Peter Abrahamson

advertisement

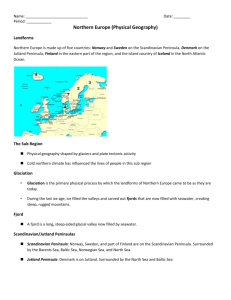

DENMARK: THE NORDIC WELFARE MODEL – POSSIBILITIES AND CHALLENGES Peter Abrahamson University of Copenhagen pa@soc.ku.dk Presentation to the conference ‘the Nordic welfare model: what’s in it for Latvia?, Stockholm School of Economics, Riga, Latvia, November 15th 2012 1 Introduction Crisis symptoms are the same in Scandinavia as elsewhere: Bank bankruptcies A ‘frozen’ housing market A slow down in economic activity => Rapidly increasing unemployment but unevenly severe among the countries and with Norway as an exception Yet, Well preparedness and Robustness 2 Well preparedness: Recent welfare reforms (the Danish example) 1994: Labor Market Reform 1997: Social Assistance Reform 2003: Start Allowance 2003: Welfare Reform Commission => 2006: Welfare Reform 2007: Structural Reform 2007: Labor Market Commission 3 Robustness Many years of experience of handling social integration through public intervention The so-called Scandinavian welfare regime (a strong cushioning effect) 4 The Scandinavian Welfare Regime universal and (therefore) expensive; tax financed; based on public provision of both transfers and services; emphasizing personal social services vis-àvis transfers; provides high quality provision; has high compensation rates and is therefore egalitarian; and is based on a high degree of labor market participation for both sexes 5 ‘...the Nordic model is about... universalism, generous benefits, social citizenship rights, dual-earner model, active labor market policies, and extensive social services’ (Joakim Palme 1999: 15) 6 The Nordic countries are generally characterized by publicly funded and administered programs that have comprehensive and universal coverage and relatively egalitarian benefit structures. Traditionally, they have been supported by redistributive general taxes and strong work orientations, in terms of both programmatic emphasis on work and economic policies that stress full employment (Duane Swank 2000: 85). 7 Welfare States in Times of Crisis The so-called golden age of welfare state development in Europe – the period of time from the end of the Second World War and to the first oil shock in 1973 was, generally speaking, a period of full employment. Most of the Scandinavian countries managed to maintain relatively low levels of unemployment into the early 1990s, but then the consequences of financial market liberalization were felt, particularly hard in Finland and Sweden, but also in Iceland and Norway; and in Denmark unemployment had been high since the mid 1970s. 8 1970 1975 1980 1985 1990 1995 2000 2005 2008 2009 Den. .. .. 7.8 6.6 7.2 6.8 4.3 4.8 3.4 6.0 Finl. 2.6 2.9 5.3 6.0 3.2 15.1 9.6 8.3 6.4 8.2 Iceland .. .. .. .. 2.5 4.9 2.3 2.6 3.0 7.2 Norway 1.7 2.3 1.7 2.6 5.8 5.5 3.2 4.5 2.5 3.2 Sweden 1.5 1.6 2.1 2.9 1.8 8.8 5.6 7.7 6.2 8.3 OECD .. .. .. .. 6.1 7.3 6.2 6.8 6.1 8.3 9 10 The recent development has been rather uneven in Scandinavia before the current crisis. While poverty increased by 75 percent in Finland and by 50 percent in Sweden from 1997 to 2008, very modest increases have occurred in Denmark, Iceland and Norway; and Norway stands out as the only country hardly affected by the current crisis which can be explained by its considerable oil revenue. However in all cases the initial levels were very low: 11 At-Risk-of-Poverty European Union 2004 2006 2008 2010 2011 Denmark 16,5 16,7 16,3 18,3 .. Finland 17,2 17,1 17,4 16,9 17,9 Iceland 13,7 12,5 11,8 13,7 .. Norway 15,8 16,9 15,9 14,9 .. Sweden 16,9 16,3 14,9 15,0 16,1 EU-27 25,6 25,2 23,5 23,4 .. 12 Annual growth rate GDP 2007 2008 2009 2010 2011 2012 Denmark 1,7 -0,8 -5,8 1,3 1,1 0,5 Finland 5,3 0,3 -8,4 3,7 2,9 0,6 Iceland 6,0 1,3 -6,8 -4,0 3,1 2,4 Norway 2,7 0,0 -1,7 0,7 1,7 1,8 Sweden 3,3 -0,8 -4,8 5,8 4,0 0,9 13 14 15 Table 4. Functional Distribution of Social Expenditure in Scandinavia 2008 in Percent Families & Children Denmark 13 Finland Iceland Norway 12 13 13 Sweden 10 Unemployment 5 7 2 2 3 Illness Old Age Disability Surviving Relatives 23 38 15 0 27 35 13 3 40 22 14 2 33 31 13 1 26 40 15 2 Housing Social Assistance 3 3 2 2 3 3 1 3 2 2 16 Table 5 Labor Market Participation Rates in Scandinavia 2009, men and women ages 16-64 Denmark Finland Iceland Norway Sweden Men Women 78 74 69 68 80 76 78 74 75 71 17 Absolute 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Denmark 1747 1752 1724 1735 1771 1746 1725 1760 1778 1802 1850 1909 1892 Fertility Finland 1761 1746 1700 1735 1729 1726 1718 1760 1800 1803 1837 1829 1846 Iceland 2120 2040 2048 1994 2076 1948 1932 1990 2033 2052 2074 2094 2140 Norway 1889 1857 1814 1845 1851 1784 1754 1797 1828 1836 1904 1901 1957 Sweden 1607 1532 1511 1503 1547 1570 1653 1717 1752 1769 1854 1880 1907 18 19 Denmark On April 21st 2009 the newly appointed Prime Minister, Lars Løkke Rasmusen presented the government’s work program for the coming six months, and stated that ‘handling of the crisis is of course the totally dominating objective’ (Prime Minister’s Office 2009: 1; author’s translation) 20 Spring Package 2.0: Growth, Climate, Lower Taxes It was expected that the tax reform would reduce income taxes by more than 28 billion DKK => 1½ per cent of GDP (long-term, permanent effect) 21 The tax reform will reduce marginal personal income tax and Increase environmental taxes 22 Part of the agreement was also to return to citizens the earlier collected compulsory pension saving Other elements concerned grants to renovation of own home Enabling the municipalities to build more public housing In short, the exercise was to increase private consumption substantially 23 Initiatives from the Ministry of Social Affairs Fighting ghettoization and building more units Reducing the number of people facing eviction from their apartment because of arrears Support to NGOs to establish debt counseling services DKK 850 million in funds to enable the municipalities to renovate and construct ‘citizen near’ institutions 24 Some of the changes can be summed up as: administrative reform: in 2011 “Payment Denmark” was established and is expected to take over a number of municipal case-administration areas (those with “objective” criteria) Free choice of technical aids for disabled has been inroduced Reimbursement was changed to increase incentives for activation (30 percent for passive periods, 50 percent for active periods) 25 Local authorities must no later than 1. August 2011 provide a healthy luncheon in all day care institutions (but parents have to pay) 26 Conclusion The initiatives taken together will: Increase private consumption substantially It is, however, much more uncertain whether that will lead to an increase in domestic production/growth or to an increase in imports? 27 The many initiatives to increase activity within construction renovation and building have reduced unemployment in the sectors that are the hardest hit 28 Tax reductions disproportionately will benefit the better off in Denmark and hence increase inequality while the opposite is expected in Sweden 29 Income poverty/relative poverty and inequality have been on the increase in Scandinavia since the mid 1990s However, given the initial very low level of inequality and poverty, and especially the very small prevalence of long-term unemployment and long-term poverty the increases are not expected to spill over into less social cohesion 30 The welfare reform and other public initiatives taken immediately prior to and during the current crisis in Scandinavia were all made within a particular Scandinavian political culture based on consensus and compromise and a tradition for taking inspiration and advise from ad hoc policy commissions 31 They were, furthermore embedded in a culture characterized by a high degree of trust both in government and in each other, which again is a reflection of extremely low levels of corruption that prevail in Scandinavia. This poses limitations to the transferability of Scandinavian experiences to regions with different traditions and conditions 32 Thank you very much for your attention! 33