Wraps, Platforms and Nucleus` Place within them by Paul

Wraps, Platforms and Nucleus’

Place within them

Paul Bradshaw

Chairman Nucleus, Director Sanlam UK

Why now?

● Open Architecture is old in the UK i.

Skandia launched in 1984 following the offshore lead of Lloyds Life and others

●

But the UK is way behind the rest of the world on wrap: i.

Historic dominance of life companies in general and with profits in particular ii.

Highly complex and continuously changing retail tax environment creates big barriers to entry iii.

Very profitable mutual fund pricing cartel iv.

Extremely fragmented distribution model v.

Strong historic silo model (stock-broking, IFA, private banking)

● Now because: i.

With Profits was severely undermined in 2003 by new capital, reserving and transparency requirements ii.

Technology reached a tipping point iii.

But fundamentally Regulator’s ‘broken market’ hypothesis leads to proposition transparency and distribution reinvention

Who are the players?

● Wraps are now extremely fashionable so everyone has to have one

● We divide into transparent and opaque: i.

Opaque is where a mutual fund kickback is not transparent

(Skandia, Cofunds, Hargreaves Lansdown, Funds Network,

Standard life) ii.

Transparent is where fees and kickbacks are transparent

(Transact, Nucleus and most modern versions)

● Big commercial debate about regulation going forward, but we think trend is clear and most opaque providers are embarked on large scale rewrites for transparency

● Significant (and often understated) mutual fund impact. Approximately

30% of Nucleus customer assets are low cost trackers

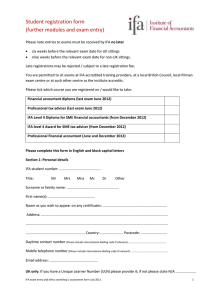

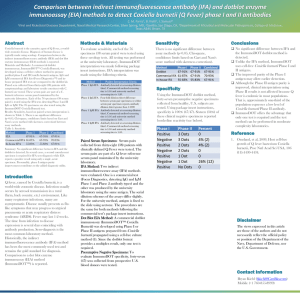

The opaque legacy platforms still dominate

(30/6/10 - source Platforum)

Platform Assets(£bn)

Skandia

Cofunds

Funds Network

Hargreaves Lansdown

Transact

Standard Life

35

24.8

18.8

17.5

8.5 (31/3/10)

4.9

• Nucleus at 30/6/10 £1.57bn

What do observers say?

● In 2006 Datamonitor estimated total UK wrappeable assets in 2005 as £2.5tr

● Ernst and Young forecast £275bn by

31/12/12 (2010 Life and pensions outlook)

● Navigant Consulting forecast £300 bn by

2014-January 2010

Nucleus

● Positioned as the IFA wrap with equity ownership at 51% subject to various calls

●

Owned between 30% and 40+% (dependent on options) by Sanlam

● Entrepreneurial and talented management - up to 17% equity

●

Supported by Bravura software and back office by Scottish Friendly

Assurance

● Total capital employed to date £10M (including accumulated debt due to

Sanlam)

●

Tax wrappers supported: i.

General account ii.

ISA iii.

Sipp (open architecture individual pension) iv.

Onshore Bond (SFA) v.

Offshore Bond (Scottish Life International)

So what about Nucleus?

● IFAs have to buy a share in SPV to join (£15,000)

● Rigorous entry criteria

● Typical firm is large regional IFA (average 5-10

RIs)

● All entry firms have largely transformed their businesses into post RDR compliant trail based revenue

● Average client investment £130k

Nucleus-a short history

● Launched 1/1/2007 with 7 supporting IFA firms

● First EBITDA positive April 2010 - Board decided to pursue aggressive growth strategy

● Current assets (4/10/10) £1.813bn

● Current supporting firms 69

● Current cash inflows £75-£100M per month

● Currently best platform on Platforum IFA research (August 2010)

● Runner up on service quality and number 3 overall at Platform Awards

● We now need to increase our capital and redeem the Sanlam debt and this will be finalised shortly.

● We are extraordinarily encouraged by the strong IFA customer investment desire

● We continue to view our core asset as the hearts and minds of our IFA community

And what are the competitors doing?

● UK Life companies are caught with nasty stresses: i.

Solvency II is complex and generally capital expensive ii.

It is very difficult to live on wrap unbundled margins eg Standard Life’s half year results show non commission expenses as about £614M for the half year. At

35bps gross margin that equates to retail assets of £350bn (cf total £108bn disclosed) iii.

And wrap doesn’t translate very well into EV reporting (even though the cash flows are similar)

● But fundamentally removing commission incentives removes all competitive advantage in IFA market

● Thus marketing attention is focused on direct to customer: i.

The legacy book ii.

Corporate wrap/workplace marketing

● Creating, we believe a vicious circle of IFA disillusion to our advantage

● Mutual fund companies are challenged by transparency, the loss of trail commission will focus real attention on added value

Conclusions

● UK retail FS market subject to unprecedented change

● Structural competitors severely challenged by: i.

Solvency II, complex, high regulator scrutiny ii. RDR-none of the leaders (other than Transact) are RDR compliant. FundsNetwork, Cofunds and Skandia face significant software and marketing reinvention challenge iii. Reinventing margin in a transparent world for all incumbents might imply halving cost base or worse

= Unprecedented opportunity