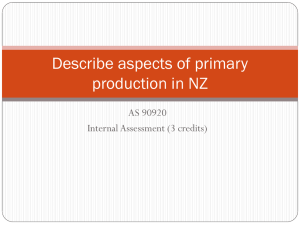

Nonfat Dry Milk Powder Prices

advertisement

US Dairy Industry Situation and Outlook September 2012 Executive Summary 2 • US Milk Supply Situation and Outlook – Milk output was strong in the first part of the year, but is falling rapidly due to increased herd culling and record high temperatures in some regions – Severe drought in the US Midwest has forced grain/feed prices to record highs resulting in a sharp decline in dairy farm profitability • Dairy Products Situation and Outlook – Production is following milk supplies lower yet stock levels remain adequate – Dairy prices are forecasted to increase for the balance of 2012 and sustain relatively high price levels in 2013 with key watch-outs including world/regional economic conditions and Oceania milk output • US Dairy Industry News – Farm Bill legislation awaits action in House of Representatives, but delays are possible due to November elections; key point for dairy is the end of the support price program that dates from 1949 – New plant capacity coming in WMP and AMF US Weather Situation and Outlook • • 3 US drought conditions on July 31 were the worst since 1988 with some comparisons to the “Dust Bowl” years of the 1930’s The prime corn and soybean growing states experienced extreme drought conditions during the most critical time period for crop development US Milk Supply Situation and Outlook • • 4 2012 started with positive farm margins, but have dropped sharply by summer 2012 and 2013 are expected to have near average farm margins as milk prices increase to compensate for high feed prices Aug 8 - $8.10/Bu $/Bushel $7.50 $6.50 $5.50 $4.50 $3.50 $2.50 Milk Price – Feed Cost = Margin per Unit of Milk Mar-12 May-11 Jul-10 Sep-09 Nov-08 Jan-08 Mar-07 May-06 Jul-05 Sep-04 Nov-03 Jan-03 Mar-02 May-01 Jul-00 Sep-99 $1.50 Jan-98 • Due to the extreme drought conditions, grain prices rallied to alltime record highs in July… over $8.00/bu for corn with soybeans near $17.00/bu While the focus has been on the supply shortage, high prices are dampening demand from ethanol (fuel), feed, and exports Nov-98 • Corn Prices - 1998-2012 $8.50 US Milk Supply Situation and Outlook • • • • • 5 Milk production in the first half of 2012 was 3% above 2011 levels However, for the second half of 2012, due to the drought and high feed prices, milk production is expected to be flat to lower than year ago The number of dairy cows increased for 2 ½ years, but started to drop in the 2nd quarter Dairy cow culling is increasing due to high feed prices and low/negative farm margins Some regions could face feed shortages due to the drought US Dairy Products – Milk Powder Situation and Outlook • • • • 6 With higher milk production to start the year, particularly in the key milk powder producing states (e.g. California), powder production has been up strongly from year-ago levels Lower milk output in the 2nd half of the year will likely curtail milk powder production As milk powder plants have been stressed to maximize throughput, more NFDM was produced instead of SMP in spring 2012 However, longer-term, both WMP and SMP production are expected to increase as drying plants are built or upgraded to make those products US Dairy Products – Milk Powder Situation and Outlook • • • 7 While exports have been strong, they have not been able to keep up with production, therefore, milk powder stocks have increased Stocks are being drawn down rapidly in the summer as end-users build inventory in anticipation of higher prices later in 2012 Through May, NFDM/SMP exports were up 12% compared to 2011 US Dairy Products – Milk Powder Situation and Outlook • Due to lower milk output, dairy commodity prices are expected to move higher in the 2nd half of 2012 with the magnitude dependent on end-user demand and the need to ration anticipated smaller supplies Nonfat Dry Milk Powder Prices $/Lb $2.20 Actual Futures $2.00 $1.80 $1.60 $1.40 $1.20 8 Sep-… May… Jan-13 Sep-… May… Jan-12 Sep-… May… Jan-11 Sep-… May… Jan-10 Sep-… May… Jan-09 Sep-… May… Jan-08 Sep-… Jan-07 $0.80 May… $1.00 US Dairy Products – Butter Situation and Outlook 9 • Butter production has posted continual year-over-year gains, but will see seasonal declines into the summer • The growth in butter stocks has been strong due to higher production and lower exports US Dairy Products – Butter Situation and Outlook • • 10 Butter exports through May 2012 were 26% below year-ago levels, but were only 2% below year-ago in May and the highest in 12 months In the March-May period, over 75% of US butter exports went to the Middle East and North Africa, primarily Saudi Arabia US Dairy Products – Butter Situation and Outlook • Butter exports have been increasing over the last 5 years and are expected to increase in the future as more milk is used in the production of SMP, thereby generating more butterfat • CME butter futures prices also have an upward trend $2.40 Butter Prices $/Lb Actual Futures $2.20 $2.00 $1.80 $1.60 $1.40 $1.20 11 Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 $1.00 US Dairy Products – Cheese Situation and Outlook • • • • • 12 Following higher milk supplies, American cheese production has been above year ago levels so far in 2012 Lower milk supplies will likely result in cheese production dropping below year ago levels in the 2nd half of the year Mozzarella production is more sensitive to demand and slipped below year ago levels in May Longer-term consumption trends favor additional mozzarella production given demand from pizza restaurants and exports Annual per capita consumption of mozzarella in the US is over 5 kg US Dairy Products – Cheese Situation and Outlook • • • • 13 With higher American cheese production, stocks have increased above last year, but are not burdensome US domestic demand has been steady, but exports have been very strong Through May, cheese exports totaled 258 million pounds, equal to 6% of US production and up 18% on a year-overyear basis US cheese exports will likely increase in the future as cheese-friendly items like pizza and cheeseburgers become more prevalent US Dairy Products – Cheese Situation and Outlook • Cheese prices in 2012 have ranged from $1.40-1.70/lb through July, but have moved sharply higher for the balance of 2012 • CME cheese futures prices exhibit the same upward price trend as seen in the other dairy commodities $2.20 Cheese Prices $/Lb Actual Futures $2.00 $1.80 $1.60 $1.40 $1.20 14 Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 Jan-11 Sep-10 May-10 Jan-10 Sep-09 May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 $1.00 US Dairy Products – Whey Situation and Outlook • Sweet dry whey powder production has dropped below 2011 levels as more manufacturers switch to higher protein whey products (e.g. WPC 80) • Dry whey powder stocks have followed production trends and are below year ago levels Lower animal numbers in the US over the next 18 months will likely decrease the demand for whey for animal feed use • 15 US Dairy Products – Whey Situation and Outlook • • • • 16 WPC production in 2012 is above levels seen the last few years as plants have moved to higher value/higher protein whey products The co-products of WPC production are lactose, which has seen strong demand and very high prices due to SMP standardization, and milk permeate which is also seeing higher demand Despite only small gains in production, WPC stocks moved sharply higher in the 2nd quarter as exports dropped With lower milk and cheese production expected in the 2nd half of 2012 and into 2013, WPC production and stocks will likely fall WPC stocks graph US Dairy Products – Whey Situation and Outlook • • • • 17 Whey powder exports have recovered from early year lows and are 3% below year-ago levels for 2012 Nearly 2/3rd of whey production is exported; China remains the major customer for US whey products WPC exports have also recovered from early year lows and are above 2011 levels Longer term, US whey product exports are expected to post continued growth in the future as its uses expand US Dairy Products – Whey Situation and Outlook 18 $0.80 Dry Whey Powder Prices Actual Futures $0.70 $0.60 $0.50 $0.40 $0.30 $0.20 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 $0.10 $1.70 $/Lb WPC 34 Prices Actual Forecast $1.50 $1.30 $1.10 $0.90 $0.70 $0.50 $0.30 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 • US whey product prices hit levels in late 2011 and early 2012 that negatively impacted exports as the gap between US and European prices widened • With US prices falling back, the export interest has returned • Whey product prices are expected to post moderate increases for the balance of 2012 • Prices in 2013 are expected to remain near late 2012 levels with some potential easing in the 2nd half of 2013 $0.90 $/Lb US Farm Bill Update • Every 5 years, the US Congress develops agricultural policy through a Farm Bill encompassing production agriculture, but with around 80% of spending going to supplemental feeding programs • The dairy package of the Farm Bill consists of the following: – – – – Elimination of support price program for dairy products (dates from 1949) Elimination of MILC/deficiency payments to offset low milk prices Establishes a farm margin insurance program based on milk and feed prices If the margin insurance program is chosen, the dairy producer participates in a growth management program in order to balance supply and demand • Elimination of the support price program is a fundamental change for the US dairy industry • Election year politics make the outlook uncertain – Passage before November election is unlikely – Likely short-term extension with attempt to pass in “lame duck” session in late 2012, but more likely in early 2013 19 US Dairy Industry News Exports have become important to the US dairy industry and firms/plants are making changes to produce more products for the export markets • New milk powder plants – Dairy Farmers of America (Nevada) – WMP plant start-up in 2013 – Continental (Michigan) – start-up in 2012 – Grassland (Wisconsin) – expanded MPC and other milk powder capacity in 2011; significant expansion in milk powder capacity in 2013-14 • New/expanded cheese plants – Leprino (CO) – start-up in late 2011 with mozzarella production – Increased interest in new cheese styles with focus on export markets – More focus on whey generated from cheese plants with increased investment on whey processing • New infrastructure – Glanbia investing $14 million (US) in a new Cheese Innovation Center that will provide research and development support 20 Summary – Short Term Outlook • The severe summer drought has significantly lowered crop output. As a result, corn and soybean prices have rallied to record-high levels. • These record-high grain prices translate to record-high feed prices for dairy farms, thereby causing financial losses on farms (negative margins). • Dairy farms have quickly reacted to the high feed price situation by increasing herd culling and adjusting feed rations. • With dairy herds getting smaller due to culling, milk production is falling quickly, accelerated by very high temperatures in key milk producing regions. • The loss of dairy cows will negatively impact medium-term milk supplies. • The outlook for dairy product prices is higher for the rest of 2012 and likely sustaining high price levels through 2013. 21 Summary – Long Term Outlook • The US dairy industry continues to grow and evolve • Farms are getting larger and are forward integrating in the supply chain, thereby better identifying customer needs for new products • The cheese industry is growing with increasing focus on specialty cheeses and cheese styles for export (e.g. Gouda) • Probably the most significant change is happening at milk powder producers as they are shifting from NFDM to producing SMP and WMP • Further development of risk management tools allow customers to establish longer-term prices from their suppliers • US dairy companies have embarked on a strategy developed in 2009 to become a consistent exporter to the global dairy market • That study identified the US as best situated to meet the growing demand for dairy products in the future given the potential for supply growth along with an infrastructure that supports growth 22