BANK ACCOUNT RECONCILIATIONS Page 3 of 3

advertisement

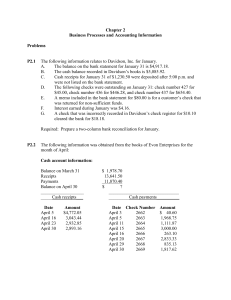

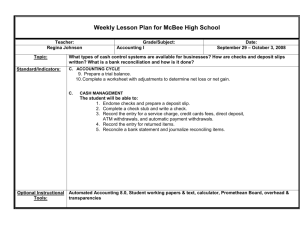

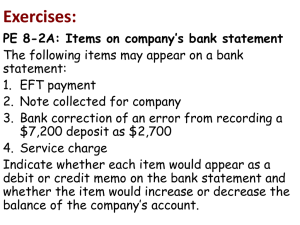

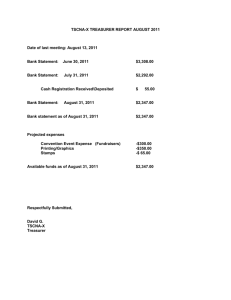

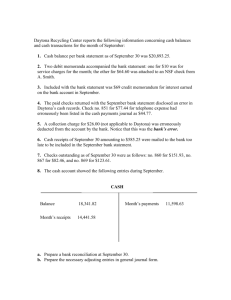

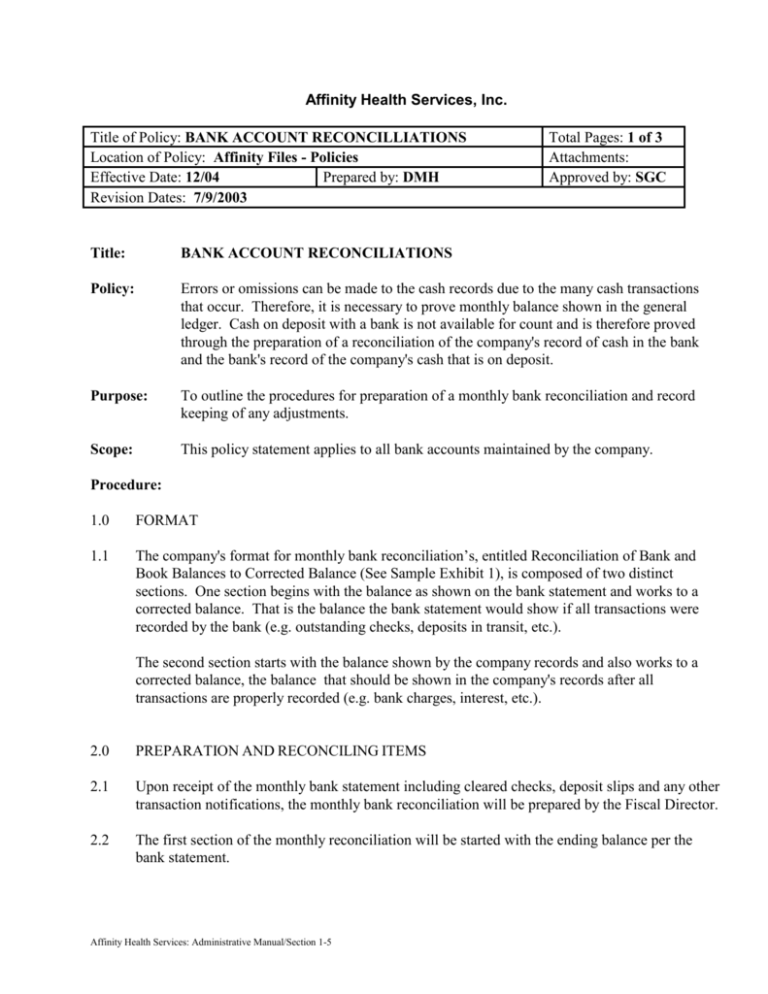

Affinity Health Services, Inc. Title of Policy: BANK ACCOUNT RECONCILLIATIONS Location of Policy: Affinity Files - Policies Effective Date: 12/04 Prepared by: DMH Revision Dates: 7/9/2003 Total Pages: 1 of 3 Attachments: Approved by: SGC Title: BANK ACCOUNT RECONCILIATIONS Policy: Errors or omissions can be made to the cash records due to the many cash transactions that occur. Therefore, it is necessary to prove monthly balance shown in the general ledger. Cash on deposit with a bank is not available for count and is therefore proved through the preparation of a reconciliation of the company's record of cash in the bank and the bank's record of the company's cash that is on deposit. Purpose: To outline the procedures for preparation of a monthly bank reconciliation and record keeping of any adjustments. Scope: This policy statement applies to all bank accounts maintained by the company. Procedure: 1.0 FORMAT 1.1 The company's format for monthly bank reconciliation’s, entitled Reconciliation of Bank and Book Balances to Corrected Balance (See Sample Exhibit 1), is composed of two distinct sections. One section begins with the balance as shown on the bank statement and works to a corrected balance. That is the balance the bank statement would show if all transactions were recorded by the bank (e.g. outstanding checks, deposits in transit, etc.). The second section starts with the balance shown by the company records and also works to a corrected balance, the balance that should be shown in the company's records after all transactions are properly recorded (e.g. bank charges, interest, etc.). 2.0 PREPARATION AND RECONCILING ITEMS 2.1 Upon receipt of the monthly bank statement including cleared checks, deposit slips and any other transaction notifications, the monthly bank reconciliation will be prepared by the Fiscal Director. 2.2 The first section of the monthly reconciliation will be started with the ending balance per the bank statement. Affinity Health Services: Administrative Manual/Section 1-5 BANK ACCOUNT RECONCILIATIONS Page 2 of 3 Next, any deposits in transit that were made by the company but were not yet recorded by the bank will be listed and added to the bank balance. Next, any checks that were written on the account prior to month-end but which have not yet cleared the bank, will be listed and deducted from the bank balance. From these steps, the "corrected" ending balance will be derived for the first section. 2.3 The second section of the monthly reconciliation will be started with the ending balance per the company's books. Next, any interest or any other bank credit items will be listed and added to the balance. Next, any bank charges, transfer fees, etc. will be listed and deducted from the balance. From these steps, the "corrected" ending balance will be derived for the second section and should equal the "corrected" balance for the first section. 2.4 Any discrepancies between these two balances will require research by the Fiscal Director to determine the cause, such as recording errors, omissions, mispostings, etc. This can also include recalculation of the bank statement for any possible errors made by the bank. 3.0 ADJUSTMENTS AND JOURNAL ENTRIES 3.1 Any book reconciling items such as interest, bank charges and any recording errors will be summarized and drafted in journal entry form for recording the general ledger. 3.2 Outstanding checks are recorded monthly with the bank reconciliation. Include the vendor name as well as the check number and amount when completing the list of outstanding checks. 3.3 If a check appears on the list of outstanding checks for a second month in a row, investigate immediately. A stop payment and replacement check may have to be issued. 3.4 If an outstanding check cannot be resolved in Item 3.3 above, please refer to the policy for abandoned and unclaimed property. Affinity Health Services: Administrative Manual/Section 1-5 EXHIBIT 1 BANK ACCOUNT RECONCILIATIONS Page 3 of 3 (FACILITY’S NAME) Sample Reconciliation of Bank and Book Balances to Corrected Balance Account No. For Month Ended XX/XX/XX Reconciliation of Bank Balance Ending balance per bank statement $10,000.00 Additions: Deposit in transit 2,500.00 Deductions: Outstanding Checks # 1003 # 1232 # 1235 150.00 325.00 1,275.00 1,750.00 Corrected Balance $10,750.00 Reconciliation of Book Balance Ending balance per books $10,750.00 Additions: Interest Deductions: Bank charges Wire transfer fees Check Charges 100.00 15.00 15.00 70.00 100.00 Corrected Balance Affinity Health Services: Administrative Manual/Section 1-5 $10,750.00