Cola Wars Continue: Coke and Pepsi in 2006 Presented by: Tigers Team

advertisement

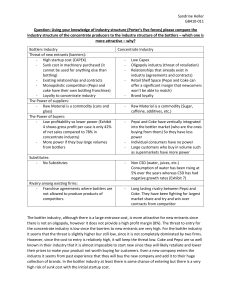

Cola Wars Continue: Coke and Pepsi in 2006 Presented by: Tigers Team Spring 2008 Overview History Historical Industry Profitability Concentrate vs. Bottler Profitability Competition between Coke and Pepsi Sustaining Profits History of Pepsi Pepsi was created in 1893 in North Carolina by Pharmacist Caleb Bradham. By 1910 Pepsi had built a network of 270 bottlers. Pepsi struggled and declared bankruptcy twice During Great Depression grew in popularity due to price decrease to a nickel. In 1938, Coke sued Pepsi-Cola brand for infringement on Coca-Cola’s trademark. History of Coca-Cola Coca-Cola was formulated in 1886 by pharmacist John Pemperton who sold the product at drug stores as “potion for mental and physical disorders.” In 1891, Asa Candler acquired the formula, established a sales force and began brand advertising of Coca-Cola. In 1919, went public under control of Robert Woodruff expanded and developed in national and international markets. Successful during WWII with the high CSD consumption from the U.S soldiers. Industry Profitability: Porter’s Five Forces Rivalry Substitutes Coke Alliances Pepsi Acquisitions Cadbury Product Innovation Porter’s Five Forces (Cont.) Barriers to Entry Power of Suppliers Exclusive Territories Sugar Substantial Investment Packaging Current Market Presence Porter’s Five Forces (Cont.) Power of Buyers Vending Super Markets Convenience and Gas Mass Merchandisers Fountain Fast Food Profitability of the CSD Industry Concentrate Business vs. Bottling Business Concentrate Producers Blend raw material ingredients Packaged Mixture in plastic canisters Shipped to bottlers Diet CSDs Added artificial sweeteners Concentrate Business vs. Bottling Business Bottlers Purchased Concentrate Added carbonated water and high fructose corn syrup Bottled CSD product Delivered to customers accounts Diet CSDs Added sugar or high-fructose corn syrup Concentrate Business vs. Bottling Business Concentrate Producer Little Capital Investment Cost of $25 million - $50 million One plant to serve US Significant costadvertising, promotion, market research and bottler support Bottlers Capital Intensive High-speed production lines Bottling costs $4 million to $10 million Capacity of $40 million warehouse cost $75 million Coke and Pepsi each require 100 plants Pressure from Coke/Pepsi Bottler Consolidation Bottler plants decreased in the US 2000 plants to 300 from 1970-2004 Coke’s re franchising bottling operations Buying Poor managed bottlers Infusing with capital Selling to large bottling plants •In 1985, Coke purchased two of the largest bottling companies Vertical integration Affects on Industry’s Profits Coke was the first concentrate producer to build a nationwide franchise bottling network, that Pepsi and Cadbury Schweppes followed suit. Franchise agreements with both Coke and Pepsi allowed bottlers to handle the non-cola brands of other concentrate producers. Bottlers could not carry directly competing brands. Affects on Industry’s Profits (Cont.) Throughout the 1980s, the growth of Coke and Pepsi put a squeeze on smaller concentrate producers Shelf space for small brands declined and were shuffled from one own to another. Affects on Industry’s Profits (Cont.) In a five year span, Dr Pepper was sold several times, Canada Dry twice, Sunkist once, Shasta one, and A&W once. Phillip Morris acquired Seven-UP in 1978 for a big premium, but racked up huge losses in the early 1980s, and then left the CSD business in 1985. Affects on Industry’s Profits (Cont.) In 1990s, through a series of strategic acquisitions, Cadbury Schweppes became the third-largest concentrate product. Coke has a world market share of 51.4%, Pepsi has 21.8% and Cadbury Schweppes has 6% Sustaining Profits Shift to non-carbonated beverages (keep up with demand of health conscious society) Continue on current path and see where it leads U.S. Liquid Consumption Trends 60 50 40 30 20 CSD 10 Alcohol 0 Milk 1970 1981 1990 1996 2000 2003 NCSD