Steve-Herling - Virginia Chamber of Commerce

advertisement

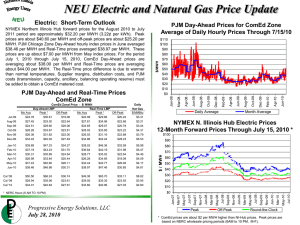

Future Generation Mix in PJM Governor’s Conference on Energy Richmond, VA Steven R. Herling Vice President, Planning PJM Interconnection October 17, 2013 PJM©2013 PJM Well Positioned for Growth in Gas-Fired Generation 2 PJM©2013 Where the Drilling Action is Today 3 PJM©2013 Shale Gas Production Continues to Climb 4 PJM©2013 Delivered Fuel Price $/MMBtu 10 PJM-Eastern Hub 9 Henry Hub 8 Coal Delivered Price 7 6 5 4 3 2 1 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 0 Source: IHS-CERA, September 2013 5 PJM©2013 Lingering Low Electricity Demand Load, MW 190,000 185,000 180,000 175,000 170,000 165,000 160,000 2011 Load Forecast 2012 Load Forecast 2013 Load Forecast 155,000 150,000 145,000 140,000 Year 6 PJM©2013 7 $80 July 2020 $100 January 2020 $120 July 2019 $140 January 2019 $160 July 2018 January 2018 July 2017 January 2017 July 2016 January 2016 July 2015 January 2015 July 2014 January 2014 July 2013 January 2013 July 2012 January 2012 July 2011 January 2011 July 2010 January 2010 July 2009 January 2009 July 2008 January 2008 Spot Power Price Projections East, On-Peak East, Off-Peak West, On-Peak West, Off-Peak AEP-Day, On-Peak AEP-Day, Off-Peak N. Ill, On-Peak N. Ill, Off-Peak $60 $40 $20 $0 Source: IHS-CERA, September 2013 PJM©2013 Evolving Generation Mix in PJM Cleared Installed Capacity 70,000 Coal 60,000 Gas ICAP MW 50,000 40,000 Nuclear 30,000 20,000 Renewables 10,000 0 Demand Response 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 2012/2013 2013/2014 2014/2015 2015/2016 2016/2017 Delivery Year PJM©2013 Evolving Generation Mix 100% 90% 80% Wind S. Waste Hydro Oil Nuclear Natural Gas Coal 70% 60% 50% 40% 30% 20% 10% 0% 2007 2008 2009 2010 2011 9 2012 2013 PJM©2013 Projected Generation Mix 100% 90% 80% Solar 70% Wind 60% Other 50% Hydro 40% Oil Nuclear 30% Gas 20% Coal 10% 0% 2013 2014 2015 2016 2017 2018 2019 2020 Source: IHS-CERA, September 2013 10 PJM©2013 Generation Deactivations Over 20 GW of Actual & Announced Deactivations 2011-2016 11 PJM©2013 Natural Gas Dominates Current Active Projects in the Queue Nuclear 2,556 5% Coal 2,188 4% Other 1,934 4% MW Capacity Value Wind 2,623 5% Natural Gas Wind Natural Gas 43,701 82% Coal Nuclear Other As of July 2013 Nuclear Other 2,696 4,542 6% Coal 4% 2,201 3% Wind 17,293 24% MW Energy Value Natural Gas Natural Gas 45,722 63% Wind Coal Nuclear Other As of July 2013 12 PJM©2013 Evolving Generation Mix in Virginia Capacity By Fuel Type 2005 (MW) Nuclear, 3432 Gas, 6790 Coal, 5735 Hydro, 3654 Oil, 2245 Capacity By Fuel Type 2009 (MW) Waste, 142.6 Gas, 7510 Nuclear, 3425 Coal, 5801 Hydro, 4007 Oil, 2236 Waste, 169 13 PJM©2013 Evolving Generation Mix in Virginia Capacity By Fuel Type 2013 (MW) Gas, 8660 Nuclear, 3581 Coal, 5767 Hydro, 4038 Oil, 2213 Waste, 339 14 PJM©2013 Generation Under Construction in Virginia Nuclear Natural Gas 15 PJM©2013 Active Queued Generation in Virginia 16 PJM©2013 Evolving Generation Mix in Virginia 17 PJM©2013 Decreasing Emission Rates PJM Average Emissions (lbs/MWh) Carbon Dioxide Sulfur Dioxides Nitrogen Oxides 1,300 1,250 9 8 7 6 1,200 CO2 5 1,150 4 1,100 3 1,050 2 1,000 1 950 0 2005 2006 2007 2008 2009 2010 2011 SO2 and NOx 1,350 2012 Source: PJM EIS 18 PJM©2013 Natural Gas Impact to PJM Capacity Pricing from $167.46 from $357.00 from $167.46 from $136.00 2015/2016 Base Residual Auction Results (last year) 19 PJM©2013 Increasing Power Generation Natural Gas Consumption Most other categories of natural gas consumption have had flat or decreasing usage trends! 20 PJM©2013 Power Generation is NOT the Ideal Gas Customer Power generation gas use does not fit neatly into the gas contractual construct • Electricity demand, like gas demand, fluctuates and is subject to steep ramps, especially in winter • Increased wind and other intermittent resources don’t help • Fastest starting generation resources, generally are gasfired combustion turbines which can go to full output in about 10 minutes or less 21 PJM©2013 Some Electric/ Gas Coordination Issues • Language barrier • “Intermittency” of electric demand • Power generation use of interruptible service • Gas Day vs. “Electric Day” • Natural gas has some storage -- “just-in-time” fuel source 22 PJM©2013 Firm vs. Interruptible Service Majority of PJM gas-fired generators have interruptible gas delivery service • Generators buy available firm service from others, via capacity release or bi-lateral arrangement • Use marketers to acquire a bundle of commodity and delivery • Risk curtailment for local delivery issues – Northern NJ – January 2013 – Cleveland – July 2013 What PJM is doing: Discussing changes to market rules, dual fuel requirements, etc. as part of the PJM Gas Electric Senior Task Force 23 PJM©2013 Gas Day vs. Electric Day Issue: Timely gas nominations are due at 10 a.m. the day before (Day 1); electric “awards” are made at 4 p.m. the day before (Day 1) = 6 hours later; actual gas flow occurs starting at 10 a.m. on Day 2 What PJM is doing: Discussing potential for market timing changes (INGAA has signaled a willingness to change nomination timing) 24 PJM©2013 Natural Gas is a Just-in time Fuel Source • We’re used to having significant fuel at the generation site—coal piles, nuclear fuel, etc. • Gas moves at ~35 mph – it takes days to arrive from the Gulf of Mexico, although proximity to Marcellus/Utica helps • Pipeline can “line pack” to some degree, but advanced planning is necessary • Pipelines do have storage to some degree, but generators have to contract for it What PJM is doing: Learning about gas pipeline capabilities and anticipating “big picture” look from the EIPC Gas Study 25 PJM©2013 What is FERC Doing? • Bringing the industries together – Series of technical conferences • Some finger pointing, but also • Some very useful information exchange – Trying to exert leadership to bring solutions (Moeller) • NOPR on communications – Remove barriers between gas control and system operators to exchange non-public information What PJM is doing: Supporting the FERC efforts through participation and comments 26 PJM©2013 In the Meantime…. • Pipeline expansion process is working (hopefully, in time to save New England!) • Large majority of gas-fired generators use interruptible service in PJM and other markets (and PJM has had some operational issues) • We continue to exchange large amounts of data via electronic bulletin boards, but is minimally useful in operations • Operators on both sides stand ready to respond to surprises that will pop up periodically (daily in New England!) 27 PJM©2013 Summary • Power generation is a “double edged sword” for the gas business – Largest growth market – Potential to cause problems in operations • Working together, we can minimize the operational problems – Awareness of the limitations on each side – Increased real time communications across the aisle – Use of the demand side resources on each side 28 PJM©2013 Questions 29 PJM©2013