Micro Finance - Ta Meri Financial Services JSC

advertisement

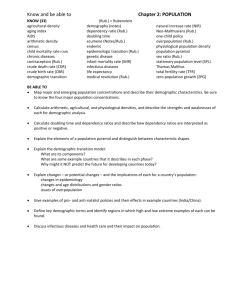

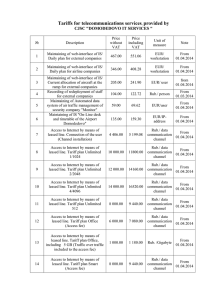

Vyruchai Dengi Company’s Profile Limited Liability Company providing microfinance and consumer finance products Overview • Incorporated in 31/10/2011 • Wholly owned subsidiary by Ta Meri Financial Services JSC • Commenced activities as Micro Finance and Sales Finance • Micro Finance and Sales Finance Company – Financing retail customers and corporate customers for short term periods • Non-Deposit taking company • Commenced Micro Finance and Sales Finance business from July 2014 Organization Structure Front Office Business Strategy & Marketing Sales & Dealer Network Operations Information Technology Internal Audit Treasury Front Office Organization Structure Back Office Risk Management & Collections Collections HR & Administration Legal, Compliance & Secretarial Company Secretary & Compliance Controling Accounts Treasury Back Office Board of Directors Profiles Executive Director Vasiliy Nazarov Chief Financial Officer Bohuslav Kratěna Strong proffesional with experience in russian speaking countries with strong orientation to KPIs, P&L results and customer orientation Economy and law education background, field experience in enterprise restructuring and banking sector generally Number of Employees Russian Federation 250 200 150 31.09.14 31.12.14 100 50 0 Sales Network Operations HQ Total Head Count Branches Sales Finance No. of branches Micro Finance 30.09.2014 EOY 30.09.2014 EOY 63 100 5 8 * by the end of year 2014 another 300 points of sales will offer our products Our Partners Company Field of Business Voltmart electronics Tair electronics Garant electronics Park mobile phones Domashnij kompyutr PC Komtek PC Kontakt electronics iCom authorised reseller apple Bereket home appliances Triumf home appliances Fokstrot electronics (Ukrainain network) Comfy electronics (Ukrainian network) Products Microfinance Name od Product Dengy do zarplaty Trust Loan Loan Amount 1,000 to 10,000 RUB ($30 - $300) 1,000 to 30,000 RUB ($30 - $1,000) Redemption 2 weeks every month Maximum Maturity 2 months 9 months Interest Rate Target Group 2% daily low-end clients, to overcome short-term insolvency ; working woman with 1-2 children and salary up to 20,000 RUB ($600) 1% daily low-end clients, to overcome short-term insolvency and support consumption ; working woman with 1-2 children and salary up to 20,000 RUB ($600) Products Sales Finance Name od Product Maximum Loan Amount Down payment Maximum Maturity Easy 15,000 RUB ($500) 10% 24 months clients who wish their redemption is low Fast 25,000 RUB ($800) 30% 12 months clients who wish to pay all their debt quickly Popular 25,000 RUB ($800) 20% 18 months clients who are not very familiar with loans and want what other people are using My Loan 30,000 RUB ($1,000) 10% 3 to 36 months Equity Loan 20,000 RUB ($600) Interest Rate 59% p.a. clients who like to model their loan (adjust the maturity and height of down payment) 49% p.a. offered in the network of our partners, loan with 0% interest rate, supposed to attract customers who are used to Ukrainian loan system (0% interest rate, revenues are hidden in charges and fees) 20% (possibility to pay overall sum in 4 months without paying interest) 18 months Target Group Volume of Business September 2014 • processed almost 10 ths applications, 5,3 ths customers • average value of amount: 15 ths RUB • since the beginning of operations total amount of loans disbursed: 77 mio RUB • plan till end of the year: 250 mio RUB Asset Portfolio 2014 70 60 60 60.5 50 40 40 40 31.5 Consumer Finance 30 Micro Finance 17 20 10 1 0 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Asset Portfolio in Mio RUB 2014 16 Asset Portfolio 2014 120.00 100.00 80.00 Earning Assets in Mio RUB 60.00 Consumer Finance Micro Finance 40.00 20.00 0.00 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Asset Portfolio in Mio RUB 2015 17 Managing Director Strong Risk Management System Back Office Head of Risk Management & Collections Credit Risk Retail Risk Wholesale Risk Operations Risk Fraud Risk Collections Regional Collections Strong Risk Management System (contd.) Risk Strategy Risk Communication • Identifying Key Risks • Counterparty risks • Market risks • Operational risks • Liquidity risks • Reputational risks • Strategic risks Risk Control Risk Assessment Risk Monitoring Funding Mix Funding Mix as of Dec 31st 2014 Funding Mix as of Dec 31st 2015 0.00% 16.47% 83.53% 100.00% Equity Bank Lines Equity Bank Lines Key Ratios Equity ratio 90% 80% 70% 60% 50% 40% 80% 68% 60% 50% 43% 39% 38% 30% 37% 35% 33% 31% 30% 20% 10% 0% Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Equity ratio Key Ratios Debt Equity Ratio 25% 20% 16% 16% 17% 17% 18% 18% 18% 19% 19% 20% 20% 21% 15% 10% 5% 0% Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Debt Equity Ratio KPIs 2014 Profit/loss statement RUB/EUR 49,49 Data thousand EUR Year 2014 Q3 Revenue Q4 Year 2015 Total Q1 Q2 Q3 Q4 Total 237 958 1 194 1 564 1 954 2 152 2 482 8 153 Financial costs 43 207 250 352 431 468 523 1 774 Operating costs 408 723 1 131 733 721 713 788 2 954 Total costs 451 930 1 381 1 085 1 152 1 180 1 311 4 728 Profit/loss -215 28 -187 480 802 972 1 172 3 425 KPIs 2014 Balance statement Amount of credits default loans % default Internal Investor Total investment Year 2014 Q3 Q4 2 478 8 439 46 268 1,9% 3,2% 963 1 111 2 074 2 579 5 384 7 963 32,4% 67,6% Q1 13 188 726 5,5% Year 2015 Q2 Q3 18 341 23 292 1 430 2 262 7,8% 9,7% Q4 30 364 3 163 10,4% 3 186 7 656 10 842 3 792 8 980 12 772 5 004 11 121 16 125 4 398 9 176 13 574 31,0% 69,0% Contact us Ing. Roman Vavroň CEO of Ta Meri Financial Services JSC Tel: +357 99 02 4144 Mail: roman.vavron@tamerigroup.com