Buy Presentation Template

0

Buy Presentation: Verizon

Communications Inc.

March 27, 2012

Presentation Prepared By:

Colton Shoenberger, Matthew McLaughlin, Matthew Rich, and Henry Apostoleris

Investment Thesis

Thesis

Verizon Telecommunications Inc. would make a strong defensive position in Ithaca College Investment Club’s portfolio because of its strong economic moat, high returns and profit margins, low volatility (beta .54), considerable dividend, and sustainable future profitability. The company boasts industry-high wireless network quality along with industry-low churn rates, as well as the largest

LTE network, nearly three times as large as the next largest U.S. LTE network (AT&T). In addition, Verizon’s operations are welldiversified compared to its smaller competitors, and the company is experiencing considerable growth with its FiOS television and internet services. Moving forward, minority wireless competitors, lacking significant cash amounts for capital investments, will have trouble competing with Verizon as demand for smartphones and data availability increases.

Stock Price (One Year) Revenue 2007-2011

Verizon Revenue, 2007-2011

115 000

110 000

105 000

100 000

95 000

90 000

85 000

80 000

2007 2008 2009 2010 2011

2

Industry Overview and Recent Trends

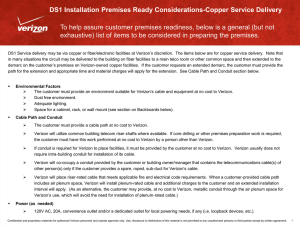

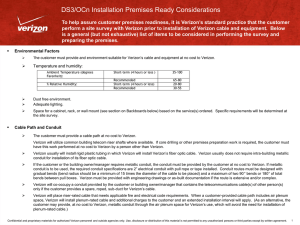

Telecom is an industry of high fixed-costs and low variable costs

– Competitors rely on cash flow to expand networks and services

– Operators often take in substantial debt to finance capital expenditure

Trends

– Major revenue stream shifting from voice to data (texts, images, internet access, etc.)

– 3G to 4G LTE

– Postpaid to prepaid shift

– Voice Over Internet Protocol (VoIP)

– Fiber Optic TV and broadband internet

3

Company Overview and Operations

Company Overview

Verizon Wireless is the industry leader in United States mobile plans and phone sales

Operations

– Mobile Voice and Data Plans (Postpaid and prepaid)

– Phone and Equipment Sales

– FiOS Television

– Landlines (Business Enterprise, Small Business and Home)

– Broadband Internet

Revenue Stream Breakdown Wireless Breakdown

Domestic Wireless (Services and Devices)

Wireline (Fixed-Line, Enterprise, Television and Internet)

Voice and Global Services Data Services Devices Other

4

Recent Telecom News

Verizon raises lease fees for FiOS TV DVR 6% ($15.99 to $16.99/month), and increases set-top box rates 17% ($5.99 to $6.99 monthly) (3/23)

FreedomPop plans to release an iPhone WiMAX shell providing 1GB of free data per month; “freemium” mobile broadband (3/23)

T-Mobile cuts 1,900 jobs and closes seven call centers (3/21)

Verizon and Comcast executives gave testimony to Congress defending proposed $3.6 billion spectrum and marketing deal as a way for Verizon to handle a coming spectrum crunch (3/20)

AT&T acquisition of T-Mobile rejected by Congress; costs AT&T approximately $4.2 billion in losses (2/23)

5

Valuation Comparable

Verizon (VZ)

AT&T (T)

Sprint Nextel (S)

Deutsche Telekom

(DTEGY)

LEAP Wireless

(LEAP)

MetroPCS (PCS)

United States

Cellular (USM)

Price

39.73

31.71

2.74

11.95

10.13

10.56

42.46

Mkt. Cap

112.5

188 B

8.2 B

51.61 B

773.7 M

3.5 B

3.59B

EPS

2.16

2.18

-0.88

0.17

-3.91

0.84

2.1

P/E

70.03

-

11.6

19.7

18.4

14.5

-

Dividend

0.92

-

-

-

1.98

1.73

-

Div./Yield

8.1

-

-

-

5

5.56

-

Beta

1.5

-

0.85

0.86

0.55

0.59

1.07

6

Operating Comparable

Verizon (VZ)

AT&T (T)

Sprint Nextel (S)

Deutsche Telekom

(DTEGY)

LEAP Wireless

(LEAP)

MetroPCS (PCS)

United States

Cellular (USM)

Total Debt to

Assets

23.9

Total Debt to

Equity

153.3

Return on Assets Return on Equity Return on Capital Pretax Margin

1.1

6.5

9.2

9.5

EBITDA Margin

26.5

24

41.1

61.4

177.4

1.5

-5.7

3.6

-22.3

3.7

-

5.3

-7.8

24.1

15.1

39.4

62.5

50

13.9

136.9

525.1

162.1

24.3

0.4

-6.3

3.5

2.9

1.5

-41.3

11

4.9

1.4

6.7

5.9

-

5.2

-9.1

9.9

7.2

32.4

17.8

26.6

19.6

7

Sector Ratio Analysis

Valuation Ratios

Price to Sales

– Verizon: 1.01

– Sector: 1.23

Price to Cash flow

– Verizon: 4.18

– Sector: 8.01

Profitability

Operating Margin (TTM)

– Verizon: 11.62

– Sector: 14.30

Net Profit Margin (TTM)

– Verizon: 9.20

– Sector: 7.99

Financial Strength

Current Ratio

– Verizon: 1.01

– Sector: 1.41

Interest Coverage (TTM)

– Verizon: 7.64

– Sector: 0.11

Receivable Turnover

– Verizon: 9.41

– Sector: 6.13

Inventory Turnover

– Verizon: 44.30

– Sector: 31.33

Efficiency

8

Competitors

AT&T (T)

Strengths

– Similar dividend, beta, and economic moat to Verizon

Weaknesses

– Recent T-Mobile acquisition failure caused $4.2 billion in losses

– Recently abolished unlimited data plan; may lead to increased churn rates

– Fewer data plan options than Verizon

– Smaller 4G LTE network than Verizon (about 1/3 the size)

Sprint (S)

Strengths

– Near 52 week low

Weaknesses

– High degree of uncertainty/high volatility

– As data services become more important to the industry, Sprints current financial instability will make it hard to compete with larger rivals

– Smaller 4G LTE network than Verizon

9

Competitors

Deutsche Telekom (T-Mobile; DTEGY)

Strengths

– Recent joint venture with France Telecom (FTE) in UK

Weaknesses

– Low margins, especially in the U.S.

– Recently cut jobs and call centers

LEAP Wireless (LEAP)

Strengths

– Upgrading its smartphone lineup, leading to higher ARPU and lower churn

Weaknesses

– Multiyear low margins will make 4G build out difficult as competition intensifies; strains on company profitability

– Rejected merger offer from MetroPCS in 2007 suggests management more interested in building a company than maximizing shareholder value

MetroPCS (PCS)

Strengths

– Record level of subscriber additions, revenue, and adjusted

EBITDA in 2011faciliated by postpaid to prepaid trend

Weaknesses

– Small margin for execution error due to high penetration rates and contracting margins

– Many customers currently running on outdated CDMA network incapable of satisfying increasing data demands

– High churn rates

U.S. Cellular (USM)

Strengths

– Strong ARPU on smartphone customers

Weaknesses

– Postpaid subscriber base has shrunk all four quarters in 2011

– Declined to offer iPhone

– Spectrum gap between USM and competitors increasing

10

SWOT Analysis

Strengths

Considerable dividend, good returns and profit margins

Industry-low churn rates (customer loyalty)

Industry-high network and product quality (smartphone and data availability)

Strong economic moat (ability to purchase spectrum)

Has a customer base of 49.3 million in the U.S. alone, gained

2 million postpaid subscribers in 2011

Brand name

Opportunities

Increase in demand for 4G LTE technology will pull strong profit margins along with easing network quality with customers split between 3G and 4G phones

iPhone 5 and new iPad will use LTE technology

AT&T rising prices on unlimited plan and removing unlimited data plan

Foreign opportunities to expand business into Canada, Asia and some parts of Europe

Expansion on audio conferencing services (VoIP)

Weaknesses

Near 52 week high

Need to make heavy investments on spectrum to prevent competition and encourage 4G and heavy data plans

Upgrading fixed-line network despite declining demand

Lack of customer care centers compared to competitors

Threats

Potential FCC regulation on spectrum auctioning would help minority mobile companies compete with Verizon’s network quality

Economic downturn could push consumers away from

Verizon’s postpaid plans, stifle 4g LTE adoption, and push customers toward cheaper pre-paid options from MetroPCS or

LEAP

11

Analyst Recommendations

Analyst Recommendations and Fair Value Estimates

Firm

BMO Capital Markets

Goldman Sachs

Hilliard Lyons

Jefferies

JP Morgan

Macquarie

Openheimer and Co.

Recommendation

Outperform

Buy/Neutral

Buy

Buy

Neutral

Outperform

Outperform

Consensus Rating

– Buys: 44.7%

– Holds: 52.6%

– Sells: 2.6%

Credit Ratings

– S&P Rating: A-

– Moody's Rating: A3

– Fitch Rating: A

Target Price

44.00

44.00

41.00

45.00

40.00

45.00

42.00

12

Recommendation

We recommend that Ithaca College Investment Club purchase 24 shares of Verizon Communications Inc. around $39.42, around

4.5% of our portfolio, and maintain this position for 2-3 years. In the case of major economic downturn or another variable causing serious change in the stock’s value in the future, we should reevaluate as necessary.

13