4th October 2012

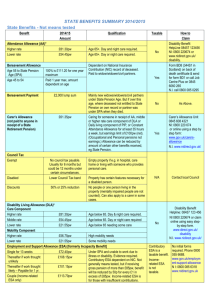

advertisement

Impact of Universal Credit Dr Phil Agulnik Entitledto 4th October 2012 I am… • An economist specialising in social security • Before Entitledto I worked for DWP and other central govt. departments • Entitledto supply a free public benefits calculator performing over 2 million calculations a year • We provide a range of benefit calculators for local authorities, including self-service, adviser, and under occupation calculators • Entitledto are an IRRV strategic partner What the Government says about Universal Credit “Universal Credit is the Government’s key reform to tackle the two key problems of poor work incentives; and complexity. It will enable the system to help people to move into and progress in work, while supporting the most vulnerable. It will be simple to understand and administer and it will protect both the welfare of those most in need and the public purse” The scope of Universal Credit In scope • Income-based Jobseeker’s Allowance • Income-related Employment and Support Allowance • Income Support (including Support for Mortgage Interest) • Child Tax Credit • Working Tax Credit • Housing Benefit Out of scope • Council Tax support • Disability Living Allowance • Contributory Benefits • State pension • Child Benefit • Pension Credit • Carer’s Allowance Structure of Universal Credit The Means Test Step 1 - Calculate Maximum Amount Step 2 - Assess Capital, Unearned Income and Earned Income Step 3 - Taper reduces Maximum Amount - apply disregards - 65p in the £ taper on earned income - £ for £ taper on unearned income Step 4 - Adjustments - sanctions - benefits cap - transitional protection (for some) Maximum Amount Standard Amount for single/couple plus • Child Element • Disabled Child Additions • Childcare Element • Carer Element • Limited Capability for Work or Limited Capability for Work-Related Activity Element • Housing Element Rent restriction through under-occupation rules Rent restriction through LHA rules Mortgage interest restrictions (or loan?) Non-dependant deduction(s) No housing element for supported/exempt accommodation Income and capital Employed earnings - actual income during assessment period - real time earnings from HMRC Self-employed earnings - self-reported income during assessment period - minimum income floor Unearned income - prescribed in regulations - not prescribed = not treated as income - generally same income types disregarded as now, except for full disregard of war pension income All above calculated as a monthly figure Capital - no change for benefits, big change for tax credits Assessing earnings – Real Time Information Unearned Income Prescribed income (taken into account) includes: (a) Retirement pension (b) The following benefits: (i) contribution-based jobseeker’s allowance; (ii) employment and support allowance; (iii) carer’s allowance; (iv) bereavement allowance; (v) widowed mother’s allowance; (vi) widowed parent’s allowance; (vii) widow’s pension; (viii) maternity allowance; (ix) foreign benefits (c) Spousal maintenance (d) Student income (e) Etc etc Earnings disregards (may change) Current system Final system Tax Housing Universal Universal Credits Benefit Credit max Credit min disregard disregard Original proposal Universal Universal Credit Credit min max disregard disregard Single Couple Lone parent £6,420 £6,420 £6,420 £260 £520 £1,560 £700 £3,000 £9,000 £700 £1,920 £2780 (extra £260 for child 2+) £0 £3,000 £7,700 £0 £520 £2080 (extra £260 for child 2+) Couple with children £6,420 £520 £7,250 £2440 (extra £260 for child 2+) £5,700 £1040 (extra £260 for child 2+) Disabled, single or couple £6,420 £1,040 £7,000 £2,080 £7,000 £2,080 Plus 100% of pension contributions disregarded! Transitional Protection Three kinds of claim for UC: 1. New claim, e.g. when someone loses their job and claims benefit 2. Change of circumstance (natural migration), e.g. when an extra child is born 3. Managed migration, when DWP initiates the transfer onto UC DWP’s claim that “no one will be worse off!” only applies to managed migration! Transitional protection for this group means cash amount can not go down Some affected groups... Disabled Adults • Current Disability Premiums will be replaced with just two elements: limited capability for work limited capability for work related activity • Entitlement based on the Work Capability Assessment, rather than DLA/PIP assessment • Limited Capability for Work element likely to be the same level as ESA WRAG component • Limited Capability for Work Related Activity element is likely to be higher than ESA Support component, but lower than Severe Disability Premium (SDP). Big winners and losers! Disabled Adults – other changes • No equivalent of Permitted Earnings • Higher earned income disregard, but no equivalent of WTC disability element • Carer Element not paid in addition to Limited Capability Elements – one or the other Loss of SDP – Citizens Advice example Disabled Children • Two rates of disabled child additions Higher rate when child awarded highest rate of DLA (care) or is registered blind Lower rate when child awarded other rates of either component of DLA (mobility or care) • Figures proposed to date suggest that higher rate may be same or more than current Child Tax Credit severe disability element • But lower rate same as WRAG component, worth half of current Child Tax Credit disability element of £57 per week • Note: DLA/PIP assessment used for children The Self-Employed Minimum Income Floor Intended as alternative to work conditionality for selfemployed Calculated as 35 hours times minimum wage Exemption during start-up period Start-up Period Within 12 months of starting self employment Up to 12 months exemption from MIF Once in every 5 years Duty to report income each month No carry forward from previous month Permitted reductions Flat rate deductions for mileage/use of home Couples where one person over Pension Credit age • Under UC the age of the youngest person in a couple will determine whether they claim Pension Credit or UC • As well as existing gap in benefit rates, working age also have under occupation rules, work conditionality etc • As with examples above, massive difference in income between a ‘natural’ transition onto UC and managed migration DWP estimates of winners and losers (Impact Assessment Oct 2011) Timetable… Implementation Timescale Feb ‘11 Design & build Apr ‘13 Oct ‘13 Apr ‘14 Pilot Oct ‘14 Oct ‘15 Oct ‘16 Oct ‘17 New claims from out of work customers New claims from in work customers Natural transitions due to change of circs Managed transitions 2.5m Legacy load JSA, ESA, IS, HB, WTC, CTC 4.5m 6m 8m UC load Pathfinders and LA led Pilots • Pathfinders in Oldham, Tameside, Warrington and Wigan start April 2013. Live UC claims from new JSA claimants • Pilots to test aspects of delivery (online, monthly payment, rent to claimant not landlord) from now.... Bath and North East Somerset Council Birmingham CC Caerphilly County BC Dumfries and Galloway Council LB Lewisham Melton and Rushcliffe BC as partnership Newport CC North Dorset DC North Lanarkshire Council Oxford CC West Dunbartonshire Council West Lindsey DC Conclusion: Winners and Losers • One year to go! But draft UC regs not complete and further draft regs this month. Entitlement rates and disregards in December (presumably) • Modelling winners and losers at the moment requires guess work as to rates and rules • Winners have an incentive to transfer to UC via a change of circumstance. In line with policy intention to encourage 1-16 hours work • Losers have an incentive to be part of managed migration and get transitional protection Conclusion: Impact on LAs • Difficult to estimate run down in HB caseload due to switching incentive for UC winners • Council Tax Support schemes re-designed from April 2014 to align rules (e.g. on self-employed) • Council Tax Support schemes may need to split working age claimants into those claiming UC and those not • April 2013 changes mean a big cohort of losers. In contrast UC losers are protected • ‘Can’t pay’ rather than ‘won’t pay’ may be biggest problem for new Council Tax Support schemes My contact details: Email: Phone: Web: Or phil@entitledto.co.uk 07816 638590 www.counciltaxsupport.com www.solutions.entitledto.co.uk