2% Dispatchable rule issues CMWG

advertisement

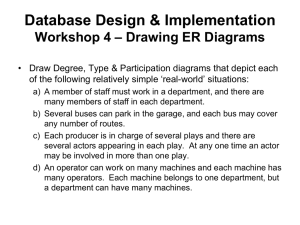

2% Shift Factor dispatchable rule discussion and alternatives for the 2% rule Kris Dixit 1 Goals • Discuss the merits of the 2% shift factor dispatchable rule and conceptually understand its impact on convergence • Discuss 2% rule and possible options that will meet the original intent while maintaining convergence between the three markets 2 Example – 1: CRR Market Line is overloading due to flow that is being driven by sink bids on the load zone in the CRR auction. A Gen D has a -10% SF on this constraint but there are no counter flow offers on this node. This is the only generator with a –ve shift factor on the constraint G D B Bus B has a load that is being driven by its LDF due to Load Zone (sink) bids • With no CRR counter-flow bids, there is technically no generation on D in the auction. Within this model, Gen D is offline • The fact that Gen D is offline, allows for line to congest and create a shadow price, thus causing a price difference between A and B in the CRR auction 3 Issue 2 Example – 2: DAM Market Line is overloading due to flow that is being driven by sink bids on the load zone in the DAM. A Gen D has a -10% SF on this constraint but there are no energy offers on this node G D B Bus B has a load that is being driven by its LDF due to Load Zone (sink) bids • With no offers on bus D (TPO or energy), generator D is offline in the DAM. This generator may have no offers because it may intend to come online as merchant or has sold capacity bilaterally. • The fact that Gen D is offline, allows for line to congest and create a shadow price, thus causing a price difference between A and B in the DAM 4 Example – 3: RT Market Line is overloading due to real time flow Gen D has a -10% SF on this constraint. Gen D is offline. This is the only generator with a -ve shift factor on the constraint X D A B Bus B has a load that is being driven by its demand • Generator D is offline. • Due to loads on B line A-B starts to congest • ERCOT operations would use the 2% rule to identify all generators with > 2% shift factor on the constraint that are dispatchable. • In this case there are no dispatchable generators with greater than 2% shift factor and the constraint is deactivated 5 Summary • Identical situation occur in DAM, CRR and RT markets. However, congestion only occurs in DAM and CRR markets and not in RT • Nearly impossible for ERCOT’s DAM and CRR Team to account for these constraints since they are being driven by information on dispatchable generators that is not available in advance • The 2% dispatchable rule creates a fundamental disconnect between the CRR, DAM and RT markets, that cannot be accounted for in the CRR and DAM markets • This leads to divergence between the three markets 6 The 2% rule • The 2% rule has been discussed in detail at CMWG and WMS • The intent of the 2% rule was to make sure that the market did not show price signals for smaller lines that may have no locational benefit once generation is built • However the 2% rule does not remain consistent through generation development cycles (see slides 10,11,12) • The 2% rule cannot be seamlessly transitioned to the CRR and the DAM markets, since the minimum shift factor used is 0.0001 in those markets 7 Our Proposal • Eliminate 2% dispatchable rule. • Reapply the 2% rule differently by deactivating constraints on lines lower than a specific MVA threshold • For example: if we deactivated all transmission lines with capacities less than 50MVA • Such a rule can be seamlessly used across all three markets and could remain consistent through development cycles • Creates certainty for market participants that are trying to understand market exposures 8 Appendix 9 Issue 1 Example – 2% rule at timestamp T = 0 C Bus C has a +10% SF on this constraint but does not see any price signal. There is no generator on this node. Bus D has a -10% SF on this constraint but does not see any price signal. There is no generator on this node. D 50 MW line loaded to 102% A • • • • • B In this specific example the line A to B is overloading and there is no generator that has > 2% shift factor on this constraint. If there was a generator at bus C, it would have a +10% shift factor on the constraint If activated this constraint would create a negative price on bus C, consistent with the reliability state. Based on the 2% rule, this constraint is deactivated and SCED does not produce a price signal at bus C consistent with this state. Prices at all four points are identical, masking the underlying reliability issue 10 Issue 1 Example – 2% rule at timestamp T = 1 C There is now a generator on this bus with a +10% SF on this constraint. Now we see price signals since there are generators with shift factors greater than 2% Bus D has a -10% SF on this constraint. This bus will now see a price signal associated with the reliability issue D 50 MW line loaded to 102% A • • • • • • B Based on the historical price signals produced by SCED, bus C seems to have a good pricing profile and a developer decides to build a generator on bus C. Since there are no historical price signals, developer will never recognize reliability issues ERCOT and TDSP screening studies may catch this issue, only if they show up in typical base cases. If not, developer builds generation. When developer builds the intended generation, ERCOT would activate the constraint and the generator would become a discount to the rest of the system The only remedy would be a SPS, specifically at higher SF levels. Point D would have been a better siting location 11 Issue 1 Summary • The 2% rule is inconsistent through generation development cycles • The 2% rule masks potential reliability issues that are supposed to be discovered through price signals • The 2% rule is a throwback to zonal congestion management and is no longer relevant to the design intent of the nodal market 12