Containing Revenue-Cycle Costs

advertisement

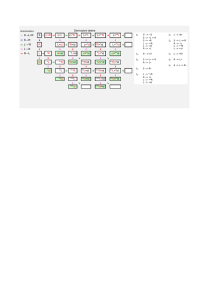

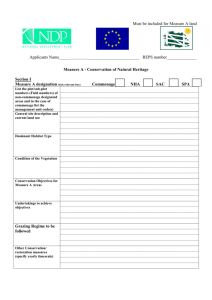

Containing Revenue Cycle Costs 1 Presented By: Robert Geer Senior Consultant Accelerated Receivables Management, LTD ‘ARM’ 1400 Renaissance Drive Suite 400 Park Ridge, IL 60068 888-874-1447 2 WHAT POINTS WILL WE TRY TO MAKE IN THIS PRESENTATION? We should all be held responsible for reducing operation costs. Cost cutting should be planned, cutting costs in a crisis almost always negatively impacts results. 3 WHAT POINTS WILL WE TRY TO MAKE IN THIS PRESENTATION? The cost of money impacts overall hospital performance and should be part of the cost-to-collect ratio. 4 WHAT POINTS WILL WE TRY TO MAKE IN THIS PRESENTATION? Cutting costs before the Revenue Cycle Departments are performing well is dangerous. Levels of performance should be set as goals with a time-frame. 5 WHAT POINTS WILL WE TRY TO MAKE IN THIS PRESENTATION? In addition to planning to reach certain performance goals by certain dates, cost cutting objectives, also with timeframes, should be established. 6 Overview Hospitals and other healthcare providers have now experienced a decade of: •Low Profit Margins •Increased Compliance Requirements •Decreased Cash Flow 7 HealthCare's Response Response has often been cost reductions done in a crisis. Response has often been to reduce staff. Response has often had a negative effect on financial position. 8 What Not To Do Manage Like I Won’t Be Asked to Reduce Costs 9 Plan Cost Reductions While cost reductions done in a crisis often have negative effects.. Cost cutting done systematically, can quite ironically, improve performance. 10 Steps to Cutting Costs Develop a Documented Plan Measure Costs Measure Performance 11 Where to Look for Revenue Cycle Cost Reductions Staffing •Do not look at nonmanagement staff only. In the newer, leaner organization every manager or supervisors should have 12-13 people reporting to him or her. 12 Where to Look for Revenue Cycle Cost Reductions Salary Levels in Relationship to Job Responsibilities and Tasks. Often technical staff, now expensive, is doing tasks that are clerical in nature. Using clerical and reducing technical staff can add up to big savings. 13 Where to Look for Revenue Cycle Cost Reductions Compare claims to staffing ratios but remember there are great differences in the quality of claims being downloaded. If your revenue cycle cannot deliver a clean claim to the Business Office your staffing costs will remain high. Improving the Quality of Claims is the Key to Cost Reductions 14 Where to Look for Revenue Cycle Cost Reductions Purchased Services This is often an area that gets passed over during crisis cost reductions. Most Revenue Cycle Departments have a significant part of their budget for purchased services. 15 Where to Look for Revenue Cycle Cost Reductions Some things to look at in cost reductions in purchased services: • Ask yourself if the purchased service could be done in house cheaper and more effectively. • Investigate current operations, should can you save money and improve performance by buying services? 16 Where to Look for Revenue Cycle Cost Reductions Some things to look at in cost reductions in purchased services: • Look for opportunities to consolidate vendors, fewer vendors are easier to mange and combining purchases might save money. • Renegotiate contracts at the end of the term. Always get proposal from competing vendors. 17 Where to Look for Revenue Cycle Cost Reductions Some things to look at in cost reductions in purchased services: But remember cheaper is not always better. A collection agency that charges a lower rate but under-performs will hurt your organization. 18 Where to Look for Revenue Cycle Cost Reductions Some things to look at in cost reductions in purchased services: Keep up on technology. Don’t continue to use old technology that may be both performing poorly and using more human resources than necessary. 19 Measuring Costs Cost-To-Collect The ability to know how much it is costing to collect is a critical efficiency indicator. 20 Cost-To-Collect Ratio How is it computed? Method #1 Business Office Costs --------------:---------------Divided by Cash Collections 21 Cost-To-Collect Ratio Method #2 Business Office & Patient Access Costs --------------:---------------Divided by Cash Collections 22 Cost-To-Collect Ratio Using total Revenue Cycle Costs will give you a better idea of the total cost-to-collect however whatever method you choose it is important to use that method consistently. 23 A New Way to Look At The Cost-toCollect 24 Cost-To-Collect Ratio In computing costs the cost of money is often overlooked. The cost of money is critical to many providers who must borrow money to meet cash needs because cash flow from the Revenue Cycle cannot sustain the organization. 25 Cost-To-Collect Ratio The cost of money is also important to the Provider who does not borrow money but collects just enough cash to meet daily needs. How So? Because that provider is loosing the opportunity to create investment income that would be created from additional cash flow. 26 Cost-To-Collect Ratio ADDING THE COST OF MONEY TO THE COST-TO-COLLECT RATIO PLACES THE IMPORTANCE OF REACHING CASH GOALS AT A HIGHER LEVEL. 27 Cost-To-Collect Ratio Also, remember that increased costs alone do not increase the cost-to-collect ratio. Increased Operating Costs coupled with significant increases in cash flow will actually result in a lower cost-to-collect ratio. 28 Cost-To-Collect Ratio Let’s look at the table that illustrates various scenarios with understanding the cost-to-collect ratio. Example #1 No additional cost of money is added to the cost-to-collect, example #1 illustrates the traditional method used to calculate the cost-to-collect ratio. 29 Cost-To-Collect Ratio Example #2 Here interest expenses are included in expenses. As you can see this additional cost causes the ratio to decrease. 30 Cost-To-Collect Ratio Example #3 Here expenses were decreased by cutting staff, however cash collections also decreased thereby giving the provider an increased cost to collect. This is clearly an example of where cutting staff that resulted in decreased cash flow netted a higher cost-to-collect ratio. 31 Cost-To-Collect Ratio Example #4 In this example overall costs increased, however cash flow increased also. The additional cash flow not only allowed the provider to stop borrowing money to meet needs additional cash allowed the provider to invest excess cash and provided interest income. 32 Cost-To-Collect Ratio The trick here is to measure the relationship of increased costs to increased cash flow. As a percentage have you seen a greater increase in cash flow than in costs? 33 Cost to Collect* Typical Approach Expense Category salary, wages, benefits purchased services supplies other total direct cost 1400 Renaissance Drive Suite 400 Park Ridge, IL 60068 (847) 824-5510 - Phone (847) 824-7166 - Fax www.ARMLTD.com $178,750 $68,750 $13,750 $13,750 $275,000 allocated overhead $85,250 total cost to collect $360,250 cash collected $10,800,000 *Cost -To-Collect is determined by tabulating all business office expenses for a giv 3.34 Cost To Collect Ratio period and dividing the figure by the total number of dollars collected during the sam period. Suggested Approach: Alternative Approaches 1 Expense Category salary, wages, benefits purchased services supplies other total direct cost allocated overhead interest expense (income) total cost to collect cash collected Cost To Collect Ratio $ 2 3 4 $178,750 $68,750 $13,750 $13,750 $275,000 $178,750 $68,750 $13,750 $13,750 $275,000 $176,250 $68,750 $13,750 $13,750 $272,500 $178,750 $83,750 $13,750 $13,750 $290,000 $85,250 $85,250 $85,250 $85,250 $8,000 $5,400 -$4,000 $360,250 $368,250 $363,150 $371,250 $10,800,000 $10,800,000 $10,125,000 $11,800,000 3.34 3.41 3.59 3.15 - Assumptions: 1234- cash collections meeting operating cash needs cash collections not meeting operating cash needs. staff reductions made before performance indicators are met. technology / outsourcing enhancements made to increase cash flow Notes: 1- no addition "cost of money" to be added to the "cost to collect" calculation 2- interest expense of money borrowed to cover operating needs added to "cost to collect calculation. 3- need to borrow "lost" cash collections. Related interest expense added to total cost to collect. 4- return on additional cash treated as a reduction in total "cost to collect" calculation 34 What Does All of This Mean? Several things: 1. Decreasing expenses in a crisis often means decreased performance which overall, costs the hospital more. 2. If performance increases more than costs, adding costs can be an overall savings to the hospital. 35 What Does All of This Mean? 3. Increased cash flow decreases the cost-to collect. 36 What Does All of This Mean? So maybe our focus in healthcare should be more on increased cash flow rather than totally focusing on expense reduction. 37 Cost of Staff So you are trying to find a way to calculate how much cash flow you might loose by eliminating staff. How Can You Do That? 38 Cost of Staff Method #1 -- Dollars per FTE There are 14 managers/supervisor/billers/ follow-up collectors on your staff collection $5,000,000 per month. This means that each person contributes $357,000 per month. If you reduce 1 FTE and do nothing to improve process or technology you can expect a reduction of $375,000 per month in cash flow. 39 Cost of Staff Method #2 -- DRO Model Your can expect an increase of one day in GDRO if you reduce management/technical staff by 1 FTE. To compute the loss calculate what one day of DRDO increase would mean in reduced cash flow. 40 Cost of Staff We are not saying that you should not reduce staffing costs. Many providers are overstaffed and need to cut people. However, don’t fool yourself. 41 Cost of Staff If you have not: •Improved Processes, •Improved Education and Training, and •Improved Technology Performance Levels Will Decrease. 42 When Should I Take the Risk and Cut Expenses? Mostly When You Reach Agreed Upon Benchmarks. 43 When Should I Take the Risk and Cut Expenses? Agreeing to reach certain levels of performance before doing any significant cost cutting, especially in manpower reductions, will reduce your risk of declining future performance. However, it may be possible to reduce nonstaff expenses in the early stages of your cost savings plan. 44 When Should I Take the Risk and Cut Expenses? Your roadmap should indicate that most of agreed upon performance standards would be met before you attempt to manage the same volumes with less staff, or less costly staff. 45 Benchmarks The benchmarks discussed here are mostly the same ones used to measure the performance of the Revenue Cycle. That is the point, only when performance reaches certain defined levels and maintains them for some time is it “safe” to consider staff reductions. 46 Ben ch m ar k s w i t h Recom m en ded A ch i ev em en t T ar get s Ben ch m ar k Cash Collections Revenue Days Percentage of Discharged Receivable > 90 Days Percentage of Claims Downloaded to Billing/ Claims Editing System with Errors Percentage of Denied Claims Total Uncollectibles Bad Debt Uncollectibles Cost to Collect T ar get 95% of Monthly Net Revenue 55 Days 25% 95% Error Free Claims Less than 4% of Gross Billings Less than 4.5% of Gross Revenue Less than 3.0% of Gross Revenue 2% to 3% 47 Benchmarks Cash Recoveries Setting a cash goal to collect 95 percent of the previous month’s net revenue is the most straightforward method that is easily explained to the organization. 48 Benchmarks Cash Recoveries Generally, organization that have achieved a benchmark level of collecting 95 percent of net revenue over an extended time period can be safe in assuming that they are maximizing cash recoveries. 49 Benchmarks Days in Receivable Gross Days Revenue Outstanding is the most commonly used measurement of accounts receivable performance. However, because there are so many factors that can differ from provider to provider the best way to use Days is to compare performance against your own historical performance. 50 Benchmarks Days in Receivable We would suggest that you achieve less than 65 Days before you consider staffing reductions. 51 Benchmarks Percent of Discharged A/R Over 90 Days If your percentage is greater than 25% you may have a problem with addressing your “older” A/R. This number, in combination with GDRO, will point to possible issues. 52 Benchmarks Percent of Discharged A/R Over 90 Days We recommend that this number be at 25% or less. Reaching this benchmark indicates that you are doing a good job of addressing your aged receivable. 53 Benchmarks Percentage of Claims with Errors This is a less common benchmark but is especially critical to staffing levels. Monitoring the percentage of errored claims to total claims is critical to measuring the re-work and manual intervention required by staff. Re-work and manual intervention are the key reasons departments may be overstaffed. 54 Benchmarks Percentage of Claims with Errors To gather this information, count the number of claims not “passing” edits both in your patient accounting system and in the electronic vendor system. 55 Benchmarks Percentage of Claims with Errors Process improvements in Patient Access and in Clinical Departments are the key to reducing errors. As a goal, you should process 95 percent of claims error free. 56 Benchmarks Percentage of Denied Claims Denied claims are another consumer of staff resources for Patient Accounting. The higher the denial rate the more staff resources are consumed “fixing claims” and resubmitting them. The difference between a 10 % error rate and a 4% rate could mean a reduction of 1 FTE. 57 Benchmarks Percentage of Denied Claims Here we would set a 4 percent error rate as a benchmark. 58 The Report Card It is important to keep a “report card” on progress made on each of these indicators. It is also import to share the “report card” with everyone that has an effect on producing a clean claim. Display the “report card” on offices, in cubicles, and on bulletin boards. 59 Conclusion Cost reductions are coming, too many of us manage hoping this is not true for us. •Don’t be “caught” without a cost cutting plan. •Stick to the promises you make in your plan. 60 Conclusion Good management is all in the planning. Good management is also about the ability to visualize the future and being prepared. Good management is also about being able to communicate your vision. 61 Conclusion Cost reductions are coming, are you prepared with a plan to: •Improve cash flow, •Improve training and education, •Improve processes, and •Improve technology? 62