AvantGard Executive Overview

advertisement

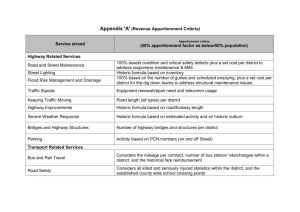

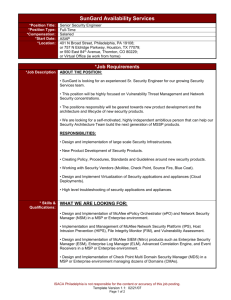

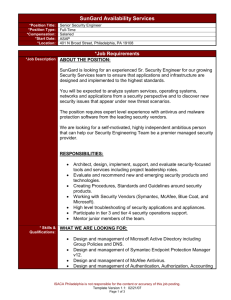

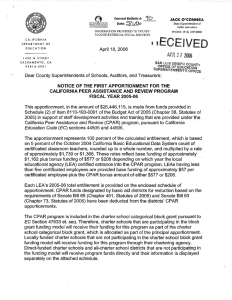

GAIN GLOBAL VISIBILITY OF CASH & RISK FOSTER CONNECTIVITY UNLOCK HIDDEN CASH DRIVE EFFICIENCIES & PRODUCTIVITY AVANTGARD 2012 GIOA CONFERENCE APS 2 Presentation Karen Tanaka Sr. Account Relationship Manager SunGard History 1982 2005 Today Founded in 1982 Went Private in 2005 Today Spin-off from Sun Oil Company Consortium of private equity firms organized by Silver Lake About $5 billion revenue Went public in an IPO in 1986 At the time it was the second largest leveraged buyout ever Since 1986 SunGard has completed more than 175 acquisitions Transaction valued at $11.4 billion Fortune 500 company Largest privately held business software and services company More than 25,000 customers in 70 countries 20,000 employees 2 Strong Track Record 2010 $4.99 billion Compound Annual Growth Rate: $5 billion 18.9% (1983 - 2011) $4 billion $3 billion $2 billion $1 billion 1983 $46 million 1980 1985 1990 1995 2000 2005 2010 3 2010 Revenue By Business Higher Education 10% By Region Public Sector 4% $4.99bn Europe, Middle East, Africa 22% Financial Systems 56% Asia-Pacific 5% $4.99bn Availability Services 30% Americas 73% 4 Where to Find Us North America Europe Middle East SunGard has 20,000 employees in more than 200 cities and 30 countries. South America Africa Asia Pacific Australia & New Zealand 5 AVANTGARD APS 2 AVANTGARD APS 2 WEB-BASED SOLUTION AvantGard APS 2 Advanced Portfolio System 2 (APS 2) An investment accounting and portfolio management solution for the back-office. Offers web solution including Fund Accounting Is fully complementary to other AvantGard Treasury, SunGard Public Sector, SunGard Bancware for both public and private sector. Strengths of AvantGard APS 2 The availability of a 1.5 million securities database warehouse which allows user to access current and historical data including market prices, paydown factors, accrual rates, rate changes, call date and a wide range of other market data information Web Based solution - SAAS On-line real-time access to current and historical investment data A wide array of instrument coverage Custodial reconciliation Interfaces to pricing vendors, trade order management systems, general ledger and asset / liability systems Hosting capabilities with SSAE 16 (formerly SAS 70 type II) audit Disaster recovery Investment Accounting Sample instrument coverage Equities Money Market securities, Notes, Bonds Mortgage Backed and Asset Backed securities ARMs, Hybrids, TBA, Dollar Rolls CMOs, Inverse Floaters, IOs, POs, Residuals Liabilities/Collateral backed Derivatives Calculation Methods 20 Amortization/Accretion Methods 77 Accrual Methods Over 530 Data Entry Validation Check Analytics Convexity, Duration, Effective Duration, Modified Duration, WAC, WAM, WAL Prepayment Speeds – CPR/PSA Multiple Yields calculation Regulatory Reporting and Compliance GASB 31, GASB 40 Financial Reporting Package (10K/10Q) Collateral tracking and reporting Multi-currency with FX cash accounts Sample Production Environment Sample Reporting Sample Reporting Fund Accounting/Interest Apportionment Module Fund Accounting Overview Commingled Pool in the Portfolio Investment activity by the pool is maintained in the Portfolio Accrued and cash earnings are readily available Interest Apportionment Apportionment for each participant can be selected by the following: Dollars Yield / Interest Rate “Dollar Day Balance” calculation for Apportionment Interest Apportionment Interest Apportionment Investment Portfolio Commingled Pool Participant Participant Participant Participant Fund Summary Report Fund Ledger Report Apportionment Report You’re in Good Company… 1,800+ Customers 1,600+ Treasury Customers 6 of F10 (Treasury) 50 of F100 (Treasury)