GASB 62

advertisement

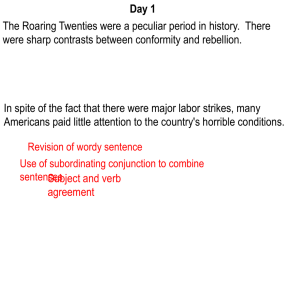

SM GASB 62 Codification of Accounting and Financial Reporting Guidance Contained in Pre-November 30, 1989 FASB and AICPA Pronouncements Jamie Matthews, CPA May 2013 SM Introduction • Objective: incorporate into the GASB’s accounting and financial reporting guidance that is included in FASB & AICPA Pronouncements before November 30, 1989, which does not conflict with or contradict GASB pronouncements • Effective Date: for periods beginning after 12/15/11 (FYE 12/31/12 & FYE 6/30/13) SM Organization of Statement • Organized by topic • Each topic contains provisions derived from FASB or AICPA pronouncements that address the subject matter SM Pronouncements Included • Leases • Sales of real estate • Real estate projects • Research and development arrangements • Broadcasters • Cable TV systems • Insurance enterprises • Lending activities • Mortgage banking activities • Regulated operations SM Pronouncements Included • Special and extraordinary items • Comparative financial statements • Related parties • Prior-period adjustments • Accounting changes and error corrections • Contingencies • Extinguishments of debt • Troubled debt restructuring • Inventory SM Clarifying Guidance • Capitalization of interest – scope clarified to address assets granted to other governments • Current assets and liabilities – operating cycle (something other than 12 months) not allowed • Related parties – definition clarified to recognize related organization, joint ventures and jointly governed organizations • Change in accounting principle – omits change in depreciation method • Interest rate costs – imputation – scope excludes low interest loans that make the market SM Disclosure Removed The District has elected to apply all Financial Accounting Standards Board (FASB) pronouncements issued before December 8, 1989, unless FASB conflicts with GASB. The District has not elected to apply FASB pronouncements issued after that date. SM Interest Capitalization Interest costs during construction should be capitalized when: • Asset are constructed/produced for own use (including assets constructed or produced by others for the enterprise for which deposits or progress payments have been made) • Assets intended for sale or lease that are constructed or otherwise produced as discrete projects (for example, real estate developments) SM Interest Capitalization Construction cost of the following assets related to a proprietary fund should not include an interest cost element: • Assets that are in use or ready for their intended use • Investments accounted for by the equity method after the planned principal operations of the investee begin • Investments in regulated investees that are capitalizing both the cost of debt and equity capital • Assets acquired with gifts and grants that are restricted by the donor or grantor to acquisition of those assets to the extent that funds are available from such gifts and grants (interest earned from temporary investment of those funds that is similarly restricted shall be considered in addition to the gift or grant for this purpose) SM Interest Capitalization Interest capitalization period begins when the three conditions are present: • Expenditures for the capital asset have been made. • Activities that are necessary to get the capital asset ready for its intended use are in progress. • Interest cost is being incurred. SM Interest Capitalization • Interest capitalized is limited to the actual interest expense recognized for the period • Interest capitalization for proprietary funds should take into consideration only debt that is to be paid by a proprietary fund • Interest cost to be capitalized for assets constructed with tax-exempt borrowings Cost of borrowing Interest Earned on Proceeds Capitalized Interest (Tax-Except Borrowings) SM Tax Exempt Borrowings • The key to determining if you should offset the interest expense with the interest earned is to determine if the resources are externally restricted to finance acquisition of specified qualifying assets or to service the related debt. SM Illustration of Interest Capitalization • Gilbert Community College District (GCCD) is having a building constructed for $1,400,000. They made the following payments during the construction period in 2012: Jan 1 $210,000 March 1 May 1 Dec 31 $300,000 $540,000 $450,000 Total $1,500,000 • Construction was complete and the building was ready for use on December 31, 2012. GCCD had the following debt outstanding: Specific Construction Debt 15%, 3-year note, dated 12/31/11, interest payable annually on 12/31 $750,000 Other Debt 10%, 5-year note, dated 12/31/07, interest payable annually on 12/31 $550,000 12%, 10-year note, dated 12/31/06, interest payable annually on 12/31 $600,000 SM Illustration of Interest Capitalization • Weighted Average Accumulated Expenditures during 2012 is as follows: X Expenditures CY Capitalization Period* = Weighted Avg Accumulated Expenditures (WAAE) 1/1 210,000 X 12/12 = 210,000 3/1 300,000 X 10/12 = 250,000 5/1 540,000 X 8/12 = 360,000 12/31 450,000 X 0 = 0 1,500,000 * Months between the date of expenditures and date interest capitalization stop or the end of the year, whichever comes first (in this case 12/31) 820,000 SM Illustration of Interest Capitalization • Avoidable interest is computed as follows: Debt Construction Note Plug ($820-750) Total WAAE Allocate WAAE X $750,000 X 70,000* X $820,000 Avoidable Interest Interest Rate = 15% = $112,500 11.04% ** = 7,728 $120,228 ** 10% 5 year note Principal $550k, Interest $55k & 12% 10 year note Principal $600k, Interest $72k. Total Interest $127k divided by Total Principal $1,150 = 11.04% SM Illustration of Interest Capitalization • Avoidable Interest is $120,228 • Actual Interest is $239,500 • Interest cost to be capitalized is the lessor of avoidable interest or actual interest Debit: Building (capitalized interest) $120,228 Debit: Interest Expense $119,272 (239,500-120,228) SM For More Information: Jamie Matthews, CPA Gilbert Associates, Inc. jamie@gilbertcpa.com