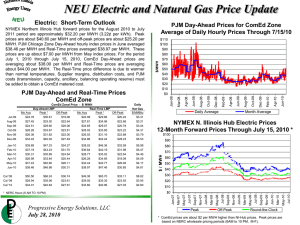

Scott Benner PJM FastDR PLMA

advertisement

Demand Side Response Participation In the Energy & Ancillary Service Markets Scott Benner PJM Interconnection, LLC www.pjm.com PJM©2012 PJM as Part of the Eastern Interconnection • 26% of generation in Eastern Interconnection KEY STATISTICS PJM member companies 750+ millions of people served 60 peak load in megawatts 163,848 MWs of generating capacity 185,600 miles of transmission lines 65,441 GWh of annual energy 832,331 generation sources 1,365 square miles of territory 214,000 area served 13 states + DC Internal/external tie lines 142 • 28% of load in Eastern Interconnection • 19% of transmission assets in Eastern Interconnection 21% of U.S. GDP produced in PJM As of 1/4/2012 www.pjm.com 2 PJM©2012 Demand Response Registrations & Business Segments • Demand Response are represented by Registrations • Registrations are made up of one or more Locations (sites) – Each Location is an EDC Account / meter point www.pjm.com 1. 2. 3. 4. 5. 6. 7. 8. Retail Industrial/Manufacturing Office Building School Hospital Food Service Warehouse Residential Example Devices eLRS Types Least Common … Most Common • Locations contain one or more Devices that can provide wholesale ancillary services 3 HVAC Lighting Environmental Controls (Temperature) Energy Storage Manufacturing Processes PJM©2012 Demand Side Participation in PJM • Where we’ve been. • Where we are. • Where we’re going . . . www.pjm.com 4 PJM©2012 Demand Response History at PJM • On 6/1/2006, PJM enacted tariff & market rule changes to allow Demand Side Resources to participate in the capacity, energy and ancillary service markets – Resources 500kW and larger were eligible to participate in the ancillary services – No more than 25% of each ancillary service market’s requirement could be serviced by demand side resources • Synchronous Reserve • Frequency Regulation • Day-Ahead Scheduling Reserves www.pjm.com 5 PJM©2012 Demand Response in the Capacity Market • RPM delivery year 2007-2008 was the first containing DR products, most as Interruptible Load for Reliability • Looking forward to DY2012-2013, Demand Side Resources providing emergency energy curtailments & efficiency improvements will make up 7% of the “installed capacity” in PJM Nuclear, 33708, 17% Natural Gas, 49183, 25% Coal, 77696, 39% Petrolium, 14475, 7% Renewables, 10115, 5% Demand Side, 14007, 7% www.pjm.com 6 PJM©2012 Demand Response in Synchronized Reserve • In Sept 2006, PJM qualified its first DSR to provide synchronous reserve – A resource that is consuming energy provides reserve by curtailing its demand within 10 minutes upon request – A Curtailment Service Provider (CSP) offers the resource to the market and coordinates with PJM Dispatch – PJM requires 1-minute interval data submitted via eLRS for M&V • On 10/14/2006, PJM issued its first synchronized reserve event with an assigned demand side resource • While individually small, many resources can collectively provide the same MW of reserve as a generator www.pjm.com 7 PJM©2012 www.pjm.com 8 May 2012 Apr 2012 16.85% 17.38% 17.53% 16.91% 17.06% 15.58% 15.38% 16.28% 14.95% 14.57% 14.14% 12.45% 840 700 560 7.5% 420 5.0% 280 2.5% 140 0.0% 0 Average Market Requirement (MW) 20.01% 20.32% 19.46% 22.28% 20.0% Mar 2012 Feb 2012 Jan 2012 Dec 2011 12.52% 16.58% 17.5% Nov 2011 Oct 2011 Sep 2011 Aug 2011 Jul 2011 Jun 2011 May 2011 Apr 2011 Mar 2011 Feb 2011 14.54% 14.46% 14.67% 13.29% 12.07% 10.0% Jan 2011 Dec 2010 Nov 2010 Oct 2010 Sep 2010 Aug 2010 Jul 2010 15.46% 14.64% 14.85% 13.93% 15.0% Jun 2010 May 2010 Apr 2010 Mar 2010 14.18% 13.49% 12.5% Feb 2010 Jan 2010 Maximum DR Penetration (% of Req.) Demand Response Participation in Synchronous Reserve Synchronous Reserve DR Participation by Month 25.0% 1400 22.5% 1260 1120 980 As of 5/15/2012 PJM©2012 Addressing Barriers to Entry to the Ancillary Service Markets • Advanced Technology Pilot (ATR) Program – Asset owners work with Applied Solutions dept. to investigate technologies that don’t quite fit current market rules – Over time, pilots move to production, and compensation • In Summer 2011, PJM began the stakeholder process to lower the qualification limits from 500kW to 100kW – FERC approval was effective 10/20/2011 – PJM & members agreed to delay implementation to after AC2 www.pjm.com 9 PJM©2012 Demand Response in Frequency Regulation • On 11/21/2011, two Demand Side Resources began participation in PJM’s Regulation Ancillary Service Market – A resource that is consuming energy continuously increases or decreases demand in response to a PJM issued control signal – PJM requires 10-second interval metering via DNP3 for M&V • Demand Side Resources provide regulation service using – – – – www.pjm.com Pumps at a municipal wastewater treatment plant Battery bank at a manufacturing facility Ceramic “thermal storage” bricks in residential communities Electric vehicles parked at charging stations 10 PJM©2012 Typical Demand Response to Regulation Control Signal 0.10 0.08 0.06 0.04 MEGAWATTS 0.02 0.00 -0.02 -0.04 This registration is a network of many pumps, each raising and lowering consumption relative to the regulation signal while honoring local operating constraints (pond levels) -0.06 -0.08 Regulation Signal www.pjm.com 11 14:00 13:55 13:50 13:45 13:40 13:35 13:30 13:25 13:20 13:15 13:10 13:05 13:00 -0.10 Response PJM©2012 Demand Response in Day-ahead Scheduling Reserve • Day-Ahead Scheduling Reserve (DASR) Market, formerly the Operating Reserve service – PJM maintains an operating reserve for each hour of the day • When the reserve requirement is not met, either additional generation is dispatched on-line or DR is assigned to curtail – A resource that is consuming energy is paid to curtail energy in the assigned hours, if directed to curtail by PJM Dispatch • Market clearing price correlates to high demand days DASR MCP – For year 2012, the reserve requirement is 7.03% of forecasted demand $1,000.00 $100.00 $10.00 $1.00 $0.10 $0.01 2011 J www.pjm.com F M A M J J 12 A S O N D PJM©2012 Demand Side Participation in PJM • Where we’ve been. • Where we are. • Where we’re going . . . www.pjm.com 13 PJM©2012 It’s Been a Busy 2012 So Far . . . • Raising the 25% DR Participation Limit – Although the limit has never been reached, this is considered a barrier-to-entry by the industry • The highest DR participation in the synchronous reserve market in a single hour to date was 22.3% in Mar 2012 – On 4/23/2012, in the Demand Response Subcommittee, PJM began the stakeholder process to alter the limit • Continued investigation into advanced technologies – Behind-the-meter energy storage devices (thermal, batteries) – “Ultrabattery” ultra-capacitor / lead-acid battery hybrid – Networked mobile electric vehicles providing regulation www.pjm.com 14 PJM©2012 Demand Response in the Energy Markets • Day-Ahead and Real-Time Energy Markets – A resource that is consuming energy curtails its demand via Emergency Energy directives by Dispatch • On April 1st, 2012, implemented FERC Order 745 – Supply-side offer curves for Economic DR participants – DR can set LMP, get paid full LMP for curtailments – Net Benefits Test • On May 14th, 2012, FERC accepted PJM’s Price Responsive Demand (PRD) filing – Demand-side offer curves for Economic DR participants www.pjm.com 15 PJM©2012 Performance Based Regulation • On May 17th, 2012, FERC issued a ruling approving PJM’s Performance Based Regulation • Continuous, hourly performance scores for each regulating resource based on – Accuracy – Timeliness – Precision • Payment based on performance AND MW offered into the market www.pjm.com 16 PJM©2012 Demand Side Participation in PJM • Where we’ve been. • Where we are. • Where we’re going . . . www.pjm.com 17 PJM©2012 Changes in Registration Aggregation • In Winter 2011, PJM began the stakeholder process to address metering and grouping of Registrations – Registrations cannot use sub-metering for M&V – Registrations cannot group Locations across transmission zones, or resources > 100 kW – PJM Markets use offers at the Registration level • On April 2nd, 2012, PJM filed with FERC to allow submetering for Regulation M&V, effective June 1st, 2012 – Also allows multiple CSP at same location, different devices • Aggregation currently being discussed in – Demand Response Subcommittee for Energy – Regulation Performance Senior Task Force for Regulation www.pjm.com 18 PJM©2012 Coming Attractions • Implementing Performance Based Regulation – Scheduled for production on Oct 1st, 2012 • Smart Meters & “Prices to Devices” – Price Responsive Demand Nodal Pricing • “Unrestricted” Load Forecasting – PJM predicts load using historical similar days, weather – Models will adjust for DR curtailing for Economics www.pjm.com 19 PJM©2012 Fast Demand Response Opportunities • Fast Demand Response can provide – Price-sensitive Energy curtailments – Synchronous Reserve service – Frequency Regulation service … any wholesale service that a generator can provide ! www.pjm.com 20 PJM©2012