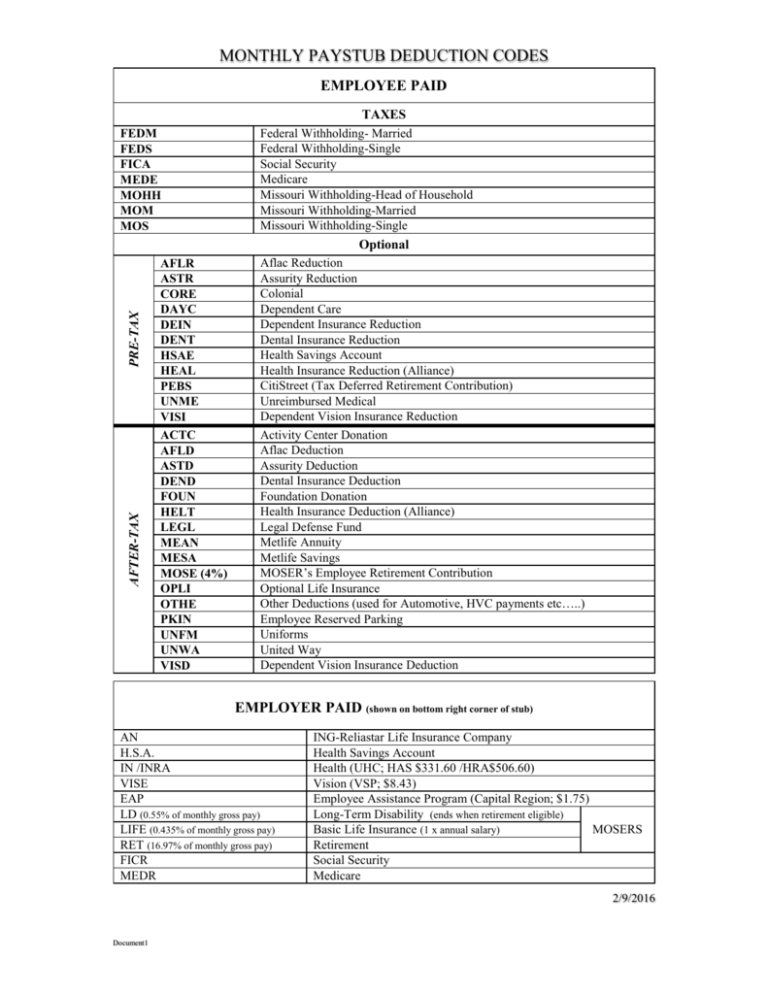

Deduction Codes

advertisement

MONTHLY PAYSTUB DEDUCTION CODES EMPLOYEE PAID TAXES FEDM FEDS FICA MEDE MOHH MOM MOS Federal Withholding- Married Federal Withholding-Single Social Security Medicare Missouri Withholding-Head of Household Missouri Withholding-Married Missouri Withholding-Single AFTER-TAX PRE-TAX Optional AFLR ASTR CORE DAYC DEIN DENT HSAE HEAL PEBS UNME VISI ACTC AFLD ASTD DEND FOUN HELT LEGL MEAN MESA MOSE (4%) OPLI OTHE PKIN UNFM UNWA VISD Aflac Reduction Assurity Reduction Colonial Dependent Care Dependent Insurance Reduction Dental Insurance Reduction Health Savings Account Health Insurance Reduction (Alliance) CitiStreet (Tax Deferred Retirement Contribution) Unreimbursed Medical Dependent Vision Insurance Reduction Activity Center Donation Aflac Deduction Assurity Deduction Dental Insurance Deduction Foundation Donation Health Insurance Deduction (Alliance) Legal Defense Fund Metlife Annuity Metlife Savings MOSER’s Employee Retirement Contribution Optional Life Insurance Other Deductions (used for Automotive, HVC payments etc…..) Employee Reserved Parking Uniforms United Way Dependent Vision Insurance Deduction EMPLOYER PAID (shown on bottom right corner of stub) AN H.S.A. IN /INRA VISE EAP LD (0.55% of monthly gross pay) LIFE (0.435% of monthly gross pay) RET (16.97% of monthly gross pay) FICR MEDR ING-Reliastar Life Insurance Company Health Savings Account Health (UHC; HAS $331.60 /HRA$506.60) Vision (VSP; $8.43) Employee Assistance Program (Capital Region; $1.75) Long-Term Disability (ends when retirement eligible) Basic Life Insurance (1 x annual salary) MOSERS Retirement Social Security Medicare 2/9/2016 Document1 MONTHLY PAYSTUB DEDUCTION CODES UNEM Unemployment Tax (this number will always be 0) 2/9/2016 Document1