Cola Wars Case Assignment: Value Chain & Five Forces Analysis

advertisement

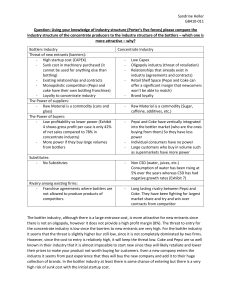

Cola Wars Case Assignment Fall 2022 Case: “Cola Wars Continue: Coke and Pepsi in 2010”, David Yoffie and Renee Kim HBS Case #711-462 Themes of the case: • • • • • Mapping the value chain Understand the relationship between different stages of the value chain in an industry, including strategic reasons for vertical integration Understand how the five competitive forces affect industry profits The nature of rivalry in a mature industry How trends in the market can shift the balance of power in an industry value chain General instructions: • • • • • • Complete this assignment with your case team. Submit your first draft by the due date. I will give time (about 20 minutes) in the beginning of class for your team to meet to finalize and submit. Only use information given in the case. Outside research or data is not necessary and is not helpful in answering the questions. Create a powerpoint slidedeck for your answers (see below). There are three questions. Question 1 is a diagram. Question 2 is a multi-part question in which you apply a five forces analysis to the soft drink industry. The last question relates to vertical integration strategies that are discussed in the case. A discussion board is available for your group to share thoughts, develop answers, and get feedback from me; posting is optional After our case discussion, you can post an additional slide “Case update” to show any revisions to your original recommendation to Q3. This is optional. If you do not submit one I will assume that your original version stands. PowerPoint Slidedeck instructions • • • • • • Upload your completed Powerpoint slides on Canvas as a Group Assignment (one per group). Do not submit a PDF file – upload a Powerpoint file. Add references from the case; show where you sourced information. If helpful, you may add supporting notes underneath each slide to explain and add detail to your answers – avoid crowding slides with text. Save the file as “COLA WARS CASE_TEAM ID” so that the filename contains the identifying name of your team. Add a footer to your deck so that the TEAM ID appears on every slide. This is helpful if we discuss slides in class. There will not be formal presentations in class, but selected slides may be shared in class during case discussion. 1 Q1. The Value Chain in Soft Drinks Draw a flowchart that shows the value chain in the soft drink (CSD) industry. Show the Concentrated Soft Drink (CSD) companies – Coke and Pepsi and their direct rivals - as occupying the focal business (the center of the diagram should show a box for CSD producers). Show their buyers to the right, and suppliers to the left, of the focal business. Follow the dollar to understand buyer and supplier with respect to CSD ; the case specifies direct transactions that link market participants. You can indicate flows that “skip” some players on the value chain, as described in the case. Once you’ve mapped the major transactional relationships, add boxes to your diagram to show “Substitutes” and “New entrants” with respect to the CSD companies, in order to identify these additional players in the market. In mapping the value chain, follow these guidelines: • • Coke and Pepsi are in the focal business in the value chain diagram. As described in the case, they have diversified into non-CSD businesses like snacks, fast food restaurants, and alternative drinks. They have also periodically invested in bottling operations. These moves change the value chain. For the purposes of this diagram, show the CSD companies as non-diversified, independent of franchised bottlers and non-soda products. Laying it out this way will help uncover of the strategic reasons for expansion by the CSD companies into other businesses. You can group firms into their respective businesses, rather than listing individual companies, e.g. “Fast Food Restaurants”; “Supermarkets”. Q2. Five Forces Analysis The CSD industry has historically been extremely profitable, as described in the case, and updated here: http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html. How can a five forces analysis help explain that historical performance? The five forces model provides a list of factors that may be important in assessing the ability of a focal industry to capture profits. Analyse each of the five forces below with respect to Concentrated Soft Drinks (CSD), the core business of Coke and Pepsi. Some may be more important than others and your analysis can reflect that. Players in each of the categories should match to your diagram of the value chain. Suggested length: one slide per force, two for rivalry, one slide for summary. At the top of each slide, summarize your overall assessment of that force with an overall assessment of Low/Medium/High. Then, give the supporting evidence from the case (include references as needed): 1. Supplier power (purchased inputs) 2. Buyer power–focus on important buying groups that are involved in direct transactions with CSD companies as shown on your value chain. The case describes contractual terms; consider how these influence power on the value chain. 2 3. Power of substitutes 4. Barriers to entry 5. Threat of rivalry between Coke and Pepsi: - These companies have been rivals for over 100 years. What are the major eras in the war, and how have the weapons changed over the years? (one slide) - How intense is rivalry between them in the era described in the case? Would you assess their rivalry as zero-sum, or positive sum competition? (one slide) 6. Summary of five forces analysis: Overall, how does a five forces analysis help explain the historically strong profits of the CSD business? Q3. CSDs and Bottlers: Together or apart? As shown in Table 4 of the case, bottling is less profitable than concentrate production, and this is reinforced by data in Table 3a. Given the stark difference in profitability, consider whether it makes strategic sense for Coke and Pepsi to forward integrate into bottling, as they have done in the past. Answer the following: What are pros and cons of the strategy of the CSD companies to own their own bottlers, rather than deal with them as franchised independents? Where possible, apply the five forces analysis to address this question. Then, recommend a vertical integration strategy for Coke and Pepsi going forward from the time of the case: Should they continue to purchase bottlers, or seek to interact as independents? Suggested length: 1 or 2 slides. Note: After our class case discussion, you can submit a additional slide to make any changes to your answer to Q3 (optional). If you do not submit one, I will assume that your original version remains your final recommendation. Grading Rubric This is a graded team assignment worth 10% of your grade. Assessment is based on: • • • • • • • Ability to analyze, not just summarize, information given in the case Quality and thoroughness of the analysis Application of key concepts of five forces model Ability to select the best examples from the case to support analysis Effort and clarity Consistency: different pieces of the report should fit together and reinforce one another Proper citation of case data 3