual Fund Performance and Seemingly Unrelated Assets,” Journal of Financial Exonomics, 63 (2002). 38 Insider trading Strong form market efficiency implies that even insiders trading on private information cannot earn excess return A number of studies find that insiders are able to earn abnormal profits Violation of Strong form efficiency 39 Verdict on Market Efficiency Market is pretty efficient Opportunities for easy profits are rare. Financial managers should assume, at least as a starting point, that security prices are fair and that it is difficult to outguess the market. New information is rapidly incorporated into the prices. 40 EMH Exercises Indicate whether or not the EMH is contradicted, if so which form of EMH is contradicted An investor consistently earn an abnormal return over that expected by the market by examining charts of historical prices The acquisition of the latest annual report of a company enables an investor to earn an abnormal return. A stock which has been fluctuating between $25 and $27 in the last three months suddenly rises to $40 per share right after management announces a new project that has a promising impact on the firm's expected future cash inflows. By subscribing to the Value Line Investment Survey, an investor can earn at least 5% over that earned by the market on comparable risk investments. 41 Why We Care Offering several points of view on how the market works, and the evidence for and against Using this you can form your own opinion about how the market works and invest accordingly 42