England

advertisement

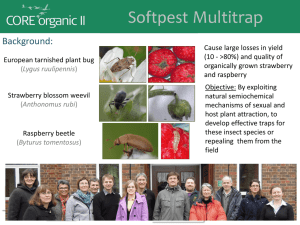

IRO China 2014 Tim Place – England 1 Introduction Tim Place I am Managing Director of Place UK Ltd. We are Soft fruit growers, processors and traders We grow raspberries, Strawberries, blackberries and Rhubarb in the East of England We market our fruit fresh to UK supermarkets as a member of the “Berrygardens” Cooperative (who market 72% of the UK grown fresh raspberries) We sell Frozen fruit direct to UK manufacturers and Supermarkets We purchase frozen fruit from abroad.. 2 The English Raspberry Fruit Growing Regions 3 UK Markets Fresh sales are approx 95% Supermarkets Wholesale markets Farm Shops and Pick your own Frozen sales are only approx 5% Supermarkets Food service Manufacturers – Deserts, Jams, Yoghurts, Juices.. 4 UK Raspberry production 2008 Area 1,571 Ha 2013 1,616 Ha Over 5 years Area increased by only 2.9% Tonnage has increased by 2% Value/t has decreased by 2.3%. Volume 14,800 t Value £6128/t 15,100 t £5986/t Source: DEFRA July 2013 5 UK Raspberry production volume Tonnes 40000 35000 30000 25000 20000 Tonnes 15000 10000 5000 0 Source: DEFRA July 2013 6 UK Raspberry production Area Hectares 4000 3500 3000 2500 2000 Hectares 1500 1000 500 0 Source: DEFRA July 2013 7 Value of UK grown Raspberries £ Thousands 120000 100000 80000 60000 Value £,000 40000 20000 0 Source: DEFRA July 2013 8 Value/tonne UK grown Raspberries £ per tonne 8000 7000 6000 5000 4000 value/t 3000 2000 1000 0 Source: DEFRA July 2013 9 Fresh sales of UK grown fruit BSFL Volume Data Volume - Tonnes 9,000 8,444 8,299 8,226 8,500 8,000 7,500 7,177 7,011 7,000 6,500 6,000 5,500 5,000 2009 2010 2011 2012 2013 10 UK Varieties Current – Tulameen, Glen Ample, Octavia, Driscoll Maravilla and Cardinal Outgoing – Tulameen, Ample and Octavia New – Driscoll Margarita, RD 345.1, JHI late florocane 0447C-5, Berry Gem, Berry Jewell, Radiance, Grandeur, Brilliance, Imara and Kweli 11 Variety attributes Taste Appearance (size and colour) Shelf life Yield Crop timing Health benefits. 12 Tulameen 13 Maravilla 14 New varieties The UK Raspberry Breeding Consortium program at the James Hutton Institute Marketing group exclusive Berrygardens – Driscoll’s Berryworld – Edward Vinson (Berryworld Plus) Total Berry – PSI New primocane varieties are replacing the traditional floricane cultivars, they give late season production and the opportunity to double crop.. 15 Berry Breeding Large scientific institutes and breeding companies are using genetically focused breeding techniques to produce potentially crop changing innovation. JHI and MRS in Dundee are working on gene markers for: Root rot (phytophthora) Gene H (cane diseases) Fruit size Post harvest softening. 16 Raspberry variety trials 17 UK Growing Systems Soil or pots Soil sterilisation Raised plastic covered bed Post and wire, with lateral supports Trickle irrigation (Clean water) Beneficial Insects Polythene tunnels Hand picking into retail punnet.. 18 Proportion of Total BG Production Area in Substrate 19 Substrate grown crop 20 Polytunnels 21 Accreditation Assured produce Nurture – Tesco Leaf – Waitrose Field to Fork – M & S BRC SEDEX. Food Safety 22 Growing Problems Loss of chemicals Water restrictions Planning restrictions on Poly tunnels Labour Phytophthora Vine Weevil, Raspberry beetle, Leaf curling Midge Spotted winged Drosophila (SWD)? 23 Phytophthora damage 24 Fresh Packing Fast cooling within 2 hours of picking to below 4 Centigrade Inspection and weighing to average weight Heat sealing Dispatch to Supermarket.. 25 Heat Sealing 26 Heat sealed punnet 27 UK Exports 2012 Fresh 76t Frozen 99t 2013 72t to Irish republic, Netherlands 131t to Ireland, France, Belgium. Source: HM Revenue and Customs 2011-2013 prov 28 UK 2013 Fresh Imports Spain Morocco Germany South Africa Netherlands Belgium Italy USA Denmark France Portugal Mexico Other TOTAL Tonnes 6337t 1097 658 487 479 257 242 223 220 82 69 36 106 10293t Value £000s £39,258 £3,830 £1,950 £3,625 £1,591 £1,632 £646 £1,574 £424 £324 £548 £259 £227 £55,888 Source: HM Revenue and Customs 2011-2013 prov £/t £6195/t £3491/t £2964/t £7443/t £3322/t £6350/t £2669/t £7058/t £1927/t £3951/t £7942/t £7194/t £2142/t £5430/t 29 Fresh Import variations over 5 years to 2013 Volume growth of 5% over 5 years Average price per tonne has remained similar Growth from Morocco and South Africa, mainly of the very popular Driscoll varieties. 30 UK 2013 frozen Imports Poland Netherlands Serbia Belgium Chile Germany China Bulgaria Other TOTAL Tonnes 4048t 2598t 1342t 1784t 542t 1285t 193t 110t 242t 12,144t Value £000 £7207 £3448 £3022 £2,915 £1198 £2670 £202 £226 £681 £21,569 Source: HM Revenue and Customs 2011-2013 prov £/t £1780/t £1327/t £2252/t £1634/t £2210/t £2078/t £1047/t £2055/t £2814/t £1776/t 31 Frozen import variations over 5 years to 2013 The average price had decreased from £2/kg to £1.75/kg (and has now recently risen to £2.30/kg) The volume has increased from 8500t/year to 12000t/year Poland and Serbia have doubled their volume Chile has reduced from 2000t to 500t. 32 Fresh Raspberry Market information 2013 Retail value £150 million 34.8% of the population purchase fresh raspberries. Turnover growth +7.5% Volume growth +6.1% The average customer bought raspberries 7 Times in the last year.. Source: Kantar World Panel 33 4 weekly Retail Raspberry Volume Source: Kantar World Panel 34 Fresh Raspberry Retail Sales Volume Volume Tonnes Raspberry Volume tonnes - Kantar Worldpanel Data 15,116 16,000 14,136 13,284 12,590 12,314 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 2009 2010 2011 Source: Kantar World Panel 2012 2013 35 Fresh Retail Raspberry Sales Value Value £000's Raspberry Expenditure in £000's - Kantar Worldpanel Data £157,540 £145,832 £160,000 £129,591 £140,000 £136,981 £124,540 £120,000 £100,000 £80,000 £60,000 £40,000 £20,000 £0 2009 2010 2011 Source: Kantar World Panel 2012 2013 36 Processed fruit Volumes Processing fruit is only produced when supply exceeds fresh sales or from class 2 fruit Class 1 fruit is: punnet frozen for punnet sales in Supermarkets IQF for sale to manufacturers within the UK Class 2 fruit is: Pureed or Juiced Most of the IQF Raspberries used in the UK are imported from Serbia, Chile and Poland A large proportion of the Concentrate and Puree used in the UK is imported from Poland.. 37 Raspberry Processing Companies in the UK • • There are very few Raspberry processors in the UK. Among them are: TRADE SOLUTIONS - (SCOTLAND) - LTD SCOTTISH SOFT FRUIT PROCESSORS 38 Summary England now grows only for the fresh market – Good flavour and shelf life. (only surplus fruit is frozen) Healthy eating and good flavour is encouraging the market to continue to grow. New autumn fruiting primocane varieties are extending the season - June to November All raspberries are protected with polytunnels. 2014 has started with warm weather and good growing conditions. 39 IRO China 2014 Tim Place – England 40