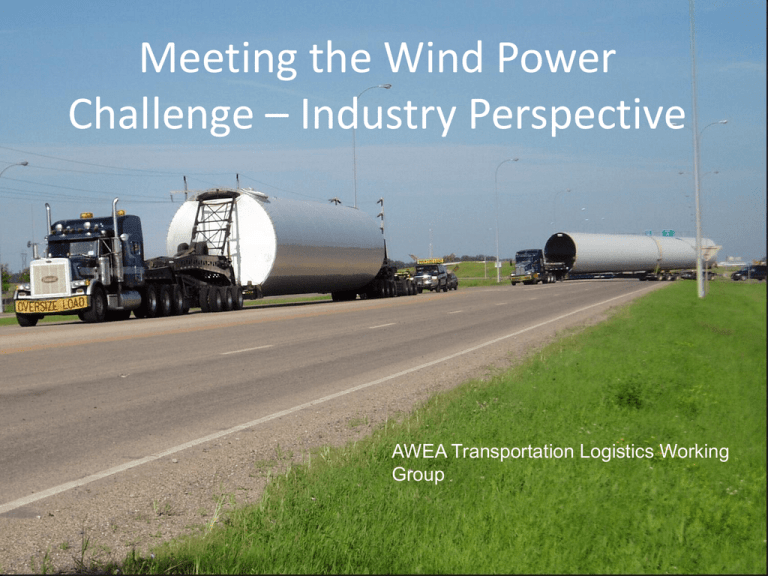

TLWG - Transportation Logistics Working Group

advertisement

Meeting the Wind Power Challenge – Industry Perspective AWEA Transportation Logistics Working Group • Overview of AWEA – Mission – Members – TLWG – Transportation Logistics Working Group • North America Wind Energy – Early Beginnings – Transition Years – Current Status • Wind Farm Locations AWEA – American Wind Energy Association • Founded in 1974 • More than 2,500 business members – Wind project developers – Transportation and construction companies – Manufacturers from bolts to turbines • More than 8,000 parts in a turbine • www.AWEA.org provides extensive info on wind • • • • Trade association for the wind energy industry Over 2,500 business members www.awea.org Develops policies and conducts analysis to support wind industry growth Executes wind industry’s legislative agenda Promotes wind energy through advocacy, advertising and media relations Convenes conferences and workshops to educate the public and bring industry members together TLWG - Transportation Logistics Working Group • AWEA has established a Transportation and Logistics Working Group (TLWG) to identify the key transportation challenges facing the industry and work toward solutions to ensure wind energy growth continues on the path to 20% by 2030. • Member companies involved in manufacturing, transportation and logistics are represented. TLWG - Transportation Logistics Working Group • There are key transportation and logistics challenges impacting all modes of transport. • For trucking, challenges include a variety of state and local permitting rules for oversized/overweight loads; driver shortages and training; tight carrier capacity and non-optimized loads/scheduling; rising fuel costs; and hours of service constraints. U.S. Wind Industry Timeline U.S. Annual and Cumulative Wind Power Capacity Growth (Utility-Scale Wind) • • • • • Source: AWEA U.S. Wind Industry Annual Market Report Year Ending 2010 The wind industry installed 5,116 MW in the U.S. in 2010 15% growth in 2010 Total U.S. wind installations stand at 40,181 MW Average annual growth for the past five years was 35 % U.S. wind installations represent over 21% of global wind capacity U.S. Wind Power Capacity Installations by State in 2010 (MW) • • 38 states have utility-scale wind installations. 14 states have more than 1,000 MW installed. Wind Power Project Locations for 2009 and 2010 • Manufacturing – History • Import – Transition to North American Factories • Shorten The Supply Chain – Employment • Value to State and Local Governments • Growth during Recession Wind Power Manufacturing Locations 2004 Nacelle Factories 2004 Tower Factories 2004 Blade Factories 2004 All Online Wind-Related Manufacturing Facilities • At the end of 2010, there were over 400 manufacturing facilities online making windrelated products. • The online facilities span 42 states U.S. Wind Industry Jobs by State • Of the 75,000 jobs across the wind industry, Texas ranked No.1 with the largest amount of new capacity in 2010, energyhub and offices in Houston and strong manufacturing across the state. • Illinois took the No. 2 spot with strong 2010 installations and growing manufacturing base. • With the recent heaving manufacturing investment in Colorado, the state ranked No. 3 in terms of wind jobs. Winds Economic Ripple Effect for Jobs U.S. Wind Industry Total Employment Over Time • Manufacturing continued to grow in 2010, leading to a year-end total of roughly 20,000 jobs in wind-related manufacturing. • Increase in permanent operations & maintenance jobs to help run the expanding wind power fleet. • However, jobs in construction and the various service sectors that support project installation were reduced from 2009 due to the decline in new wind installations. • Overall, even with the economic headwinds, the U.S. wind industry was still able to support 75,000 direct and indirect jobs in 2010, compared with 85,000 in 2009. Hub Nacelle Blade Tower Section • Modes of Transport – Truck – Rail – Barge – Ship • Current and Future Logistical Delivery – Multi-Mode • Challenges to deliver the product – Safety to the public – Multiple differences in the Commodities – Lack of Uniformity • • • • • Weight restrictions Height Restrictions Route Continuity Pass Through Restrictions State /Police and Pilot Car Differences – County and City Changes and Restrictions – Construction • How Can We Improve The Process – Work closer with State and Local Governments – Wind Corridors – Uniformity • Weight • Length – Width – Height • Police and Commercial Escort Requirements – Multi-State Routes – Multi-State Permits • On the Road to Success – WASHTO Multi State Permit – TxPROS – Texas Permitting and Routing Optimization System – Wisconsin OS/OW Freight Network – Regional State DOT/Permit Association • SASHTO - MAASTO - NASTO On the Road to Success OS/OW Supply Chain Management OS/OW Freight Network